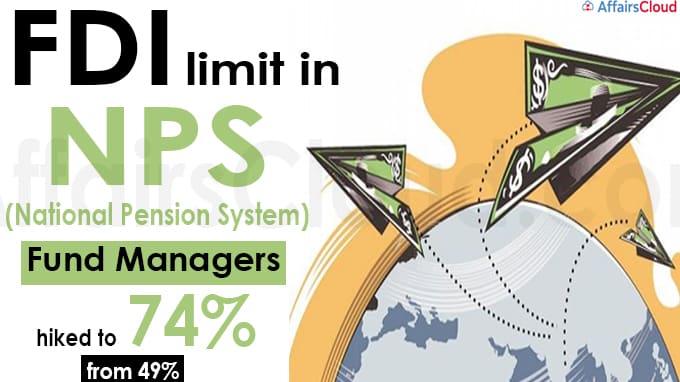

In July 2021, the ‘Pension Funds Regulatory and Development Authority’ (PFRDA) has made amendments over the PFRDA (Pension Fund) Regulations, 2015 and modified the Foreign Direct Investment (FDI) limit in the pension fund management under the National Pension System (NPS) to 74 percent from 49 percent.

In July 2021, the ‘Pension Funds Regulatory and Development Authority’ (PFRDA) has made amendments over the PFRDA (Pension Fund) Regulations, 2015 and modified the Foreign Direct Investment (FDI) limit in the pension fund management under the National Pension System (NPS) to 74 percent from 49 percent.

PFMs under NPS:

i.The NPS has 7 Pension Fund Managers (PFMs) to manage the funds of individuals as per their choice.

ii.Out of 7 PFMs, HDFC Pension Management, ICICI Prudential Pension Funds, Kotak Mahindra Pension Fund and Aditya Birla Sun Life Pension Management have foreign investments, hence the current increased percent of FDI will benefit them.

- The other PFMs are LIC Pension Fund, SBI Pension Funds, and UTI Retirement Solutions.

Note – SBI Pension Funds Private Limited is the default PFM under NPS i.e. if a user doesn’t choose among the 7 available PFMs, SBI Pension Funds would manage their funds.

Key points:

i.As of July 10, 2021, the NPS Assets Under Management (AUM) stood at about Rs 6.2 lakh crore and it is expected to rise over 30 percent year-on-year to around Rs 7.5 lakh crore in FY22.

- 6 lakh new private subscribers (corporate employees and citizens) have joined the NPS in FY21, it was about 5 lakhs in FY20.

ii.To increase the further competition in the pension sector, the PFRDA has allowed more PFMs to enter into the NPS sector by applying to it in FY22.

Note: In March 2021, the parliament approved the Amendment of the Insurance Act, 1938 to increase the FDI limit in the Insurance sector to 74 percent from 49 percent.

Recent Related News:

PFRDA is planning to raise the maximum age of entry into the National Pension System (NPS) to 70 years from 65 and plans to allow those who join after the age of 60 to continue their NPS accounts till 75 years (The present age limit is 70).

About National Pension System (NPS):

i.It is a voluntary defined contribution pension system in India, it was implemented in 2004 for public sectors and later expanded for private sectors in 2009. It was administered and regulated by PFRDA.

ii.It is portable across jobs and locations i.e it would allow a shift from one job/location to another.

iii.Pension plans or retirement plans that are offered by Mutual funds and Insurance companies are not under the jurisdiction of PFRDA.