Negotiable instrument is a document which guarantees the payment of a specific amount of money, either on demand, or at a set time, with the payer named on the document. A negotiable instrument can be transferred from one person to another. Common examples of negotiable instruments include checks, money orders, and promissory notes.

- In July 2018, The Lok Sabha passed the Negotiable Instruments (Amendment) Bill, 2017 which has the provision of allowing a court trying an offence related to cheque bouncing, to direct the drawer to pay interim compensation to the complainant.

Negotiable Instruments Act, 1881 is an Act to define and Law relating to negotiable instruments. The act gives the definitions of all the related terms. The act also deals with the offence pertaining to dishonor of cheque on account of insufficiency of funds in the drawer’s account.

According to Section 13 of the Negotiable Instruments Act, 1881, “A Negotiable Instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer.”

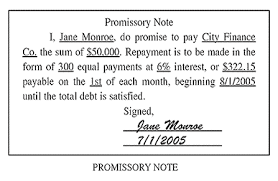

A “promissory note” is an instrument in writing that promises to pay a definite sum of money from one party to another party either on demand or at a specified future date. The person who makes the Promissory Note and promises to pay is called the drawer or maker and the person to whom the payment is to be done is called the drawee or payee. So there are two parties in a promissory note.

- It bears the sign of the drawer.

- It contains a date

- It contains a definite amount plus the rate of interest and this total sum will be paid to the payee.

- It contains the required stamp.

- The promise to pay should be unconditional. For e.g. if I have written in the promissory note that it will be payable after my marriage, then addition of this condition does not make it a promissory note.

- It should be returned back to drawer after the payment.

An example of promissory note:

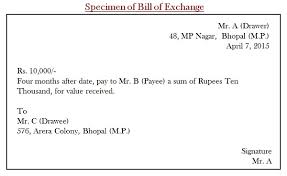

A “bill of exchange” is an instrument in writing that contains an order to pay a definite sum of money from one party to another party either on demand or at a specified future date with an intermediary to pay the sum. So there are three parties in a bill of exchange. But all may not be distinct persons as a drawer may pay on himself payable to his own order.

- It is primarily used in international trade.

- It bears the sign of the drawer.

- The order to pay should be unconditional.

- It contains a date

- It contains a definite amount that is to be paid unlike in promissory note which contains rate of interest also.

- It contains the required stamp.

- In case of dishonor, a notice is sent to the drawer which is in contrast with promissory note.

An example of bill of exchange:

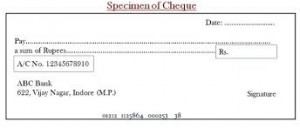

A “cheque” is bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and cheque also includes the electronic image of a truncated cheque and a cheque in the electronic form.

- ‘a cheque in the electronic form’ means a cheque which contains the exact mirror image of a paper cheque, and is generated, written and signed in a secure system ensuring the minimum safety standards with the use of digital signature and asymmetric crypto system.

- ‘a truncated cheque’ means a cheque which is truncated during the course of a clearing cycle, either by the clearing house or by the bank whether paying or receiving payment. After the generation of an electronic image for transmission, the image substitutes the physical movement of the cheque in writing.

An example of cheque:

The government has notified the Negotiable Instruments (Amendment) Bill, 2015 which allows filing cheque bounce cases in a court at a place where the cheque was presented for clearance and not the place of issue so that there is a fast prosecution of offenders.