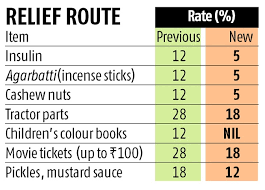

On June 11, 2017, Goods and Services Tax (GST) council lowered rates on 66 goods and services, including Insulin, schoolbags, colouring books, construction items, pickles and mustard sauce.

Highlights of GST Council meeting held on June 11, 2017:

GST council took up demands for revision intax rates of 133 items owing to demands from various quarters which cited higher tax incidence as per the forthcoming GST regime. However, tax rates for only 66 items were lowered.

- Tax rate on insulin and cashew has been lowered to 5% from the earlier 12%, food items like pickles and ketchup have been placed under 12% tax bracket as against the earlier 18% tax bracket.

- In a bid to promote regional cinema, cinema tickets costing up to Rs. 100 will be taxed at 18% and ticket costing more than Rs. 100 at 28%.

Composition Scheme for Small Businesses under GST:

As per earlier norms, an entity whose aggregate turnover in the preceding financial year is less than Rs.50 lakh can opt for a simplified ‘composition scheme’ where tax will be payable at a concessional rate on the turnover in a State.

- With a view to support small businesses, GST Council on June 11, 2017, increased the upper limit for the ‘composition scheme’ to Rs.75 lakh from the earlier Rs.50 lakh. This will benefit traders, manufacturers and restaurants with an annual turnover up to Rs.75 lakh as they can opt for the scheme and pay tax at one per cent, two per cent and five per cent respectively.

About Goods and Services Tax (GST):

The GST is a destination-based, single indirect tax that will be levied on consumption of goods or use of services across India. It is considered as biggest tax reform since independence in 1947.

- GST will be rolled out in India from July 1, 2017.It will replace 16 current levies (7 central taxes and 9 state taxes), consequentially creating India as one market with one tax rate.

- Goods and Services Tax (GST) Council headed by Union Finance Minister Arun Jaitley and comprising representatives of all states has finalised four tax brackets under GST viz. 5%, 12%, 18% and 28%.

- States/UTs which have passed the GST Bill so far: Tripura, Maharashtra, Gujarat, Assam, Arunachal Pradesh, Andhra Pradesh, Uttar Pradesh, Puducherry, Odisha, Mizoram, Sikkim, Himachal Pradesh, Nagaland, Delhi and Meghalaya Assembly on June 12, 2017 has approved the State Goods and Services Tax (GST) Bill

- GST is already prevalent in Germany, France, Italy, United Kingdom, South Korea, Japan, Canada and Australia.

- GST was first implemented in France (in year 1954).

- Russia implemented GST in 1991 while China did it in 1994.

- Saudi Arabia is planning to implement GST in 2018.