Ahead of Diwali festival, Union Minister Nirmala Sitharaman, Ministry of Finance during a press conference has announced the “Aatmanirbhar Package 3.0” covering following 12 schemes as a stimulus measure of additional Rs 2,65,080 crore to boost economic growth.

Ahead of Diwali festival, Union Minister Nirmala Sitharaman, Ministry of Finance during a press conference has announced the “Aatmanirbhar Package 3.0” covering following 12 schemes as a stimulus measure of additional Rs 2,65,080 crore to boost economic growth.

- It should be noted that as of November 12, 2020, the Central Government has provided an economic stimulus of Rs 29,87,641 crore amid COVID-19.

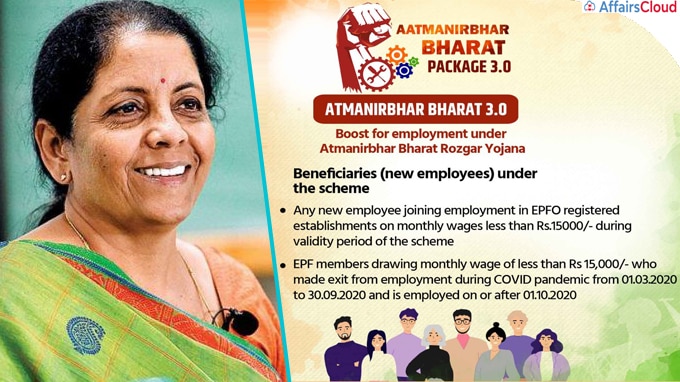

- Announcement of Aatmanirbhar Bharat Rozgar Yojana, EPFO Incentive for New Employees

Atmanirbhar Bharat Rozgar Yojana is a scheme applicable from October 1, 2020 to incentivise creation of new employment opportunities during the Covid-19 recovery phase. This will benefit any new employee joining employment in Employees’ Provident Fund Organisation (EPFO) registered establishments on monthly wages less than Rs 15,000 per month. It will also benefit those who left their job between March 1 to September 30, 2020 and are employed on or after October 1, 2020.

- In this regard, eligible establishments will get a subsidy for all new employees and the scheme will remain operational till June 30, 2021.

Eligibility Criteria for Establishments:

Entities registered with EPFO added new employees as in September 2020.

Organisations, with up to 50 employees, added a minimum of two new employees.

Entity with more than 50 employees, added at least five employees.

Subsidy Support from Central Government :

–The organisations of up to 1000 employees would receive employee’s contribution (12% of wages) & employer’s contributions (12% of wages), totalling 24% of wages, for two years.

–Employers with over 1,000 employees will get only employees’ EPF contribution of 12% from the central government.

–The subsidy support will be credited upfront in Aadhar seeded EPFO account (UAN) of an eligible new employee.

About Employees’ Provident Fund Organisation (EPFO):

Central Provident Fund Commissioner– Sunil Barthwal

Headquarter– New Delhi

- Extension of ECLGS 1.0 till March 31, 2021 from Oct 31, 2020; Launch of ECLGS 2.0

The Central government has extended the existing Emergency Credit Line Guarantee Scheme (ECLGS 1.0) for MSMEs (Micro, Small & Medium Enterprises), businesses, MUDRA (Micro Units Development and Refinance Agency) borrowers and individuals (loans for business purposes) by 5 months i.e. till March 31, 2021 from October 31, 2020. It is a fully guaranteed and non-collateral fund based-working capital term loan.

About ECLGS 1.0:

- Launched in May 2020, as a part of Rs 20 lakh crore comprehensive package, ECLGS 1.0 provided additional credit up to 20% of outstanding loans as on February 29, 2020 for entities with outstanding credit of up to Rs 50 crore as on Feb 29, 2020, and annual turnover up to Rs 250 crore, which were up to 60 days past due as on February 29, 2020.

- It had a 1-year moratorium period and a 4-year repayment period.

Launch of ECLGS 2.0:

Under Aatmanirbhar Package 3.0, Government has launched a ECLGS 2.0 for 26 stressed sectors as identified by the Kamath Committee, plus health care sector with credit outstanding of above Rs. 50 crore and up to Rs 500 Crore as on February 29, 2020. It will be available till March 31, 2021.

