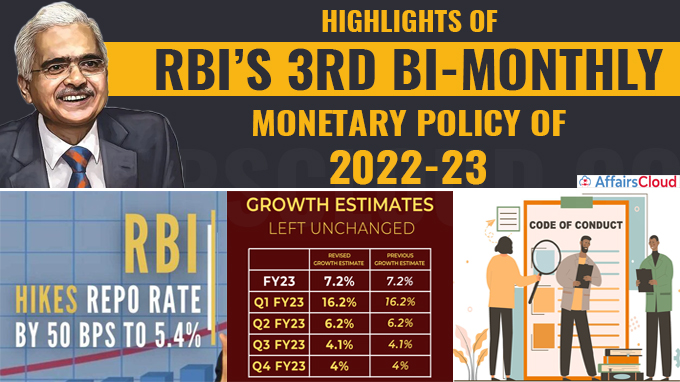

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) met on August 3-5, 2022 , and released the RBI’s 3rd bi-monthly monetary policy of FY23 which retained India’s real Gross Domestic Product (GDP) growth at 7.2% for the FY23, with FY23’s Q1 at 16.2%; Q2 at 6.2%; Q3 at 4.1%; and Q4 at 4%.

- The stance is to focus on withdrawal of accommodations.

- Real GDP growth for Q1FY24 is projected at 6.7%.

RBI’s Policy Rates:

The MPC raised the repo rate by 50 basis points to 5.40% from 4.90%. Consequently, the Standing Deposit Facility (SDF) Rate adjusted to 5.15% from 4.65% and Marginal Standing Facility (MSF) rate and Bank Rate to 5.65% from 5.15%.

- Reverse Repo Rate , Cash Reserve Ratio (CRR), and Statutory Liquidity Ratio remain unchanged.

| Category | Revised Rate on Aug 2022 | Previous Rate |

| Policy Repo Rate | 5.40% | 4.90% |

| Reverse Repo Rate | 3.35% | 3.35% |

| Standing Deposit Facility (SDF) Rate | 5.15% | 4.65% |

| Marginal Standing Facility (MSF) Rate | 5.65% | 5.15%. |

| Bank Rate | 5.65% | 5.15%. |

| Cash Reserve Ratio (CRR) | 4.50% | 4.50% |

| Statutory Liquidity Ratio | 18% | 18% |

Domestic Economy:

Inflation projection

It is retained at 6.7% in 2022-23, with Q2 at 7.1%; Q3 at 6.4%; and Q4 at 5.8%, and risks evenly balanced.Inflation has remained above the Reserve Bank’s upper limit of 6% for the sixth consecutive month.

ii.CPI inflation for Q1:2023-24 is projected at 5%.

- CPI inflation eased to 7% (year-on-year, y-o-y) during May-June 2022 from 7.8% in April 2022, although it persists above the upper tolerance band.

iii.Average daily absorption under the LAF (liquidity adjustment facility) at Rs 3.8 lakh crore during June-July 2022.

iv.Money supply (M3) and bank credit from commercial banks rose (year-on-year) by 7.9% and 14%, respectively, as on July 15, 2022.

v.India’s foreign exchange reserves were placed at US$ 573.9 billion as on July 29, 2022.

Five additional measures :-

Five additional measures have been announced by Governor.They are

CICs brought under Reserve Bank Integrated Ombudsman Scheme (RB-IOS) 2021

RBI in exercise of the powers conferred by sub section (1) of Section 11 of the Credit Information Companies (Regulation) Act, 2005, has included Credit Information Companies (CICs) aka credit bureaus, under the Reserve Bank Integrated Ombudsman Scheme (RB-IOS) 2021 w.e.f. September 1, 2022.

- This will provide a cost-free alternate redressal mechanism to customers of REs (Regulated Entities) for grievances against CICs.

- Also, to strengthen the internal grievance redress by CICs themselves, it has been decided to mandate the CICs to have their own Internal Ombudsman (IO) framework.

