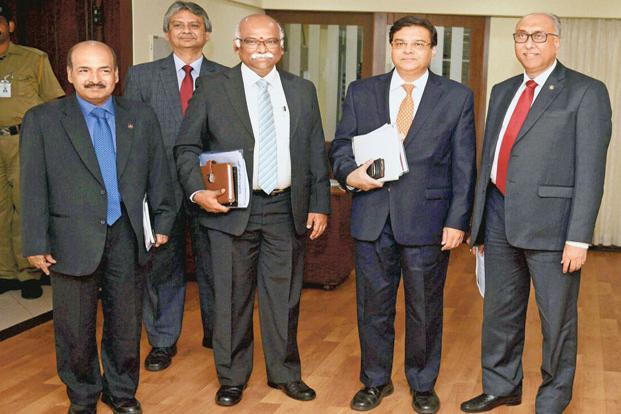

The RBI Governor Urjit Patel led six-member Monetary Policy Committee (MPC) on December 7, 2016, announced the fifth bi-monthly monetary policy statement of 2016-2017, which is also the first policy after the implementation of the demonetization decision of Government.

Major highlights of the RBI Monetary Policy Statement

1.Repo rate remained unchanged at 6.25%

2.Reverse Repo at 5.75%

3.Cash reserve ratio or CRR unchanged at 4%

4.Due to demonetization, the central bank has lowered the GDP growth forecast from 7.6 per cent to 7.1 per cent for the current fiscal.Inflation target remains 5 percent for March 2017 with risks tilted to the upside.

5.Demonetisation to lower prices of perishables and could reduce inflation by 10-15 basis points by December.

6.It may also interrupt some part of industrial activity in November-December due to delays in payments of wages and purchases of inputs.

7.Demonetisation to result in short-run disruptions in cash-intensive sectors like retail trade, hotels, restaurants and transportation, and the unorganised sector.

8.RBI has also withdrawn 100 per cent incremental Cash Reserve Ratio (CRR) from December 10, that would allow banks to retain the deposits coming to them as part of demonetisation.

9.The central bank also said that almost Rs 12 lakh crore out of total Rs 14.5 lakh crore in scrapped notes have already been deposited in banks.

10.Crude price volatility, surge in financial market turbulence could put March end inflation target at risk

11.Foreign exchange reserve was raised to USD 364 billion on December 2.

12.RBI injected Rs 1.1 lakh crore liquidity through OMO purchases this fiscal year.

13.Next monetary policy to be reviewed on February 8, 2017.

RBI Eases 2-Factor Authentication Norms for Transactions Under Rs. 2,000

In order to boost small value online transactions, the RBI relaxed norms for 2-factor authentication for payments up to Rs. 2,000 on December 7, 2016.

- The Reserve Bank of India (RBI) has relaxed the Additional Factor Authentication (AFA) norms for online transactions up to Rs. 2,000 to save time transaction time of customers and also promote government’s digital payment program.

- The relaxation for AFA Additional Factor of Authentication under shall be applicable for card not present (CNP) transactions.

- Banks and card networks are free to facilitate their customers to set lower per transaction limits.

- To avail the AFA facility, banks which will issue the cards will also offer the ‘payment authentication solutions’ of the respective card networks to the customers on an optional basis.

- The RBI said that only authorized card networks will provide such payment authentication solutions with the participation of card issuing and acquiring banks.

- Customers will have to go through a one-time registration process and enter their card details and additional information that will be authenticated by the issuing bank.

- This will help the customer to save time and effort because they will not be required to re-enter the card details for every transaction at merchant locations that offer this solution.

- The two factor of authentification will be card details already registered and the credentials used to login to the solution.

- Banks or Card network are also allowed to fix the number of times small value transactions will be allowed in a day/week/month.

Bank to Bear Full Liability of Authentication Breach

- In order to protect the customer from any breach of identity, RBI has notified the banks that the banks and authorised card networks offering such authentication solutions will bear the full liability in case of any security breach or compromise in the authorised card network.