SMALLBANK

objective : To furture finanacial inclusion by mobilising savings, offering loans to small bussinesses, lend to served and unserved small farmers and marginal farmers and samll industries ,micro and small industries and unorganised sector through high techonology and low cost operations

who can set up small banks ?

- Resident individuals/professional with 10 years of work experience in banking & finance

- NBFCs

- MFIs

- LABs

Capital requirment ?

The minimum paid up equity capital shall be 100 crores

*equity capital means equity of a company as divided among individual shareholders of common .. i.e shares or funds of stock holders

operations –>

- limited area operations

- banking products

Promoters contribution …

- Promoters to bring 40% of intial capital.

- They can reduce the stake to 26% after 12 years of operations

Foreign shareholding It would be as per the FDI They can lower policy for private sector

Prudential norm

- As applicable to existing commercial banks. No forbearance would be provided for complying with the statutory provisions.

- Need to extend 75% of its Adjusted Net Bank Credit to the sectors eligible for classification as priority sector lending

- At least 50% of its loan portfolio should constitute loans and advances of upto 325 lakh

Names of the applicants for Small Finance Banks

- Aamcol Trexim Pvt. Ltd & Mackmorn Commodities Pvt. Ltd., Kolkata

- Apex Abishek Finance Limited, Coimbatore

- Ashika Global Securities Pvt. Ltd., Kolkata

- Asomi Finance Private Limited, Guwahati

- Au Financiers (India) Limited, Jaipur

- Bhartiya Samruddhi Investments and Consulting Services Ltd., New Delhi

- BRD Securities Ltd., Thrissur

- Bretton Woods Exim Private Limited, New Delhi

- Calance Software Private Limited, New Delhi

- Capital Local Area Bank Ltd., Jalandhar

- Capital Trust Limited, New Delhi

- Chaitanya India Fin Credit Private Limited, Bengaluru

- Coastal Local Area Bank Ltd., Vijayawada

- Dewan Housing Finance Corporation Limited, Mumbai

- Disha Microfin Private Limited, Ahmedabad

- K. Cherian Varghese, Kochi

- Shubhro Sen, New Delhi

- Electronica Finance Limited, Pune

- Elite Green Private Limited, Ahmedabad

- Equitas Holding P Ltd., Chennai

- ESAF Microfinance and Investments Private Limited, Chennai

- Grama Vidiyal Micro Finance Limited, Tiruchirapalli

- Home First Finance Company India Pvt. Ltd., Mumbai

- Idhayam – G Finance and Investment Services Limited, Virudhunagar

- IIFL Holdings Limited, Thane

- Indigo Fincap Private Limited, Nawanshahar

- IntelleCash Microfinance Network Company Private Limited, New Delhi

- Inventure Finance Private Limited, Mumbai

- Ishan Developers & Infrastructure Ltd., Chandigarh

- Jagaran Microfin Private Limited, Kolkata

- Jainco Projects (India) Limited, Kolkata

- Janalakshmi Financial Services Private Limited, Bengaluru

- Kerala Permanent Benefit Fund Ltd., Aluva

- Kosamattam Finance Limited, Kottayam

- Kotalipara Development Society, 24 Parganas North

- Light Microfinance Private Ltd., New Delhi

- Lulu Forex Private Ltd., Kochi

- Mahanadhi Finance Limited, Erode

- Mangal Keshav Capital Limited, Mumbai

- Microsec Resources Private Limited, Kolkata

- Rajni Aneja, New Delhi

- Pareka Investment Private Limited, Kolkata

- Professional Management &Advisory Services (P) Ltd., Delhi

- Proficient Leasing & Finance Ltd., Allahabad

- Repco Micro Finance Ltd., Chennai

- RGVN (North East) Microfinance Limited, Guwahati

- E. Investments Limited, Agra

- Sahara Utsarga Welfare Society, 24 Parganas North

- Saija Finance Private Limited, New Delhi

- Satin Creditcare Network Limited, New Delhi

- Shri Ajay Singh Bimbhet & others, Mumbai

- Shri Ajit Kumar Sharan, Mumbai

- Shri Collin R Timms & others, Mumbai

- Shri Kiran Dhondopant Thakur & others, Belgaum

- Shri M. R. Seetharam, Bengaluru

- Shri Manish Khera, Mumbai

- Shri Nijay Kumar Gupta, Mumbai

- Shri V.Balakrishnan & others, Bengaluru

- Shri Vinod Jain, Gurgaon

- SKS Microfinance Limited, Mumbai

- Sonata Finance Pvt. Ltd., Lucknow

- Sri Jayalakshmi Automotives Private Limited, Hyderabad

- Sunmarg Welfare Society, 24 Parganas South

- Suryoday Micro Finance Private Limited, Navi Mumbai

