We are here for you to provide the important Recent and Latest Current Affairs 2 & 3 April 2023, which have unique updates of Latest Current Affairs 2022 events from all newspapers such as The Hindu, The Economic Times, PIB, Times of India, PTI, Indian Express, Business Standard and all Government official websites.

Our Current Affairs January 2023 events will help you to get more marks in Banking, Insurance, SSC, Railways, UPSC, CLAT and all State Government Exams. Also, try our Latest Current Affairs Quiz and Monthly Current Affairs 2022 PDF which will be a pedestrian to crack your exams.

Read Current Affairs in CareersCloud APP, Course Name – Learn Current Affairs – Free Course – Click Here to Download the APP

We are Hiring – Subject Matter Expert | CA Video Creator | Content Developers(Pondicherry)

Click here for Current Affairs 1 April 2023

NATIONAL AFFAIRS

MoF Increases Interest Rates on Most Small Savings Schemes, Except PPF, for Q1 FY24 The Department of Economic Affairs (DEA), Ministry of Finance (MoF) has announced an interest rate hike on various Small Savings Schemes for the first quarter of the financial year 2023-24 ( Q1 FY24) (i.e. April 1, 2023 to June 30, 2023), marking the third consecutive quarter of rate hikes.

The Department of Economic Affairs (DEA), Ministry of Finance (MoF) has announced an interest rate hike on various Small Savings Schemes for the first quarter of the financial year 2023-24 ( Q1 FY24) (i.e. April 1, 2023 to June 30, 2023), marking the third consecutive quarter of rate hikes.

- Small Savings Schemes have about 40 crore subscribers, and the basket includes 12 instruments such as the National Savings Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samridihi Account (SSA), Monthly Income Savings Scheme, all post office time deposits, etc.,

- The interest rate on these savings instruments has been raised by 10-70 basis points (bps) [one percentage point is equivalent to 100 bps].

However, the interest rate for PPF scheme has been kept unchanged at 7.1% over Q1 FY24, and its returns have remained constant at 7.1% for the last three years.

Key Information

i.The GoI reviews the interest rates for small savings plans on a quarterly basis.

ii.Although the Reserve Bank of India (RBI) sets small savings interest rates, they are linked to market yields on government securities (G-secs) with a lag and are reviewed and fixed quarterly at a spread of 0-100 basis points (bps) over (100 bps = 1%) and above G-sec yields of comparable maturities.

About Ministry of Finance (MoF):

Union Minister – Nirmala Sitharaman (RajyaSabha- Karnataka)

Ministers of State (MoS) – Pankaj Chaudhary; Dr. Bhagwat Kishanrao Karad

>> Read Full News

Women aged between 15-29 years spend 5.5 hours more than men doing Unpaid Labour: MoSPI i.The Ministry of Statistics and Programme Implementation (MoSPI) released its report titled ‘Women and Men in India 2022’ which is 24th in series. As per it, an average Indian woman, aged between 15 and 29 spends 5.5 hours doing unpaid labour. A man in that age group spends about 50 minutes a day doing work that yields no money.

i.The Ministry of Statistics and Programme Implementation (MoSPI) released its report titled ‘Women and Men in India 2022’ which is 24th in series. As per it, an average Indian woman, aged between 15 and 29 spends 5.5 hours doing unpaid labour. A man in that age group spends about 50 minutes a day doing work that yields no money.

ii.A senior woman (aged above 60) too spends four hours a day doing unpaid labour, while a senior man spends an hour and a half on the same.

iii.This report is on the lines of Oxfam report from December 2021, which noted that the unpaid work done by women looking after their homes and children is worth 3.1% of India’s GDP.

iv.The only area of unpaid work where men spend more time than women is in volunteering and training, where they spend an extra six minutes per day.

About Ministry of Statistics and Programme Implementation (MoSPI):

Minister of State (Independent Charge)– Rao Inderjit Singh (Constituency- Gurugram, Haryana)

Secretary– DR. G P Samanta

>> Read Full News

Union Budget 2023-24: Union Minister Nirmala Sitharaman announces Revamping of Credit Guarantee Scheme for MSE from April 1

Nirmala Sitharaman, the union minister of finance, announced in the union budget for 2023–2024 the revamping of the Credit Guarantee Scheme for Micro & Small Enterprises (MSE) with effect from 1st April 2023.

