According to the Reserve Bank of India (RBI) study titled “Assessment of the progress of digitisation from cash to electronic” cash payments are still the essence of transactions but digital payment are also increasing rapidly. The parameters used for this assessment are the value of Currency in Circulation (CIC) versus Gross Domestic Product (GDP), and the value of ATM withdrawals that take place across the country. Key Points:

Key Points:

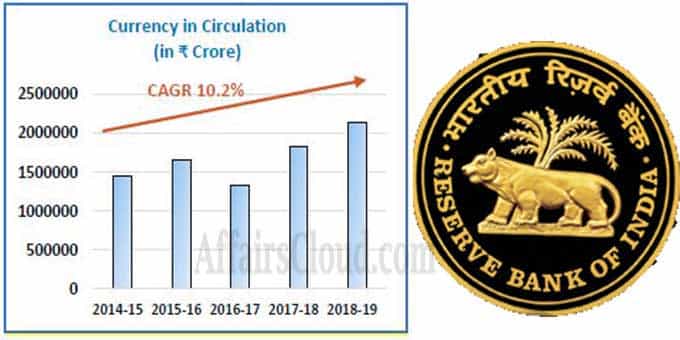

-The CIC across the country increased at a Compounded Annual Growth Rate (CAGR) of 10.2% over the past 5 years, i.e., between the financial years (FY) 2014-15 and 2018-19.

-The notes in circulation– NIC (CIC minus coins in circulation) increased at an average rate of 14% between October 2014 and October 2016.

-India’s CIC levels reduced in 2018 as compared to 2014, other countries, with the exception of Argentina, China, Indonesia, Russia, South Africa, Sweden and Turkey, had increasing cash levels.

-The cash withdrawals from ATMs increased over the past 5 years. India is next only to China in terms of the cash withdrawals from ATMs.

-The number of deposit accounts has grown to 217.40 crore as at end March 2019. As on October 30, 2019 there were 37.36 crore Basic Savings Bank Deposit (BSBD) accounts. The availability of bank accounts plays a key role in initiating digital payments from / to such accounts… Click here to Read RBI Report

How Indian economy is moving towards digital payments?

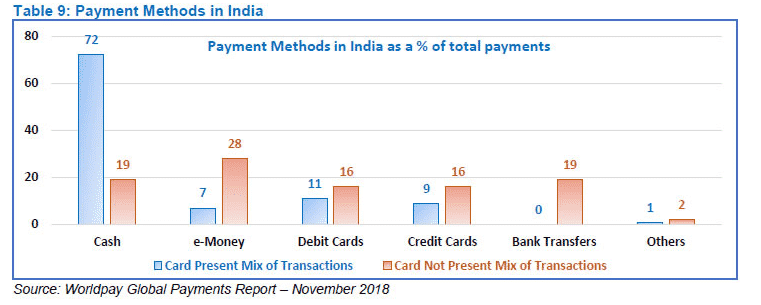

i.Due to demonetisation and active growth in the gross domestic product (GDP), the cash in circulation has decreased as a percentage of GDP to 8.70% in 2016-17. This increased to 10.7% in 2017-18 and to 11.2% in 2018-19. This increase is indicating a shift from cash to digital payments.

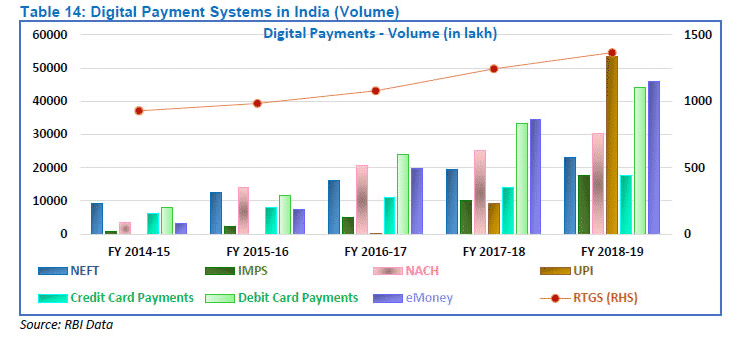

ii.NEFT, which drives the retail payments value, operationalised on a 24x7x365 basis (with half-hourly settlements. Also Immediate Payment Systems (IMPS) and Unified Payments Interface (UPI) are also the fast digital payment instruments.

iii.The value of digital payments to GDP increased from 660% in 2014-15 to 862% in 2018-19.

iv.Overall, the digital payments in the country have witnessed a CAGR of 61% and 19% in terms of volume and value, respectively over the past 5 years.

AffairsCloud Recommends to use BHIM APP – MAKING INDIA CASHLESS

Why Cash is still ruling?

i.It is being stored as economic asset rather than to make payments.

ii.In rural areas due to lack of facilities like vending machines and bank branches, cash is still used as bedrock of daily existence.

About Reserve Bank of India (RBI):

Headquarters– Mumbai, Maharashtra

Formation– 1 April 1935

Governor– Shaktikanta Das

Deputy Governors– 4 (BP Kanungo, N S Vishwanathan, Mahesh Kumar Jain, Michael Debabrata Patra)