- This will help the entities to sustain employment and meet liabilities. It will also benefit MSME sector which provides goods and services to eligible entities,

- Entities upto 30 days past due as of February 29, 2020, will get an additional credit upto 20% of outstanding.

- It had a 1-year moratorium period and a 5-year repayment period.

- Rs 1,45980 cr boost to Atmanirbhar manufacturing by PLI for 10 Key Sectors

The package 3.0 also includes a Production Linked Incentive (PLI) scheme worth up to Rs 1,45980 crore for 10 key sectors which was recently approved by the Union Cabinet. This will attract investments, boost manufacturing and enhance exports on the lines of the Atmanirbhar Bharat. Read Cabinet approves PLI Scheme worth Rs 1,45980 cr to 10 key Sectors for Enhancing

- Rs 18,000 crore additional fund for PMAY-Urban

The Finance Ministry announced Rs. 18,000 crore additional outlay for Prime Minister Awaas Yojana – Urban (PMAY-U). This is over and above the Rs. 8,000 crore announced in the Budget. This decision has been taken to help 12 lakh houses to be grounded and 18 lakh houses can be completed.

- Also, there will be a multiplying effect as additional jobs of 78 lakh will be created, besides increasing the demand of cement and steel.

- Click Here to Read about PMAY

- Govt relaxed rules on EMD and Performance Security on Contracts

In a bid to boost construction and infrastructure development projects, the Central government relaxed the regulations on earnest money deposit (EMD) and performance security on government tenders under General Financial Rules till December 31, 2021.

- In this regard Performance security on contracts reduced to 3 % from 5-10%.

- Also, EMD will not be required for tenders and will be replaced by Bid Security Declaration.

- This measure would give relief to contractors by avoiding locking up of capital and the cost of bank guarantees.

- Income tax relief for home buyers, developers to boost real estate demand

The Central Government has decided to increase the differential between circle rate & agreement value from 10% to 20% (under section 43CA of the Income Tax-IT Act) till June 30, 2021 for only primary sale of residential units of value up to Rs 2 crores.

- A relief up to 20% will also be allowed to buyers of these units under section 56(2)(x) of IT Act for the same period.

- This will reduce the difficulties faced by both home-buyers and developers and help in clearing the unsold inventory.

- Govt infuses Rs 6,000 cr in NIIF debt platform to increase infra funding

In a bid to provide proper funding to infrastructure projects, the government decided to infuse Rs 6,000 crore equity in National Investment and Infrastructure Fund (NIIF) debt platform i.e. NIIF Strategic Opportunities Fund. With this, the debt platform is expected to raise enough resources to extend debt support of Rs 1,10,000 crore to projects by 2025.

- The NIIF Strategic Opportunities Fund has set up a Debt Platform comprising an NBFC Infra Debt Fund and an NBFC Infra Finance Company. The Platform has a Loan book – Rs 8000 crore and a deal pipeline of Rs 10,000 crore.

- FM announces Rs 65,000-cr fertilizer subsidy for farmers

The Finance Ministry is providing Rs 65,000 crore for subsidized fertilizers to ensure adequate and timely availability of fertilizers to 140 million farmers. This decision has been taken as there is an estimated increase in fertilizer usage of 17.8% over the actual usage in 2019-20 of 571 lakh metric tonnes.

- This increase is due to favourable monsoons and the resultant increase in sown area.

- Fertiliser consumption which was 499 lakh MT (Metric Ton) in 2016-17 is expected to increase to 673 lakh MT in 2020-21.

- Additional funding of Rs 10,000 crore to boost rural employment

An additional outlay of Rs 10,000 crores will be provided for Pradhan Mantri Garib Kalyan Rozgar Yojana (PMGKRY) in the current financial year (FY21) to boost rural employment. Prime Minister Garib Kalyan Rozgar Yojana is also in progress in 116 districts. Rs 37,543 crores spent till date.

As on date, Rs 73,504 crore has been released under MGNREGA and 251 crore person-days of employment have been generated.Rs.40,000 crore was additionally provided in Atma Nirbhar Bharat 1.0.