- Tri-Deep Leasing And Finance Limited, New Delhi

- UAE Exchange & Financial Services Ltd., Bengaluru

- Ujjivan Financial Services Private Limited, Bengaluru

- Utkarsh Micro Finance Private Limited, Varanasi

- VAYA Finserv Private Limited, Hyderabad

- Village Financial Services Private Limited, Kolkata

- Vinayak Local Area Bank Limited, Sikar

- Vsoft Technologies Private Limited, Hyderabad

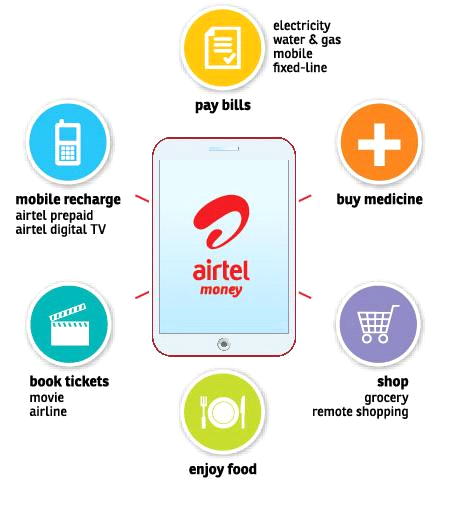

PAYMENT BANKS

Objective — to extend reach of the banking system by opening small savings accounts, facilitate payments or remittances for migrant workforce; low income households, small businesses, other unorganised sector entities and other users

Who can set up?

- NBFC

- Corporate bussiness correspondants

- Mobile telephone companies

- Super-market chains

- Real sector cooperatives

- Public sector entities

Capital requirment ?

The minimum paid-up equity capital shall be 100 crores

its outside liablities should not exceed 33.33times its net worth

operations

- increase financial inclusion

- savings/deposits/remittence/payments

- no credit lending

Promoters contribution …

- Promoters to bring 40% of intial capital from first 5 years commencement of bussiness

*Foreign shareholding It would be as per the FDI They can lower policy for private sector banks and amended time to time

Scope of activities

- Acepting the demand deposits of indiviuals intial holding of 1 lakh rupee per indivual customer

- issuance of ATM/DEBIT CARD nor credit card

- payment and remittence service

- bussiness corespondants of bank–selling small products such as , mutual funds, insurance products

Names of the applicants for Payments Banks

- A Little World Private Limited, Belapur

- Aditya Birla Nuvo Limited, Mumbai

- Airtel M Commerce Services Limited, New Delhi

- Calibre Financial Services Limited, Chennai

- Cholamandalam Distribution Services Limited, Chennai

- Citrus Payment Solutions Private Limited, Mumbai

- Concept Technosoft Ventures Limited, New Delhi

- Department of Posts, New Delhi

- Eko India Financial Service Private Limited, New Delhi

- FINO PayTech Limited, Navi Mumbai

- Fx Mart Private Limited, Zirakpur, Mohali

- GI Technology Private Limited, Chennai

- Instant Global Money Transfer Private Limited, Hoshiarpur

- Itz Cash Card Limited, Mumbai

- Kalpataru Corporation, Mumbai

- KKM Management Centre Private Limited, New Delhi

- My Mobile Payments Limited, Mumbai

- National Securities Depository Limited, Mumbai

- Novopay Solutions Private Limited, Bengaluru

- NSE Strategic Investment Corporation Limited, Mumbai

- One MobiKwik Systems Private Limited, Gurgaon

- Oxigen Services (India) Private Limited, New Delhi

- Pay Point India Network Private Limited, Mumbai

- Reliance Industries Limited, Mumbai

- Resource Square Solutions Private Limited, Chennai

- Shri Dilip Shantilal Shanghvi, Mumbai

- Shri Kishore Laxminarayan Biyani, Mumbai

- Shri M.G. George Muthoot & others, Kochi

- Shri Nijay Kumar Gupta, Mumbai

- Shri Rajib Saha, Gurgaon

- Shri Renuka Mata MultiState Co-operative Urban Credit Society Ltd., Ahmednagar

- Shri Vijay Shekhar Sharma, Noida

- Smart Payment Solutions Pvt. Ltd., New Delhi

- Suvidhaa Infoserve Private Limited, Mumbai

- Tech Mahindra Limited, Mumbai

- K. Fiscal Services Pvt. Ltd., New Delhi

- Vakrangee Limited, Mumbai

- Videocon d2h Limited, Mumbai

- Vodafone m-pesa Limited, Mumbai

- Weizmann Forex Limited, Mumbai

- YouFirst Money Express Private Limited, Mumbai

NOTE _

* as part of financail inclusion part __

* Nachiket mor committee propsal for Small & Payment banks

The Reserve Bank of India today released the names of applicants of small finance banks and payment banks, stating it received, in its Central Office, 72 applications for small finance banks (Annex I) and 41 applications for payments banks (Annex II).

It may be recalled that the guidelines for licensing of “Small Finance Banks” and “Payments Banks”, issued on November 27, 2014, indicated that in order to ensure transparency, the names of the applicants will be placed on the Reserve Bank’s website after the last date of receipt of applications. The receipt of applications for licensing of small finance banks and payments banks closed on February 02, 2015