Key Points:

i.The CICs in India are CIBIL (Credit Information Bureau India Limited), Experian Credit Information Company of India, Equifax Credit Information Services, and CRIF High Mark Credit Information Services.

ii.RB-IOS 2021, covers regulated entities (REs) such as Scheduled Commercial Banks (SCBs) including Urban Cooperative Banks (UCBs), Non-Banking Financial Companies (NBFCs) and non-scheduled primary co-operative banks with a deposit size of Rs 50 crore and above.

- Now, to make the RB-IOS more broad-based, it has been decided to bring CICs also under the ambit of RB-IOS 2021.

MIBOR Benchmark Committee to be set up

RBI also proposed to set up a committee to do an in-depth analysis of the current Mumbai Interbank Outright Rate (MIBOR) benchmark issues.

Other Responsibilities of Committee:

i.To study the need for transition to an alternate benchmark

ii.To provide suggestions for the way forward of this interest rate benchmark mechanism.

What Is MIBOR?

It is a financial benchmark rate for interest rate swaps, overnight call money, Collateralized Borrowing and Lending Obligations (CBLO), floating rate bonds, and short-term corporate loans in India. It is the rate at which Indian banks borrow from one another on an overnight basis.

- It was first introduced in India in 1998 after the formation of the Fixed Income Money Market and Derivatives Association of India (FIMMDA). The National Stock Exchange (NSE) was assigned to calculate and publish the rate.

- It should be noted that the MIBOR-based Overnight Indexed Swap (OIS) contracts are the most widely used Interest Rate Derivative (IRD) in the onshore market.

Bharat Bill Payment System to be open to NRIs as well

RBI will open the Bharat Bill Payment System (BBPS) ,owned and operated by NPCI Bharat BillPay Ltd. (NBBL), for Non-resident Indians (NRIs) which will help them pay utility bills and education fees on behalf of their family members in India. It is currently accessible only for residents in India.

- BBPS is an interoperable platform for standardized bill payments.

- More than 8 crore transactions are processed on a monthly basis.

Encouraging Standalone Primary Dealers to further Develop Financial Markets

RBI also decided that Standalone Primary Dealers (SPDs) authorized under section 10(1) of FEMA (Foreign Exchange Management Act),1999, who are also market-makers like banks, will be permitted to undertake Foreign Currency Settled Overnight Indexed Swap (FCS-OIS) transactions directly with non-residents and other market-makers.

Background:

In February 2022, Banks in India were permitted to undertake transactions in the offshore FCS-OIS market with non-residents and other market makers to remove the segmentation between onshore and offshore OIS markets and improve the efficiency of price discovery.

Managing Risks and Code of Conduct in Outsourcing of Financial Services

RBI proposes to issue a draft Reserve Bank of India (Managing Risks and Code of Conduct in Outsourcing of Financial Services) Master Directions, 2022, for public comments. These directions will provide norms on managing risks in outsourcing of financial services.

- The scope of these Directions is being expanded to also include RRBs, Local Area Banks (LABs), All India Financial Institutions, Credit Information Companies, and non-scheduled Payments Banks.

Objective of Guidelines:

To update the extant guidelines, adopt and incorporate global best practices, and to enable REs to have all current instructions on outsourcing of financial services at one place for reference.

This MPC meeting was scheduled during August 2-4, 2022, but due to administrative exigencies it was held on August 3-5, 2022. The RBI announced this change of date in July 2022 under Section 45ZI (4) of the RBI Act, 1934.

Members of MPC:

Dr. Shashanka Bhide; Dr. Ashima Goyal; Prof. Jayanth R. Varma; Dr. Rajiv Ranjan; Dr. Michael Debabrata Patra; and headed by Shaktikanta Das (RBI Governor).

About Reserve Bank of India (RBI):

i.The Reserve Bank of India was established on April 1, 1935, in accordance with the provisions of the Reserve Bank of India Act, 1934.

ii.The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937.

iii.Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.