About PMGKRY:

The scheme focuses on migrant labourers who returned to their native places, was created integrating MNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) and Grameen Sadak Yojana to provide livelihood opportunities in areas/ villages witnessing large number of returnee migrant workers amid COVID-19.

- Finance Ministry released Rs 3,000 cr to EXIM Bank for LoC under IDEAS

The Ministry of Finance has provided Rs 3,000 crore EXIM (Export Import) Bank for promotion of project exports through Lines of Credit (LoC) under the Indian Development and Economic Assistance Scheme (IDEAS) Scheme.

- It should be noted that Exim Bank extends LOC on behalf of the Government of India (GoI), as assistance to developing countries under IDEAS scheme.

- The scheme covers Asian countries (excluding Bangladesh, Nepal, Bhutan), Africa, Commonwealth of Independent States (CIS) region and Latin American region.

About EXIM Bank:

Managing Director (MD)– David Rasquinha

Headquarter– Mumbai, Maharashtra

- Rs 10,200 cr additional funds provided towards Capital and Industrial expenditure

Rs 10,200 crore are additionally provided by the Government as stimulus towards capital and Industrial expenditure including Domestic defence equipment, Industrial incentives, Industrial infrastructure, and Green energy.

- FinMin announced Rs 900 crore grant for COVID-19 vaccine research

A grant of Rs 900 crore provided to the Department of Biotechnology for Covid Suraksha Mission for research and development of the Indian Covid-19 vaccine. This is exclusive from the actual cost of vaccine and logistics purposes.

Recently Government of India launched ‘Mission COVID Suraksha’ with a corpus of Rs 3,000 crore to accelerate the development and manufacture of safe and effective COVID-19 vaccines in the country

Summary of Stimulus Measures Announced Till Date (November 12, 2020)

| Sr. No. | Stimulus | Amount (Rs. Crore) |

|---|---|---|

| 1 | Pradhan Mantri Garib Kalyan Package (May, 2020) | 1,92,800 |

| 2 | Atmanirbhar Bharat Abhiyaan 1.0 | 11,02,650 |

| 3 | PMGKP Anna Yojana – extension of 5 months from Jul – Nov | 82,911 |

| 4 | Atmanirbhar Bharat Abhiyaan 2.0 (October, 2020) | 73,000 |

| 5 | Atmanirbhar Bharat Abhiyaan 3.0 (November, 2020) | 2,65,080 |

| 6 | Reserve Bank of India (RBI) measures announced till 31st Oct 2020 | 12,71,200 |

| Total | 29,87,641 | |

Additional Expenditure for Schemes including Capital

| Sector | Capital (in Rs) |

| Housing for All – PMAY-U | Rs. 18,000 crores |

| Boost for Rural Employment | Rs.10,000 crores |

| R&D Grant for Covid Suraksha – Indian vaccine development | Rs. 900 crores |

| Industrial Infrastructure, Industrial Incentives and Domestic Defence Equipment | Rs.10,200 crores |

| Boost for Project Exports – Support for EXIM Bank | Rs.3,000 crores |

| Boost for Atmnanirbhar Manufacturing – Production Linked Incentives | Rs 1,45,980 crores |

| Support for Agriculture – Fertiliser Subsidy | Rs. 65,000 crores |

| Boost for Infrastructure – equity infusion in NIIF Debt PF | Rs 6000 crores |

| Atmanirbhar Bharat Rozgar Yojana (overall Rs 36,000 cr) | Rs 6000 crores |

| Total | Rs 2,65,080 crores |

Recent Related News:

i.On October 5, 2020 the 42nd GST Council meeting was held video conferencing from New Delhi under the chairmanship of Nirmala Sitharaman where it was decided that this year’s compensation cess collected amounting to Rs 20,000 crore will be disbursed to the states.

ii.On September 9, 2020, Nirmala Sitharaman virtually inaugurated Doorstep Banking Services by Public Sector Banks (PSBs) and participated in the online awards ceremony to felicitate best performing banks on EASE Banking Reforms Index for FY19-20.

About National Investment and Infrastructure Fund (NIIF):

Managing Director & Chief Executive Officer – Sujoy Bose

Head Quarter – Mumbai, Maharashtra.