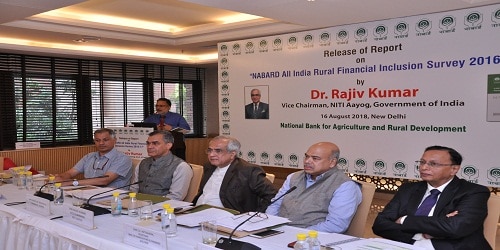

On 16th August 2018, NABARD All India Financial Inclusion Survey (NAFIS) report was released by Dr. Rajiv Kumar, Vice Chairman, NITI Aayog at an event, in New Delhi.

i. This survey was commissioned in 2016. Reference year of survey is 2015-16. The survey was conducted throughout India.

i. This survey was commissioned in 2016. Reference year of survey is 2015-16. The survey was conducted throughout India.

ii. Samples were taken from 2016 villages in 245 districts and 29 states. It covered 40,327 rural households and a population of 1,87,518.

iii. Out of this 48 % are agriculture households. 87 % are small and marginal farmer households.

iv. Data was collected through paperless method of Computer Aided Personal Interview.

v. This survey was conducted to bring together Financial Inclusion and rural livelihood aspects.

vi. This is the first edition of this survey. NABARD (National Bank for Agriculture and Rural Development) has proposed to perform this survey every 3 years.

vii. The survey assessed the income levels of rural households, mapped aspects like debt, saving, investment, insurance, pension and financial aptitude and behaviour of individuals.

viii. The survey defines farm households as families having more than Rs 5,000 as value of produce from agricultural operations in the year prior to the survey.

Highlights of NAFIS 2016-17:

Income:

- Agricultural households, which accounted for 48% of rural households, earned Rs 107,172 during 2015-16 from cultivation, livestock, non-farm sector activities and wages/salaries. Thus, farmers’ income grew at a compounded growth rate of 12% per annum compared to Rs 77,112 per annum as per NSSO (National Sample Survey Office) assessment in 2012-13. The income levels for 19 out of 29 states are above all India average and 15 states recorded annual compound growth of above 10.5% between 2012-13 and 2015-16.

- Agricultural households earned 34% of their income from cultivation. Wage earnings contributed the same proportion to the income followed by salaries (16%), livestock (8%) and non-farm sector (6%). Other sources accounted for the rest.

- Non-agricultural households reported average annual income of Rs 87,228 majorly contributed by wages (54%), followed by salaries (32%) and non-farm sector activities (12%). Agricultural households earned 23% more than non-agricultural households.

Savings & Investment:

- 88.1 % of the households reported having a bank account.

- 33 % households reported more than one savings account

- 26 % of HH have women with institutional (including SHG) savings account

- 55 % of agricultural households reported any savings during the last year and of these 53 % saved with institutions like banks, post offices and SHGs.

- Average savings per annum per saver households was reportedly Rs 17,488, of which 95 per cent is with institutional agencies

- 10.4 % of agricultural households also reported investment with the average investment per investing agricultural households was reportedly Rs 62,734.

- For all investments amounting more than Rs 10,000 in the year, 60% of the amount was funded through borrowings from either institutional or informal sources.

Debt:

- Incidence of Indebtedness (IOI)is measured as proportion of households reporting outstanding debt on the date of the survey. IOI is 52.5% for agricultural households and 42.8% non-agricultural households were reportedly indebted at the time of survey. All India IOI taking all rural households together stands at 47.4%.

- Average amount of outstanding debt (AOD) for indebted agricultural households is reportedly Rs 1,04,602 as on the date of the survey. Debt outstanding for indebted non-agricultural households is reportedly Rs 76,731. Overall extent of indebtedness taking all households combined is Rs 91,407.

- 43.5% agricultural households reported to have borrowed any money during last year from some source or the other. 60.4% of them reportedly borrowed from institutional sources exclusively. Further, 30.3% borrowed from only informal sources and 9.2% of agricultural households borrowed from both sources. 56.7% of Non-Agricultural households and 58.6% of all households borrowed from institutional sources during last year.

- During the year 2015-16, a borrowing Agricultural households reportedly availed a loan of Rs 107,083 from various agencies, 72% of which was availed from institutional sources including MFIs and SHGs. 69% of borrowings of all households and 65% of non-agricultural households were from institutional sources.

Insurance and Pension:

- About 26% of agricultural households and 25% of non-agricultural households reported to have been covered under one or the other type of insurance

- Among agricultural households who reported to have taken any loan for agricultural purposes in the last one year [2015-16] from institutional agencies, 6.9% reported being covered under crop insurance.

- The coverage under any type of pension was reported to be about 18.9 % for non-agricultural households as against 20.1 % for agricultural households

- When assessed for type of pension received, 32% of all households with senior citizens reported being covered by old age pension

Only 23% of rural income from farming:

- Agriculture does not even generate a quarter of rural household incomes in India. Out of the total rural households, 48 % are agricultural households.

- Only over 43 % of the average income of agricultural households comes from cultivation of crops and rearing of animals. Remaining 57 % income comes from non-agricultural sources.

More than half the agricultural households in India have outstanding debts:

- 52.5% of the agricultural households had an outstanding loan. Whereas 42.8% of the non-agricultural households in rural India had an outstanding loan.

- Also, agricultural households with outstanding debt had higher debt liability compared to non-agricultural ones.

- The average outstanding debt of the agricultural households is nearly equal to the average annual income of all agricultural households in India (Rs 1.07 lakh).

- Only 10.5% of agricultural households had a valid Kisan Credit Card. Those with Kisan Credit Card had used 66% of the sanctioned credit limit.

- 19% of the loans were taken to meet agricultural expenses. Another 19% of loans were taken for domestic needs. 11 % of loans were taken for housing and 12 % for medical expenses.

- Highest indebtedness was registered by farmers owning more than 2 hectares of land. 60% of such households are indebted.

- Telangana (79%), Andhra Pradesh (77%), and Karnataka (74%) had the highest levels of indebtedness among agricultural households. They were followed by Arunachal Pradesh (69%), Manipur (61%), Tamil Nadu (60%), Kerala (56%), and Odisha (54%).

88 per cent rural households have savings accounts:

- 88.1 % of rural households and 55 % of agricultural households have bank account. But only about 24 % of them use ATM services at least once in three months.

- Only 7.4 % of these households use debit or credit card. 7.5 % use cheque to make a payment at least once in three months.

- Average savings per annum per household was Rs 17,488.

Income and savings:

- The annual income of farmers increased 37.4 % between 2012-13 and 2015-16.

- The average monthly income of rural households was Rs 8,059 in 2015-16 .The average expenditure was Rs 6,646. Surplus was Rs 1,413 to save or invest.

- For agricultural households that invested more than Rs 10,000 in the year, 60 % was funded through borrowings from institutional or informal source.

- Punjab, Haryana and Kerala are the top 3 states having average monthly income of Rs 23,133, Rs 18,496 and Rs 16,927, for rural households.

- Uttar Pradesh has the least with average monthly income of Rs 6,668 per month. In Andhra Pradesh, high expenditure with respect to income was observed. Hence a rural household gets an average surplus of only Rs 95 a month.

- A family in Bihar retains Rs 262/month. In Uttar Pradesh it is Rs 315/month.

About National Bank for Agriculture and Rural Development (NABARD):

♦ Chairman – Dr. Harsh Kumar Bhanwala

♦ Headquarters – Mumbai