On March 5, 2020,According to the “Wealth Report 2020” released by Knight Frank LLP,a leading International Property Consultant, India had 5,986 UHNWIs (Ultra high-net-worth individuals) in 2019 and they expected to increase by 73% in the coming 5 years. This will almost double the current count to 10,354.United States (US) topped the Report with 240575 UHNWI’s followed by China with 61,587 & Germany with 23,078.

UHNWIs are people who are having a net worth of at least $30 million(mn) and above. Key Points:

Key Points:

i. India, according to Knight Frank, ranks 12th and had 5,986 such individuals in 2019, which is likely to reach 10,354 by 2024. The number of billionaires in India, on the other hand, is likely to reach 113 by 2024, up from 104 in 2019.

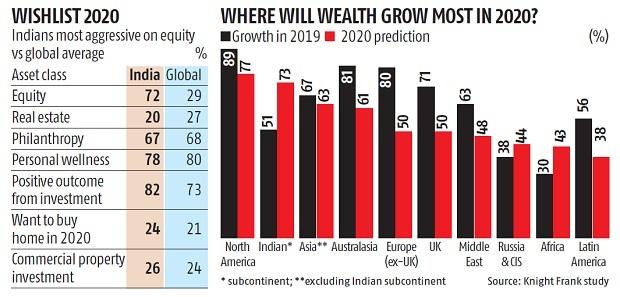

ii. Amongst asset classes, Indian UHNWIs are most aggressive in equity investment with 72 per cent willing to invest in this asset class compared to a global average of 29 per cent.

iii.Top 20 fastest growing countries that they measure, six are located in Asia (led by India with 73 per cent growth), five in Europe (led by Sweden with 47 per cent growth) and three are in Africa (led by Egypt with 66 per cent growth)

iv.Even though there is a phase of economic slowdown in the world, it does not have much effect on the rich and 51% of all the ultra high-networth individuals in India witnessed an increase in their wealth.

v.Asia: According to the study, the number of richest people in Asia will rise in the next five years. By 2024, the number of the richest in Asia will rise by 44 % compared to Europe and the US(United States).

In Asian region regarding growth in UHNWIs, India (73%) is followed by Vietnam (64% growth), China (58% growth) and Indonesia (57% growth).

vi.Normal condition: According to the report, although the India’s growth is slowing due to the current global economic crisis, it will also drive strong long-term growth.

Similarly, it is expected that the number of the richest people in India will increase as the total GDP (Gross Domestic Product ) of the country will reach 7% by 2022.

vii.Reason for the increase in wealth: Major asset investment: India’s richest people is heavily invested in equity. Indian super-rich invest 29% of their investments in stocks, 21% in bonds and 20% in property investments.

While, the Asian UHNWIs preferred property investments with 28% asset allocation, followed by 21% in equities which is closely followed by 19% allocation in bonds.

The survey is based on responses provided during October and November 2019 by 620 private bankers and wealth advisors who manage over $3.3 trillion of wealth for UHNWI clients spread across 200 countries and territories.

About Knight Frank LLP:

Headquarters– London, England

Chairman– Alistair Elliott

Knight Frank India CMD– Shishir Baijal