According to data from the Association of Mutual Funds in India (AMFI), Maharashtra, New Delhi, and Goa have the maximum mutual fund (MF) penetration in India, due to high income levels, higher literacy rates, and substantial inflows from corporations and high-net-worth individuals (HNIs).

According to data from the Association of Mutual Funds in India (AMFI), Maharashtra, New Delhi, and Goa have the maximum mutual fund (MF) penetration in India, due to high income levels, higher literacy rates, and substantial inflows from corporations and high-net-worth individuals (HNIs).

- However, this does not imply that all higher-income and developed states have high MF penetration while all “poorer” states lag behind.

AMFI determines MF penetration as the ratio of state assets managed by MFs to their Gross State Domestic Product (GSDP).

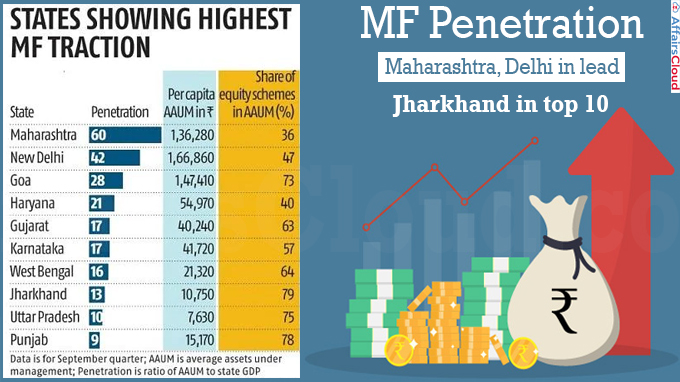

Top 5 States with highest MF penetration

| Rank | State | Penetration | Per Capita Average Assets Under Management (AAUM) | Share of Equity Schemes in AAUM |

|---|---|---|---|---|

| 1 | Maharashtra | 60 | Rs. 1,36,280 | 36% |

| 2 | New Delhi | 42 | Rs.1,66,860 | 47% |

| 3 | Goa | 28 | Rs.1,47,410 | 73% |

| 4 | Haryana | 21 | Rs.54,970 | 40% |

| 5 | Gujarat | 17 | Rs.41, 720 | 63% |

Key Points:

i.While Jharkhand is one of the top 10 states with a depth of 13%, MF penetration is barely 5-6% in Telangana and Kerala.

ii.Jharkhand has shown to be a better market for MFs since a large portion of the urban population is salaried and chooses MFs for regular investments.

iii.Jharkhand has 79% of the state’s total assets under management (AUM) in equity, and corporations generally invest in debt schemes.

- This indicates that institutional investments are unlikely to have increased penetration in Jharkhand.

- Jharkhand ranks 16th in terms of per capita AUM (Rs 10,750) despite having a higher penetration.

iv.The highest per capita AUMs are in New Delhi, Goa, and Maharashtra.

- These are the only 3 states where the per capita AUM exceeds Rs. 1 lakh.

v.The states with the lowest per capita AUM (Rs. 2,300 to Rs. 3,700) are Manipur, Bihar, and Tripura.

vi.The northeastern states also have the lowest levels of MF penetration.

vii.The penetration rate is considerably lower in southern states like Kerala, Telangana, and Andhra Pradesh.

- This is a result of investors in these states favoring gold and real estate as alternative investments.

viii.Kerala, Andhra Pradesh, Telangana, and Bihar have the lowest penetration rates among large states.

Recent Related News:

In September 2022, the Securities and Exchange Board of India (SEBI) permitted Real Estate Investment Trust (REIT), and Infrastructure Investment Trust (InvIT) to issue Commercial Papers (CPs), subject to certain conditions.

About Association of Mutual Funds in India (AMFI)

AMFI is the association of all the asset management companies registered with the Securities and Exchange Board of India (SEBI) to manage mutual funds in India.

Chairman – A. Balasubramanian (CEO of Aditya Birla Sun Life Asset Management Co. Ltd.)

Incorporated – 1995

Headquarters – Mumbai, Maharashtra