- It is revamped with an infusion of Rs 9,000 crore to the corpus to enable an additional Rs 2 lakh crore in collateral-free guaranteed credit and the reduction in the cost of the credit by about 1%.

- On 30th March 2023, Rs 8,000 crore was infused into the Credit Guarantee Fund Trust for Micro & Small Enterprises (CGTMSE) corpus. CGTMSE created a new landmark by approving guarantees totalling Rs 1 lakh crore during the financial year (FY) 2022–23.

The limit on the ceiling for guarantees has been enhanced from Rs 2 crore to Rs 5 crore. For settlement of claims in respect of guarantees for loans outstanding up to Rs 10 lakh, initiation of legal proceedings will no longer be required.

- CGTMSE has issued guidelines in this regard.

CBDT signs 95 Advance Pricing Agreements in FY 2022-23

The Central Board of Direct Taxes (CBDT), the Department of Revenue, the Ministry of Finance, have entered into a record 95 Advance Pricing Agreements (APAs) in the financial year (FY) 2022-2023 with Indian taxpayers. This year, CBDT recorded the highest-ever APA signings in any FY since the launch of the APA programme.

The agreement includes 63 Unilateral APAs (UAPAs) and 32 Bilateral APAs (BAPAs).

- A record of the largest number of single-day signings in the history of the programme was also created with a total of 21 APAs signed on 24th March 2023.

- The total number of APAs since the inception of the APA programme has gone up to 516, comprising 420 UAPAs and 96 BAPAs.

The APA Scheme aims to provide taxpayers clarity in the domain of transfer pricing by defining the pricing methodologies and determining the arm’s length price of International transactions for up to 5 years in the future.

INTERNATIONAL AFFAIRS

Georgia becomes first American state to condemn Hinduphobia, passes resolution

Georgia, United States of America(USA) passed a resolution condemning “Hinduphobia” and “anti-Hindu bigotry”- becoming the first state in the country to do so.

- The resolution was introduced by Representatives Lauren McDonald and Todd Jones from Forsyth County in the suburbs of Atlanta, home to one of the largest Hindu and Indian-American diaspora communities in Georgia.

- The resolution observed that the American-Hindu community has been a major contributor to diverse sectors such as medicine, science and engineering, information technology, hospitality, finance, academia, manufacturing, energy, retail trade, among others

BANKING & FINANCE

IRDAI Releases Liberalised Commission Regulations Benefitting Insurers & Distributors The Insurance Regulatory and Development Authority of India (IRDAI) has announced three new regulations that are anticipated to have major economic implications on market participants, including insurers and intermediaries. The three new rules are as follows:

The Insurance Regulatory and Development Authority of India (IRDAI) has announced three new regulations that are anticipated to have major economic implications on market participants, including insurers and intermediaries. The three new rules are as follows:

- IRDAI (Expenses of Management of Insurers transacting General or Health Insurance business) Regulations, 2023

- Insurance Regulatory and Development Authority of India (Payment of Commission) Regulations, 2023

- IRDAI (Expenses of Management of Insurers transacting life insurance business) Regulations, 2023

In the process, IRDAI replaced the previous regime of ‘product-wise capping’ of commission payable to intermediaries.

- This is subject to insurers adhering to the IRDAI’s overall ‘expenses of management’ (EOM) limits.

About Insurance Regulatory and Development Authority of India (IRDAI):

Chairperson – Debasish Panda

Headquarters – Hyderabad, Telangana

Establishment – 1999 (Incorporated on 1st April 2000)

>> Read Full News

IRDAI Identified LIC, GIC & New India Assurance as D-SIIs for FY23 On March 31, 2023, the Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), and New India Assurance continued to be identified by the Insurance Regulator and Development Authority of India (IRDAI) as Domestic Systemically Important Insurers (D-SIIs) for the Financial year 2022-23.

On March 31, 2023, the Life Insurance Corporation of India (LIC), General Insurance Corporation of India (GIC), and New India Assurance continued to be identified by the Insurance Regulator and Development Authority of India (IRDAI) as Domestic Systemically Important Insurers (D-SIIs) for the Financial year 2022-23.

