Commercial Banks form a very crucial part of country’s economy. These are those financial institutions that accept deposits from public, lend money to public for various purposes at different rates. They earn profits in the form of interest, commission, etc. In India, these all banks are regulated by RBI.

Post independence, banks had to be regulated. So the government brought in a law that became an Act called the Banking Regulation Act, (BR Act), 1949.As per the Act, Section 5(c) provides that ‘a banking company is a company which transacts the business of banking in India.

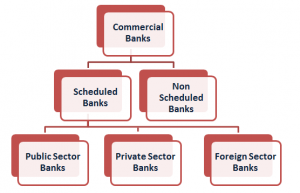

Classification of Commercial Banks:

Scheduled Banks: The banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934 are the Scheduled Banks. These include:

- Public Sector Banks: These can be further classified into Nationalized Banks and Non Nationalized banks.The Banks which were earlier in the private sector and later transferred to the public Sector by the act of nationalization are the nationalized bank. These are the banks which are owned and controlled by the government. In these the majority of stake is held by the government. Their main aim is to provide service to the public. The government holds more than 50% share in the Public Sector Banks.The first nationalized bank was Imperial Bank of India (under the SBI Act of 1955) and re-christened as State Bank of India (SBI) in July 1955.

- Private Sector Banks: These are the banks which are owned and controlled by private individuals. So their main aim is to earn profit like any other businessman does. These include ICICI Bank, HDFC Bank, Axis Bank, Yes Bank, etc. Nedungadi bank was the first private sector bank in India formed in the year 1899 by Rao Bahadur.

- Foreign Banks: These are the banks which are owned and controlled by the foreign companies. They have their headquarters in other countries and open their branches in India. Examples are Citi Bank, HSBC Ltd., etc.

Non-Scheduled Banks: The banks which have not been included in the Second Schedule of Reserve Bank of India Act, 1934 are the Non-Scheduled Banks. Example include EXIM Bank, etc.

Primary Functions of Commercial Banks:

- Accepting Deposits from the public in savings account, current account, fixed deposits, recurring deposits, deposits from NRIs.

- Lending money to the public for their various purposes like personal loans, housing loans, vehicular loans, etc.

- Providing overdraft facility to the credit card holders and under any schemes by the government like in Pradhan Mantri Jan Dhan Yojana Scheme.

Secondary Functions or Para banking Activities of the Commercial Banks:

- Issue debit, credit and prepaid cards.

- Issue Letter of Credit and Bank Guarantee.

- Collect amounts through cheques and other instruments.

- Sale and purchase of shares and debentures.

- Act as investment bank for Initial Public Offering (IPO) by a private company.

- Help in anti-money laundering through KYC process.

- Become an intermediary between its customers and other institutions, like payment of insurance premium, payment of various bills, direct benefit transfer (DBT) scheme of government, etc.

- Provide facilities such as Electronic Clearing Service, transfer of funds domestically and internationally, locker facilities, foreign exchange, etc.

With the advances in technology, the commercial banks are also making advancement and providing the citizens of India with the best facilities and they are also easing the lives of people by providing many good facilities.

2019 recent news:

- In August, 2019 Jana Small Finance Bank Ltd, which commenced banking operations in March 2018, has got the status of a Scheduled Bank.