On October 22, 2021, the Reserve Bank of India (RBI) has introduced a revised regulatory framework for Non-Banking Finance Companies (NBFCs) named ‘Scale Based Regulation’ (SBR) to regulate the NBFCs based on their size, activity, complexity, and interconnectedness within the financial sector.

On October 22, 2021, the Reserve Bank of India (RBI) has introduced a revised regulatory framework for Non-Banking Finance Companies (NBFCs) named ‘Scale Based Regulation’ (SBR) to regulate the NBFCs based on their size, activity, complexity, and interconnectedness within the financial sector.

- All the guidelines over SBR would come into effect from October 01, 2022, whereas the instructions related to the ceiling on IPO (Initial Public Offer) funding would come into effect from April 01, 2022.

About SBR Regulatory framework in Brief:

a.Regulatory Structure for NBFCs:

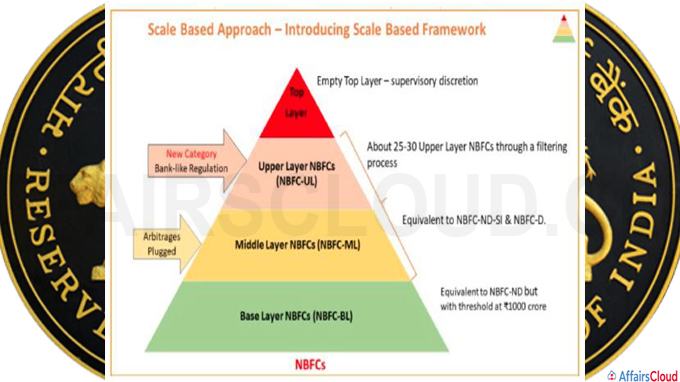

Structure of NBFCs: Under the SBR framework, NBFCs are categorised into 4 layers as Base Layer (NBFC-BL), Middle Layer (NBFC-ML), Upper Layer (NBFC-UL), and a possible Top Layer (NBFC-TL) based on the size, activity, etc.

About the layers:

1.Base Layer: It includes,

i.Non-deposit taking NBFCs below the asset size of Rs 1000 crore.

ii.NBFCs that are undertaking the following activities

- NBFC-Peer to Peer Lending Platform (NBFC-P2P),

- NBFC-Account Aggregator (NBFC-AA),

- Non-Operative Financial Holding Company (NOFHC), and

- NBFCs that are not availing public funds and do not have any customer interface.

2.Middle Layer: It includes,

i.All deposit-taking NBFCs (NBFC-Ds) irrespective of asset size.

ii.Non-deposit taking NBFCs with asset size of Rs 1000 crore and above.

iii.NBFCs undertaking the following activities

- Standalone Primary Dealers (SPDs),

- Infrastructure Debt Fund – NBFCs (IDF-NBFCs),

- Core Investment Companies (CICs),

- Housing Finance Companies (HFCs) and

- NBFC- Infrastructure Finance Companies (NBFC-IFCs)

3.Upper Layer:

i.It includes the NBFCs that are identified by the RBI as warranting enhanced regulatory requirements (based on a set of parameters and scoring methodology).

ii.The top 10 eligible NBFCs in terms of their asset size will always be in the upper layer, irrespective of any other factor.

4.Top Layer: The Top Layer will ideally remain empty. In future, it may be filled with NBFCs (from the Upper layer) that are having substantial increases in the potential systemic risk (as per RBI’s opinion).

5.Other categorization:

i.It includes NBFCs such as, Investment and Credit Companies (NBFC-ICC), Micro Finance Institution (NBFC-MFI), NBFC-Factors and NBFC-Mortgage Guarantee Companies (NBFC-MGC) will lie in any of the layers of the regulatory structure depending on the parameters of the SBR framework.

ii.Government-owned NBFCs will be placed in the Base Layer/Middle Layer (as the case may be) but they will not be placed in the Upper Layer.

b.Regulatory Changes under SBR:

1.Net Owned Fund (NoF) Requirement:

i.The minimum NOF for NBFC-ICC, NBFC-MFI, and NBFC-Factors, was increased to Rs 10 crore.

Glide path for Existing NBFCs to achieve NOF of Rs 10 crore:

| NBFCs | Current NOF | NOF by March 31, 2025 | NOF by March 31, 2027 |

|---|---|---|---|

| NBFC-ICC | Rs 2 crore | Rs 5 crore | Rs 10 crore |

| NBFC-MFI | Rs 5 crore (Rs 2 crore in NE(North Eastern) Region) | Rs 7 crore (Rs 5 crore in NE Region) | Rs 10 crore |

| NBFC-Factors | Rs 5 crore | Rs 7 crore | Rs 10 crore |

ii.For NBFC-P2P, NBFC-AA, and NBFCs with no public funds and no customer interface, the NOF was not changed and continued to be Rs 2 crore.

iii.The existing minimum NOF for NBFCs – IDF, IFC, MGCs, HFC, and SPD are also not modified.

- The existing NOF are – IDF and IFC – Rs 300 crore, MGC- Rs 100 crore, HFCs- Rs 20 crore, SPDs which undertake only the core activities – Rs 150 crore, SPDs which also undertake non-core activities – Rs 250 crore.

2.Non-Performing Assets (NPA) Classification:

For all categories of NBFCs, the current NPA classification norm was changed to the ‘overdue period of more than 90 days’ i.e. debt is classified as non-performing when loan payments have not been made for a period of 90 days.

Glide path to NBFCs in Base Layer to follow the 90 days NPA norm:

| NPA Norms | Timeline |

|---|---|

| >150 days overdue | By March 31, 2024 |

| >120 days overdue | By March 31, 2025 |

| > 90 days | By March 31, 2026 |

3.Experience of the Board – At least one of the directors of the NBFCs need to have relevant experience of having worked in a bank/ NBFC.

4.Ceiling on IPO Funding – For NBFCs, RBI has set a limit of Rs 1 crore/per borrower for financing subscription to Initial Public Offer (IPO). NBFCs were also allowed to fix more conservative limits.

5.Concentration of Credit/ Investment:

The current credit concentration limits prescribed for NBFCs under lending and investments were merged into a single exposure limit of 25 percent of Tier-1 capital for a single borrower/ party and 40 percent of Tier-1 capital for a single group of borrowers/ parties.

Click here to know more about the SBR Framework

Key Facts about NBFCs:

i.In India there are 9,651 NBFCs across 12 different categories focussed on a diverse set of products, customer segments, and geographies.

ii.As on March 31, 2021, NBFC sector (including HFCs) has assets worth more than Rs 54 lakh crore, equivalent to about 25 percent of the asset size of the banking sector.

iii.Over the last 5 years, the NBFC sector assets have grown at a cumulative average growth rate of 17.91 percent.

iv.NBFCs are the largest net borrowers of funds from the financial system and banks provide a substantial part of the funding to NBFCs and HFCs.

Recent Related News:

On June 24, 2021, the Reserve Bank of India (RBI) linked the declaration of dividends by non-banking finance companies (NBFCs) to their minimum prudential norms on Capital to Risk-Weighted Assets Ratio (CRAR) and Non-Performing Assets (NPAs).

On April 7, 2021, the Reserve Bank of India (RBI) extended the membership of Centralised Payment Systems (CPSs) facilities such as National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) to non-bank payment system operators.

About Reserve Bank of India (RBI):

Establishment– April 1, 1935

Headquarters– Mumbai, Maharashtra

Governor– Shaktikanta Das

Deputy Governors– Mahesh Kumar Jain, Michael Debabrata Patra, M. Rajeshwar Rao, T. Rabi Sankar