- IRDAI annually identifies D-SIIs and publishes the name of the insurers for public information.

- In line with the Reserve Bank of India’s benchmarking, D-SIIs are perceived to be ‘too big or (too important) to fail’.

- LIC, GIC, and New India Assurance were the D-SIIs from 2020-21.

- D-SIIs refers to insurers of large size, market importance and domestic and global inter-connectedness whose distress or failure would cause a significant impact on the domestic financial system.

About General Insurance Corporation of India Limited (GIC Re):

Chairman and Managing Director – Devesh Srivastava

Headquarters – Mumbai, Maharashtra

Establishment – 22 November 1972

>> Read Full News

DBS Bank Launches investment solution ‘digiPortfolio‘ Offers Morningstar curated Investments DBS Bank India launched an investment solution ‘digiPortfolio’ on its digibank platform, to create a set of investment options curated by Morningstar that match the risk preferences of different investors

DBS Bank India launched an investment solution ‘digiPortfolio’ on its digibank platform, to create a set of investment options curated by Morningstar that match the risk preferences of different investors

- The platform which uses both technology and human expertise is an easy, one-stop solution for users to invest money with ready-made baskets of mutual funds.

Key Points:

i.The ‘digiPortfolio’ provides instant access to investors with two plans starting at a minimum investment of Rs 10,000 up to Rs 50,000.

ii.The plans include features such as portfolio construction, monitoring, and rebalancing services, powered by Morningstar. There are no extra charges, like sales or transaction fees.

iii.Investors could invest as long as they want and they could choose based on their goals, risk preferences, and investment duration.

iv.Under the platform, the portfolios are designed to be an investment aligned to the investor’s risk appetite and investment horizon.

v.The investment options are of mutual funds selected by Morningstar. The portfolios are adjusted even when the market is volatile, to ensure the best possible returns.

vi.Various investment options, such as domestic equity, debt and money market instruments, are included in the offering. The digiPortfolio platform is easy to use as it is automated and run by Quantifeed.

Acko, Credit Access Receives IRDAI nod to Commence Life Insurance Business On March 25 2023, in its 121st meeting, the Insurance Regulatory and Development Authority of India (IRDAI), granted a certificate of registration to two new entities namely Acko Life Insurance Limited and Credit Access Life Insurance Limited to commence the life insurance business.

On March 25 2023, in its 121st meeting, the Insurance Regulatory and Development Authority of India (IRDAI), granted a certificate of registration to two new entities namely Acko Life Insurance Limited and Credit Access Life Insurance Limited to commence the life insurance business.

- With the entry of the two firms into the insurance business, the number of life insurers operating in India increased to 25 which was remaining unchanged since 2011 (after Edelweiss Tokio’s registration).

Key Points:

i.In the case of Acko, it is already operating a general insurance company named Acko General Insurance.

- Acko provides insurance covers in auto, health and travel segments.

- It is also collaborating with cab-aggregator Ola and Amazon for bite-sized insurance covers available on their respective apps.

- Acko, which became a unicorn in October 2021, is backed by Accel, Elevation Capital, Ascent Capital, Munich Re Ventures and Flipkart cofounder Binny Bansal, among others.

ii.CreditAccess Grameen Limited, headquartered in Bengaluru, Karnataka, is the largest microfinance institution in India, which focuses on providing loans to women borrowers in rural. It has the largest microfinance market share in the world.

iii.As per the statement of IRDAI, further 20 more applications are in process at various stages of registration in life, general and reinsurance segments.

About Insurance Regulatory and Development Authority of India (IRDAI)

Chairperson – Debasish Panda

Headquarters – Hyderabad, Telangana

Establishment – 2000

IPPB partners with Bharti Airtel to launch Banking Services on WhatsApp

On 31st March 2023, India Post Payments Bank (IPPB), under the ownership of the Department of Post, the Ministry of Communications, partnered with New Delhi (Delhi)-based Bharti Airtel Limited to launch banking services through WhatsApp for its customers.

- With this new IPPB WhatsApp Banking channel, users of the bank will be able to easily connect with the bank on WhatsApp and access a variety of banking services, including doorstep service requests and locating the nearest Post Office.

