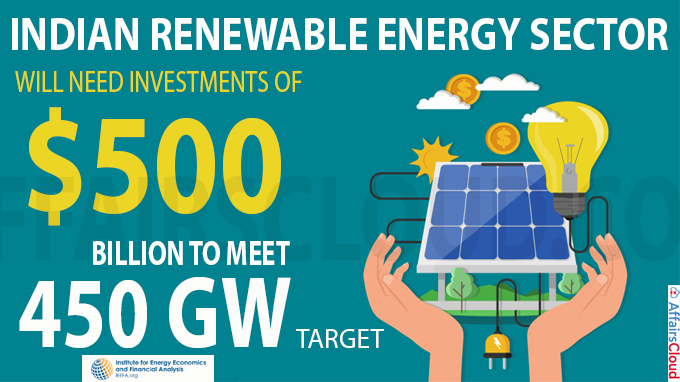

According to the report ‘Capital Flows Underpinning India’s Energy Transformation’ released by Institute for Energy Economics and Financial Analysis (IEEFA), India needs an Investment of USD 500 Billion to reach its target of 450 Gigawatts (GW) of Renewable Energy (RE) by 2030.

According to the report ‘Capital Flows Underpinning India’s Energy Transformation’ released by Institute for Energy Economics and Financial Analysis (IEEFA), India needs an Investment of USD 500 Billion to reach its target of 450 Gigawatts (GW) of Renewable Energy (RE) by 2030.

i.Out of USD 500 Billion,

- USD 300 Billion should be utilized for building Wind and Solar Infrastructure

- USD 50 Billion on Grid Firming Investments like gas-peakers, hydro power and batteries

- USD 150 Billion on expanding and modernising transmission and distribution

ii.The report also states that the RE sector in India has received investments worth USD 42 Billion since 2014.

iii.The report was authored by Tim Buckely, Director Energy Finance Studies & Saurabh Trivedi, Research Analyst.

Pull Factors:

The factors which are attracting Investors to invest in RE Sector in India are

- India’s Solar Power Tariffs hitting record Lows (at present it is INR 2 per unit)

- Declining solar module costs

- Low interest Rates (On commercial lending rates for solar projects)

- 25-year Power Purchase Agreements (PPA)

India’s Untapped Renewable Potential & Funding:

- At 900 GW India has the largest untapped Renewable potential in the World.

- India’s peak power demand will rise to 295 GW by 2021-22 & 690 GW by 2035.

- Domestic & Global Institutions across financial, corporate, energy, utility & government sectors will contribute the majority of investments needed for achieving India’s targets.

- The fundings include capital cost of adding more than 300 GW of new renewables infrastructure, producing low-cost but intermittent renewable power generation, and expansion & modernization of grid transmission and distribution.

Source of Capitals:

The sources of capital would be private equity, global pensions funds & sovereign wealth funds, to oil and gas majors, multinational development banks & India state-owned enterprises & Billionaires

Domination of India’s RE sector by Private Companies:

- The report stated that Indian renewables sector is being dominated by major private Independent Power Producers (IPPs) like ReNew Power, Greenko, Adani Green, Tata Power, Azure Power, and Hero Future Energies.

- They are facing competition from Government Corporations like NTPC Limited (formerly known as National Thermal Power Corporation) & NLC India, Coal India Limited & Indian Railways.

- Canada Pension Plan Investment Board (CPPIB) and KKR, the world’s largest private equity firm, are now major foreign investors in the Indian RE sector and leading the way, according to the report. In December 2020, CPPIB acquired an 80 percent equity stake in SB Energy India at a valuation of USD 525 million and KKR acquired major stakes in the IndiGrid InvIT in 2019.

Fact:

India Targets 175 GW Renewable Energy by 2022 – 100 GW Solar, 60 GW Wind, 10 GW Bio-Energy, 5 GW Small Hydro. 89.63 GW of Renewable Energy has already been installed by India.

Click here to read the full report

Recent Related News:

i.November 13, 2020, According to the International Energy Agency’s (IEA) report, Renewables 2020 – Analysis and Forecast to 2025, India will double its green energy capacity addition in 2021 compared to 2020 levels.

ii.November 30, 2020, The 3rd Global RE-INVEST Renewable Energy Investors Meet & Expo 2020 organised by the Ministry of New and Renewable Energy (MNRE) took place virtually from November 26-28, 2020.

About Institute for Energy Economics and Financial Analysis (IEEFA):

Executive Director – Sandy Buchanan

Headquarters – Cleveland, Ohio, USA