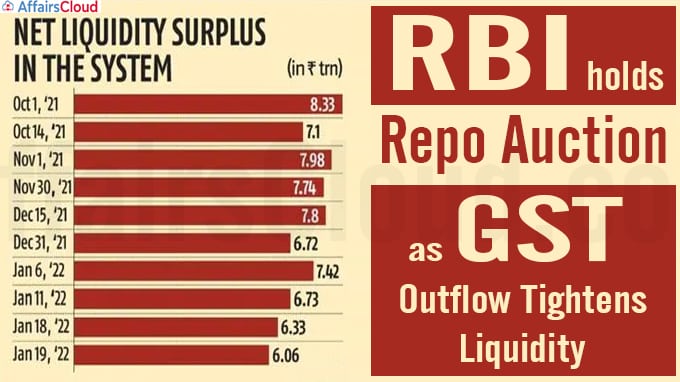

On January 20, 2022, the Reserve Bank of India (RBI) conducted an Overnight variable rate repo (VRR) auction for Rs 50,000 crore under liquidity adjustment facility (LAF) to infuse liquidity, instead of its usual fixed-rate overnight reverse repo window, as Goods and Services Tax (GST) collection tightened liquidity this week.

This auction was to stabilize overnight Call Money Market (CMM) rates which have been hardening due to outflows from banks on account of GST payments.

The weighted average call money rate also touched 4.3587% showing liquidity stress. This is the first VRR auction since March 2021.

Impact of RBI’s VRR Auction:

i.As against the notified amount of Rs 50,000 crore, RBI received bids aggregating Rs 65,700 crore. It accepted bids aggregating Rs 50,003 crore at the cut-off rate of 4.06 percent at the auction.

Result of the Overnight VRR auction held on January 20, 2022:

Tenor | 1-day |

Notified Amount | Rs 50,000 Crore |

Total amount of bids received | Rs 65,700 Crore |

Amount allotted | Rs 50,003 Crore |

Cut off Rate | 4.06% |

Weighted Average Rate | 4.10% |

Partial Allotment Percentage of bids received at cut off rate | 97.27% |

ii.As CMM rate touched 4.65% after RBI announced a one-day VRR auction for Rs 50,000 crore.

iii.This VRR auction had the desired impact, with the last trade taking place at 3.35 percent.

Points to be noted:

i.Hardening is a trading condition in which securities prices rise and volatility declines.

ii.The CMM is a market for uncollateralised lending and borrowing of funds. This market is open for participation only to scheduled commercial banks and the primary dealers to avail overnight (one day) to meet liquidity.

iii.The weighted average call money rate is used by banks for interbank lending.

Key Point:

This spike in call money is temporary. Once the government starts spending, money will again come back into the banking system. The banks will also receive the funds viz. Rs 2,49,416 crore on January 25, 2022 and Rs 4,31,426 crore on January 28, 2022 due to the reversal of funds they had deployed with RBI in VRR auctions.

Recent Related News:

As per the RBI’s publication of ‘Deposits with Scheduled Commercial Banks – March 2021’, Scheduled Commercial Banks (SCBs) deposits in FY21 grew by 11.9 percent year-on-year compared to 8.8 percent in FY20 due to high growth in the Current Account and Savings Account (CASA) deposits.

About Reserve Bank of India (RBI):

Establishment– April 1, 1935

Headquarters– Mumbai, Maharashtra

Governor– Shaktikanta Das

Deputy Governors– Mahesh Kumar Jain, Michael Debabrata Patra, M. Rajeshwar Rao, T. Rabi Sankar.