- Customers will receive the WhatsApp messaging service from Airtel IQ, a cloud-based communications platform as a service (CPaaS) company that offers customer engagement across voice, SMS, and WhatsApp channels.

IPPB and Airtel IQ will ensure multi-language support and real-time customer support agents on WhatsApp to provide quick solutions for customer queries.

ECONOMY & BUSINESS

BharatPe Group Partners with WEP to foster Women Entrepreneurship in India Bharatpe Group, one of the leading fintech company in India, has partnered with the Women Entrepreneurship Platform (WEP) to support women entrepreneurs across India in their journeys of self-reliance and business growth.

Bharatpe Group, one of the leading fintech company in India, has partnered with the Women Entrepreneurship Platform (WEP) to support women entrepreneurs across India in their journeys of self-reliance and business growth.

- The partnership, launched under the ‘BharatPe Cares’, a Corporate Social Responsibility (CSR) initiative by BharatPe Group, is in line with the brand purpose of BharatPe “To empower lives through inclusive fintech solutions”.

- This specific initiative is under BharatPe’s CSR program of PAYBACK.

Background:

i.According to the 6th economic census by the Ministry of Statistics and Programme Implementation(MoSPI), women account for only 13.76% of the total entrepreneurs (8.05 million out of the total 58.5 million entrepreneurs) in India.

ii.This highlights the need to empower women entrepreneurs in India.

About BharatPe – WEP partnership:

Aim:

To build an ecosystem that unites women entrepreneurs from across India and equip them with the required domain knowledge and the financial and technical know-how that are required to achieve their business goals.

Focus areas:

To facilitate the development of an aggregator platform that gives access to peer support, mentorship, networking channels and a range of learning resources.

Points to note:

i.The partnership between WEP and BharatPe aims to address the difficulties faced by women entrepreneurs and to level the playing field where women can enjoy equal growth opportunities.

ii.This also aims to facilitate the development of a plug-and-play digital infrastructure to address the existing gaps and aid the growth of women entrepreneurs.

Key Points:

i.According to the industry report, women entrepreneurs in India can generate 150-170 million jobs by 2030, more than 25% of new jobs required by the working-age population.

ii.Promoting women’s entrepreneurship will boost the economy through job creation and is critical to building India as a USD 5 trillion economy.

About Women Entrepreneurship Platform (WEP):

i.WEP, a first of its kind, is a unified access portal that unites women across India to build a nurturing ecosystem that enables women to realize their entrepreneurial aspirations.

ii.WEP is a public-private initiative that aims at providing a continuum of support to women entrepreneurs by leveraging the network of various stakeholders who are part of the ecosystem.

About BharatPe:

BharatPe was co-founded by Ashneer Grover and Shashvat Nakrani in 2018

Chief Financial Officer & Interim CEO– Nalin Negi

Headquarters– Gurgaon, Haryana

SCIENCE & TECHNOLOGY

Sarbananda Sonowal launches Sagar Setu Mobile App of National Logistics Portal Marine On 31st March 2023, The Union Minister Sarbananda Sonowal, Ministry of Ports, Shipping and Waterways (MoPSW) launched a mobile application – “SAGAR SETU”, the app Version of National Logistics Portal (Marine) in New Delhi, Delhi.

On 31st March 2023, The Union Minister Sarbananda Sonowal, Ministry of Ports, Shipping and Waterways (MoPSW) launched a mobile application – “SAGAR SETU”, the app Version of National Logistics Portal (Marine) in New Delhi, Delhi.

It was launched in the presence of Minister of State (MoS) Shripad Yesso Naik, MoPSW Sudhansh Pant, Secretary and other senior officials.

Key Points:

i.The app offers features such as Login Module, Service Catalogue, Common Application Format, Letter of Credit, Bank Guarantee, Certification, Track and Trace, etc. that provide real-time information on activities which are out of reach for importers, exporters, and customs brokers.

- This includes vessel-related details, gate information, container freight stations, and transactions, all easily accessible through the app.

ii.It also enables digital transactions for payments required for the clearance process of import and export.

iii.The SAGAR-SETU app helps custodians in easier access to functionalities on a handheld device by reducing turnaround time for approval and compliances.

