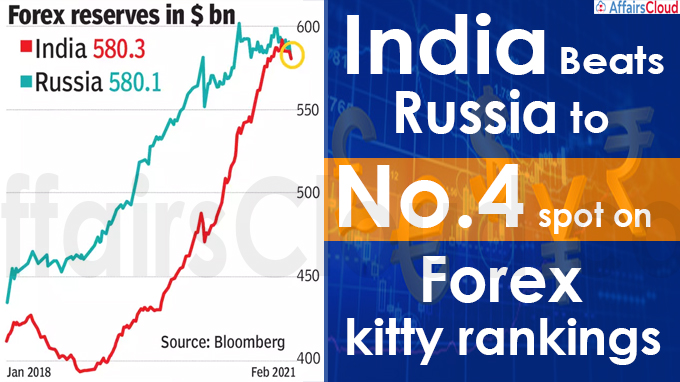

As per the Reserve Bank of India’s (RBI) data, India’s Foreign exchange (Forex) reserves to become the world’s fourth-largest by surpassing Russia. India’s foreign currency holdings fell by $4.3 billion to $580.3 billion and Russia’s forex holdings were $580.1 billion. As of March 2021, International Monetary Fund(IMF)table, China has the largest reserves, followed by Japan, Switzerland, India, and Russia.

As per the Reserve Bank of India’s (RBI) data, India’s Foreign exchange (Forex) reserves to become the world’s fourth-largest by surpassing Russia. India’s foreign currency holdings fell by $4.3 billion to $580.3 billion and Russia’s forex holdings were $580.1 billion. As of March 2021, International Monetary Fund(IMF)table, China has the largest reserves, followed by Japan, Switzerland, India, and Russia.

- Foreign exchange reserves are assets held on reserve by a central bank(RBI) in foreign currencies, which can include foreign currencies, bonds, treasury bills, and other government securities.

- Most of the foreign exchange reserves are held in U.S. dollars, as it is the most traded currency in the world.

Benefits of having a strong forex reserves position:

- This will lead to more investments through foreign investors and credit rating companies

- India now has enough reserves to cover roughly 18 months of imports; this is due to the rare current-account surplus, rising foreign direct investment, and inflows into the local stock market.

- Through this RBI can make a profit from a depreciation of the foreign currency or incur a loss on its appreciation.

- Interest is not paid on foreign cash reserves, nor on gold holdings, but earns interest on government securities.

Last year Performance:

In 2020, the RBI bought a net $88 billion in the spot forex market, this made the Indian rupee the worst performer among Asia’s major currencies and earned India a place on a US Treasury watchlist for currency manipulation.

Way forward:

- RBI Governor Shaktikanta Das stressed the idea of emerging market central banks to build reserves to prevent any external shocks.

- The RBI started further focus on strengthening foreign exchange reserves.

About Foreign exchange (forex) reserves:

The RBI Act, 1934 provides the legal framework for the deployment of forex reserves.

Objective: To limit external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

India’s Forex Reserve include:

- Foreign currency assets (capital inflows to the capital markets, Foreign Direct Investment, and external commercial borrowings)

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund (IMF)

Recent Related News:

As per the 12th edition of World Economic League Table 2021 (WELT), an Annual report released by the Centre for Economics & Business Research Ltd (CEBR), India slumped 1 spot to 6th Largest Economy (out of 195 countries) in the world in 2020 from 5th in 2019 due to the impact of COVID19. The United States (US) topped the 2020 rankings followed by China & Japan.

About International Monetary Fund (IMF):

It was conceived in July 1944 at the United Nations Bretton Woods Conference in the United States.

Headquarters: Washington, D.C., United States

Managing Director : Kristalina Georgieva

Membership: 190 countries

The largest borrowers: Argentina, Egypt, Ukraine, Pakistan