On May 14, 2020, Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman detailed the second part of the Special economic and comprehensive package of Rs 20 lakh crores to support Indian economy in the fight against COVID-19. Its first part was presented on May 13, 2020. Click Here to Read.

On May 14, 2020, Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman detailed the second part of the Special economic and comprehensive package of Rs 20 lakh crores to support Indian economy in the fight against COVID-19. Its first part was presented on May 13, 2020. Click Here to Read.

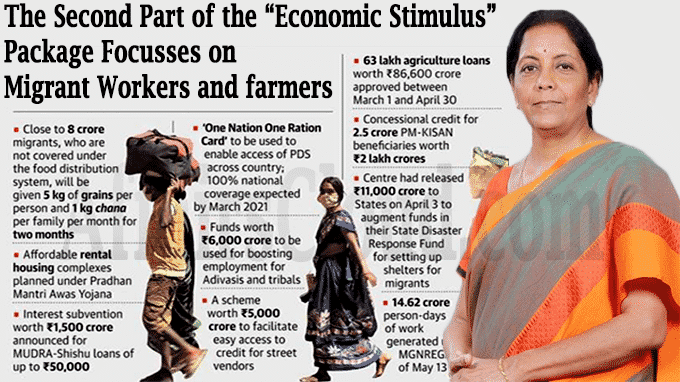

- The Part 2 of “Atmanirbhar Bharat Abhiyaan” (self-reliant India Movement) is consisted of 9 points focusing on providing relief to poor including migrant labours, street vendors, migrant urban poor, small traders, self-employed people, small farmers, housing and members of tribal community.

Here are the details of the second tranche of package:

–Free food grains supply to migrants for 2 months; Rs 3500 cr allocated

Centre has allocated an amount of Rs 3,500 crore to provide free food grains of 5 kg of rice or wheat and 1 kg of chana or pulses for all those migrants who do not fall under the National Food Security Act (NFSA), 2013. This will benefit 8 crore migrant workers.

- Cost will be fully borne by Government of India while State Governments responsible for implementation, identification of migrants and full distribution and providing detailed guidelines.

–One Ration Card fully rolled out by March 2021

The Centre has declared that the technology driven ‘One Nation, One Ration Card’ system will be fully rolled out in all states and Union Territories (UTs) by March 2021. Currently, 20 states have implemented this inter-state ration card portability.

- This system will enable migrant workers and their family members to access Public Distribution System (PDS) or subsidized ration benefits from any Fair Price Shop (FPS) in the country.

- By August, 2020 83% of PDS population will be covered in 23 states benefitting 67 crore population.

What is One Nation, One Ration Card?

This scheme is for migrant labourers. Currently a ration cardholder can buy foodgrains only from their designated FPS in which they live. But the scheme One Nation, One Ration Card will enable them to buy subsidized foodgrains from anywhere in the country. Under the NFSA, 2013, about 81 crore persons are entitled for subsidized food grains. Currently, 23 cr ration cards issued to nearly 80 cr beneficiaries of NFSA.

–Scheme for Affordable Rental Housing Complexes under PMAY for Migrant Workers and Urban Poor to be launched

Government will launch a scheme under Pradhan Mantri Awas Yojana (PMAY) for migrant labour/urban poor to provide ease of living at affordable rent by Converting government funded housing in the cities into Affordable Rental Housing Complexes (ARHC) under PPP (Public Private Partnership) mode through concessionaire.

- This scheme will incentivize manufacturing units, industries, institutions, associations to develop ARHC on their private land and operate.

- This will also incentivize State Government Agencies / Central Government Organizations on the similar lines to develop Affordable Rental Housing Complexes (ARHC) and operate.

–2% Interest Subvention for 12 months for Shishu MUDRA loanees- Relief of Rs. 1,500 crore

The small businesses under MUDRA have been mostly disrupted by lockdown and also impacted their capacity to pay Equated Monthly Installments (EMIs). Already loan moratorium has already been granted by RBI. The current portfolio of MUDRA-Shishu loans is Rs 1.62 Lakh crore (Maximum loan amount of 50,000 Rs).

- To tackle with this situation the Government of India will provide Interest subvention of 2% for prompt payees for a period of 12 months.

About PMMY:

Launched on April 8, 2015 the scheme provides loan up-to 10 lakhs to the non-corporate, non-farm small/micro enterprises. The loans provided under PMMY are classified as MUDRA (Micro Units Development & Refinance Agency Ltd) loans. The loan coverage is classified under these three products.

- Shishu: Covers loan up-to 50, 000.

- Kishore: Covers loan from Rs 50,000 and up to Rs. 5 lakhs.

- Tarun: Covers loan from Rs 5 lakh and up to Rs. 10 lakhs.

The loan is provided by commercial banks, Regional Rural Banks (RRBs), Small Finance Banks(SFB), MFIs (Micro Finance Institutions) and NBFCs (Non-Banking Financial Institution).

Click Here to read more about PMMY

–Rs 5,000 crore Credit facility for Street Vendors; Rs 10,000 working capital support

In a move to provide financial assistance to the livelihoods of street vendors which are adversely impacted by COVID-19 crisis, the Government of India has Rs 5,000 crore special credit facility for the same.

- The scheme will provide up to Rs 10,000 as working capital and will support nearly 50 lakh street vendors.

- Street vendors accepting digital payments will receive monetary rewards and more credit based on good repayment behaviour.

–Rs 70,000 crore boost to housing sector and middle income group through

The government has extended the deadline for the affordable housing Credit Linked Subsidy Scheme (CLSS) till March 2021 whose deadline had expired on March 31, 2020. Tt will lead to investment of over Rs 70,000 crores in housing and will create jobs.

- CLSS for Middle Income Group was operationalized from May 2017.

- It is a component of PMAY under which, not only economically weaker sections, but also eligible middle-income groups can avail of home loans at reduced EMIs.

–Rs 6000 crore employment push using CAMPA funds

Centre will use Rs6,000cr funds under Compensatory Afforestation Management & Planning Authority (CAMPA) for Afforestation and Plantation works, including in urban areas, Artificial regeneration, assisted natural regeneration, forest management, soil & moisture conservation works, Forest protection, forest and wildlife-related infrastructure development, wildlife protection and management etc.

- This will create job opportunities in urban, semi-urban and rural areas and also for Tribals (Adivasis).

- Compensatory Afforestation Management & Planning Authority (CAMPA) set up under Compensatory Afforestation Fund Act, 2016.

–Rs 30,000 crore Additional Emergency Working Capital for farmers through NABARD

As a part of package National Bank for Agriculture and Rural Development (NABARD) will provide an additional emergency working capital funding of Rs 30,000 crore to 30 million farmers. This is over and above the Rs 90,000 crore provided by NABARD through the normal refinance route during this year.

- The objective of this funding is to meet the crop loan requirement of farmers via rural co-operative banks and regional rural banks (RRBs).

- This will also meet the post-harvest (Rabi) and current Kharif requirement in May/June, 2020.

- The front-loaded on-top facility will be provided to 33 state cooperative banks, 351 district cooperative banks and 43 regional rural banks based on their lending.

–Rs 2 lakh crore credit boost to 2.5 crore farmers under Kisan Credit Card Scheme

Concessional credit Government will undertake a Special drive to provide concessional credit boost worth Rs 2 lakh crore to 2.5 crore farmers through Kisan Credit Cards issued by the government. Fishermen and Animal Husbandry farmers will also be included in this drive.