- App will benefit service providers and help in tracking of records and transactions offered and also receive notification of service requests.

BDL Successfully Tested the Indigenous Anti Tank Guided Missile, Amogha-III Bharat Dynamics Limited (BDL) successfully conducted a field firing test of its indigenous third generation man-portable Anti Tank Guided Missile (ATGM), Amogha-III.

Bharat Dynamics Limited (BDL) successfully conducted a field firing test of its indigenous third generation man-portable Anti Tank Guided Missile (ATGM), Amogha-III.

- Amogha-III has been developed under Integrated Guided Missile Development Programme (IGMDP) by the Research and Development (R&D) Division of BDL.

About Amogha-III ATGM:

i.The model of the new 3rd Generation ATGM, Amogha III was unveiled during the DefExpo 2020, a flagship biennial event of the Ministry of Defence(MoD) held in Lucknow, Uttar Pradesh in February 2020 in a hybrid format.

ii.The whole missile system comes with a command launch unit (CLU), remote operation capability and a tripod.

iii.Amogha-III ATGM which requires no external intervention following the lauch boasts the fire and forget capability.

iv.The missile also features a dual-mode Imaging Infrared (IIR) Seeker with a range of 200 to 2500 meters.

Features:

i.The Amogha-III, assisted by the Defence Research and Development Organisation (DRDO), showcased a tandem warhead, consisting of two separate explosive charges that are detonated in sequence.

- The first charge, known as the precursor charge, penetrates the target’s armour, creating a hole for the second charge known as the main charge to detonate inside, maximizing damage inflicted on the target.

ii.The missile can be fired in lock-on-before launch (LOBL) mode.

iii.The anti-armour tandem warhead of the missile can penetrate in excess of 650 mm beyond Explosive Reactive Armour (ERA).

iv.This missile of versatile nature is capable of top and direct attack modes.

India & UK Scientists collaborate on SMART Early Warning Flood Alert System

Scientists from India and the United Kingdom (UK) have developed a real-time Early Warning System to help reduce the destructive effects of flooding on people and property, particularly in mountainous areas where extreme water events are a major problem. The team worked on integrating science, policy and local community-led approaches to create a so-called SMART approach that better fits the local context.

- Team: Researchers from the Indian Institute of Technology (IIT) Roorkee (Uttarakhand), Imperial College London (UK), University of Birmingham (UK), and People’s Science Institute, Dehradun (Uttarakhand).

- The SMART approach covers: Shared understanding of risks ensuring every group of people in a community is represented and a wide range of data collection methods are used; Monitoring risks and establishing warning systems that build trust and exchange critical risk information helping to maintain the forecasting system.

ENVIRONMENT

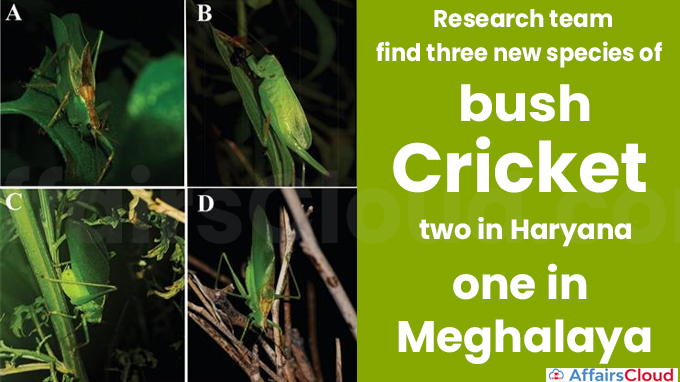

Three New Species of Bush Cricket Discovered: Hexacentrus khasiensis, Hexacentrus ashoka, & Hexacentrus tiddae Researchers from the zoology departments of Ashoka University, Haryana; Punjab University(PU), Chandigarh; and the National Institute of Science Education and Research, Odisha have discovered 3 new predatory Bush Cricket (Hexacentrus) species namely Hexacentrus khasiensis in Meghalaya and Hexacentrus ashoka and Hexacentrus tiddae in Sonipat, Haryana.

