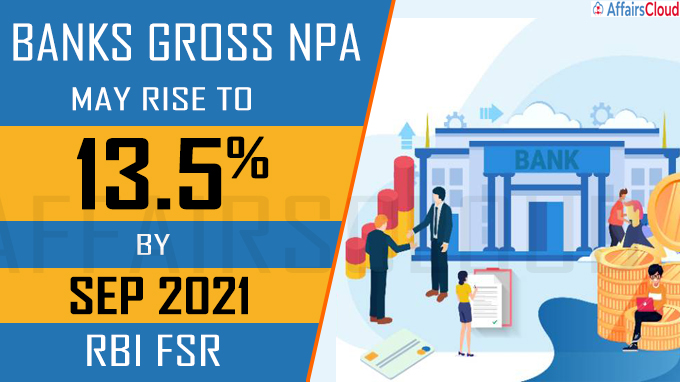

On January 11, 2021, Reserve Bank of India (RBI) released the 22nd issue of its bi-annual Financial Stability Report (FSR) 2021. It stated that gross non-performing assets (GNPAs) may rise to 13.5% by September 2021, from 7.5% in September 2020 under the baseline scenario.

On January 11, 2021, Reserve Bank of India (RBI) released the 22nd issue of its bi-annual Financial Stability Report (FSR) 2021. It stated that gross non-performing assets (GNPAs) may rise to 13.5% by September 2021, from 7.5% in September 2020 under the baseline scenario.

- In case of severe stress scenario, it is projected that the GNPA ratio will rise to 14.8% which would be 24-year high. It was 15.7% in March 1997.

- Banks GNPA and net NPA (NNPA) declined and stood at 7.5% and 2.1%, respectively, in September 2020.

- The above mentioned information is based upon the RBI’s macro stress tests covering the first six months (April-September) of the FY20-21.

September 2020 & Projected GNPA of Banks- Category Wise:

Public Sector Banks (PSBs)

PSBs GNPA ratio was 9.7% in September 2020.

- Projection: It may rise to 16.2% by September 2021 under the baseline scenario.

- Projection in severe stress scenario:6%

Private Banks (PVBs)

The GNPA ratio of PVBs was 4.6% in September 2020.

- Projection: It may rise to 7.9% by September 2021 under the baseline scenario.

- Projection in severe stress scenario: 8%

Foreign banks (FBs)

FBs GNPA ratio was 2.5% in September 2020.

- Projection: It may rise to 5.4% in September 2021.

- Projection in severe stress scenario: 5%

Other Highlights and Projections for SCBs:

—CRAR: The capital to risk-weighted assets ratio (CRAR) of Scheduled Commercial Banks (SCBs) improved to 15.8% in September 2020 from 14.7% in March 2020.

—System Level CAR: The system level capital adequacy ratio (CAR) projected a downgrade to 14% in September 2021 from 15.6% in September 2020 under the baseline scenario and to 12.5% in severe stress scenario.

—GNPA: Their GNPA ratio trimmed to 7.5% in September 2020 from 8.4% in March 2020.

—PCR: The provision coverage ratio (PCR) improved to 72.4% in September 2020 from 66.2% in March 2020.

- PCR is the percentage of bad assets that the bank has to provide for from their own funds.

—CET 1: The common equity Tier I (CET 1) capital ratio forecasted a decline to 10.8% in September 2021 from 12.4% in September 2020, in the baseline scenario. In the severe stress scenario it may further decline to 9.7%.

- Tier 1 common capital ratio is a measurement of a bank’s core equity capital, compared with its total risk-weighted assets. It signifies a bank’s financial strength.

— The focus is towards supporting the recovery of businesses and households.

–Policy measures in response to COVID-19 impacts by the regulators and the government is ensuring the smooth functioning of domestic markets and financial institutions. Click Here for Important Regulatory Measures

- This resulted in an improvement in Performance parameters of banks.

–Total bilateral exposures in the financial system increased marginally during the Q2FY21.

–The contagion risk to the banking system under various scenarios declined as compared to March 2020.

Click Here for Official Report

What are Stress Tests?

These are carried out by RBI on the basis of banks’ balance sheet positions viz. NPAs, profitability, capital and other relevant data reported by banks.

About Financial Stability Report (FSR):

It states the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC) on risks to financial stability which includes development and regulation of the financial sector.

Recent Related News:

i.After the commencement of Test Phase of First Cohort under the Regulatory Sandbox (RS) by Reserve Bank of India (RBI) on November 17, 2020, now the apex bank has announced the opening of the Second Cohort on the theme of “Cross Border Payments”.

ii.On December 18, 2020, the Reserve Bank of India (RBI) has amended the Master Direction (MD) on “Know Your Customer (KYC)”, dated February 25, 2016, by extending the applicability of centralized KYC registry to legal entities (LEs), from individual accounts w.e.f. April 1, 2021.

Static points about Reserve Bank of India (RBI):

-It was established on the recommendation of the Hilton Young Commission.

-RBI is responsible only for printing the currency notes. Minting of coins is done by the Government of India.

-Dr. Manmohan Singh is the only Prime Minister to have also served as the Governor of RBI.