Researchers from the zoology departments of Ashoka University, Haryana; Punjab University(PU), Chandigarh; and the National Institute of Science Education and Research, Odisha have discovered 3 new predatory Bush Cricket (Hexacentrus) species namely Hexacentrus khasiensis in Meghalaya and Hexacentrus ashoka and Hexacentrus tiddae in Sonipat, Haryana.

- The 3 new species were found in 2 study locations: a forested area around and inside the North Eastern Hill University (NEHU) campus of Shillong, Meghalaya, and in the forested area around Ashoka University Campus, Sonipat, Haryana.

Key Points:

i. Hexacentrus is a genus of predatory katydids. Hexacentrus is a genus of 7 species, 6 of which are morphologically defined in India and one of which is only acoustically characterised.

- Based on detailed morphological, stridulatory, and acoustic characteristics, the 3 new species fall under the genus from India.

ii. Researchers- Aarini Ghosh, Ranjana Jaiswara, Monaal, Shagun Sabharwal, Vivek Dasoju, Anubhab Bhattacharjee, and Bittu Kaveri Rajaraman.

- A Joint team of researchers from the zoology departments of Panjab University (PU), Ashoka University, Sonipat, and the National Institute of Science Education and Research, Orrisa, discovered three new species of predatory bush cricket in India.

iii. Zootaxa, a scientific mega journal for animal taxonomists, is likely to now include all 3 of the newly discovered species.

Hexacentrus khasiensis:

Type material- Holotype

Type locality- East Khasi Hill, Shillong, Meghalaya.

The species is named after the Khasi hill of Meghalaya.

Hexacentrus ashoka:

Type material- Holotype

Type locality- Ashoka University, Rai, Sonipat, Haryana.

The species is named after Ashoka University located in Sonipat, Haryana.

Hexacentrus tiddae:

Type Material- Holotype

Type locality- Ashoka University, Aswarpur, Sonipat, Haryana, India

The term ‘tiddae’ in Hindi and Haryanvi refers to Orthoptera, it is used for locusts and crickets.

OBITUARY

Renowned Author & 2-time Kerala Sahitya Akademi Award Winner Sarah Thomas Passed Away On 31st March 2023, renowned Malayalam writer, Sarah Thomas, a 2-time Kerala Sahitya Akademi Awardee, passed away in Trivandrum, Kerala, at the age of 88. She was born on 15th September 1934 in Trivandrum, Travancore Kingdom, British India (now in Kerala).

On 31st March 2023, renowned Malayalam writer, Sarah Thomas, a 2-time Kerala Sahitya Akademi Awardee, passed away in Trivandrum, Kerala, at the age of 88. She was born on 15th September 1934 in Trivandrum, Travancore Kingdom, British India (now in Kerala).

About Sarah Thomas:

i. Sarah Thomas has written 17 novels and over 100 short stories. She published her first novel “Jeevitham Enna Nadhi” at the age of 34.

ii. She was known for her work “Narmani Putava” (1978) and, “Daivamakkal” (1982) and “Grahanam” are her favourite works.

iii. Her other notable works are Agnishuddhi (1988), Chinnammu (1988), Valakkar (1994), Neelakurinjikal Chuvakum Neram (1995), Thanneerpanthal, Yatra and Kaveri.

iv. Her novels Murippadukal, Asthamayam, Pavizhamuthu, and Archana have been adapted into movies.

Awards:

i. Sarah Thomas’s novel “Narmadi Pudava” won the Kerala Sahitya Akademi Award in 1979.

ii. In 2010, she also received the Kerala Sahitya Akademi award for Overall Contribution to Malayalam literature.

IMPORTANT DAYS

Earth Hour 2023 – March 25 Earth Hour is annually observed across the globe on the last Saturday of March by turning out the lights from 8:00 p.m. to 9:00 p.m. (local time) as a symbolic act of support for the action taken on environmental issues and protecting the planet.

Earth Hour is annually observed across the globe on the last Saturday of March by turning out the lights from 8:00 p.m. to 9:00 p.m. (local time) as a symbolic act of support for the action taken on environmental issues and protecting the planet.

Earth Hour is one of the world’s largest grassroots movements for the environment.

Earth Hour 2023 was observed on 25th March 2023.

- Earth Hour 2022 was observed on 26th March 2022.

- Earth Hour 2024 will be observed on 30th March 2024.

The theme of Earth Hour 2023 is “The Biggest Hour for Earth”.

Background:

i. Earth Hour was initiated by the World Wide Fund of Nature (WWF), formerly the World Wildlife Fund and partners as a symbolic lights-out event in Sydney, Australia, in 2007.

ii. The 1st ever Earth Hour event was observed on 31st March 2007 in Sydney, Australia.

- In the 1st Earth Hour event, more than 2.2 million people and 2,000 businesses switched off their lights for one hour.

STATE NEWS

Chennai’s WABAG bags Rs 4,400 crore Seawater Desalination Project in Tamil Nadu

Chennai (Tamil Nadu)-based VA Tech Wabag Ltd (WABAG) has bagged Rs 4,400 crore Sea Water(salt water) Reverse Osmosis (SWRO) project in Tamil Nadu (TN) which after completion would be the largest sea-water desalination project in the South East Asia region.

The project has been bagged in a joint venture (JV) with Metito Overseas Limited (based in United Arab Emirates – UAE) and will be implemented on a design, build, operate (DBO) model.

Key Highlights:

i. WABAG with Metito Overseas wins an SWRO project from Chennai Metropolitan Water Supply and Sewerage Board (CMWSSB).

ii. The largest seawater desalination plant in South East Asia, worth Rs 4,400 crore, with a 400 Minimal Liquid Discharge (MLD) capacity, was funded by the Japan International Cooperation Agency (JICA).

iii. The DBO will take place over 42 months and will be operated and maintained for 20 years by WABAG.

iv. Desalination Process: Lamella Clarifiers, Dissolved Air Flotation System, Gravity Dual Media Filters followed by Reverse Osmosis, and Re-mineralization to produce clean drinking water.

- It will be further distributed by CMWSSB to the residents of south Chennai.

v. As the largest desalination plant in Southeast Asia when it is finished, this project will be a significant project for Chennai and India.

vi. The project makes Chennai the “Desalination Capital of India” with a production of about 750 MLD of desalinated water along the coast of Chennai, TN.

vii. WABAG will produce around 70% of the water used by desalination units in Chennai, TN, with the 400 MLD SWRO desalination plant.

*******

List of Current Governors in India – February 2023

List of Current Chief Ministers in India – February 2023

*******

List of Less Important News – Click Here

*****Click Here View – AC Excluded News*****

Current Affairs Today (AffairsCloud Today)

| S.no | Current Affairs 2 & 3 April 2023 |

|---|---|

| 1 | MoF Increases Interest Rates on Most Small Savings Schemes, Except PPF, for Q1 FY24 |

| 2 | Women aged between 15-29 years spend 5.5 hours more than men doing Unpaid Labour: MoSPI |

| 3 | Union Budget 2023-24: Union Minister Nirmala Sitharaman announces Revamping of Credit Guarantee Scheme for MSE from April 1 |

| 4 | CBDT signs 95 Advance Pricing Agreements in FY 2022-23 |

| 5 | Georgia becomes first American state to condemn Hinduphobia, passes resolution |

| 6 | IRDAI Releases Liberalised Commission Regulations Benefitting Insurers & Distributors |

| 7 | IRDAI Identified LIC, GIC & New India Assurance as D-SIIs for FY23 |

| 8 | DBS Bank Launches investment solution ‘digiPortfolio‘ Offers Morningstar curated Investments |

| 9 | Acko, Credit Access Receives IRDAI nod to Commence Life Insurance Business |

| 10 | IPPB partners with Bharti Airtel to launch Banking Services on WhatsApp |

| 11 | BharatPe Group Partners with WEP to foster Women Entrepreneurship in India |

| 12 | Sarbananda Sonowal launches Sagar Setu Mobile App of National Logistics Portal Marine |

| 13 | BDL Successfully Tested the Indigenous Anti Tank Guided Missile, Amogha-III |

| 14 | India & UK Scientists collaborate on SMART Early Warning Flood Alert System |

| 15 | Three New Species of Bush Cricket Discovered: Hexacentrus khasiensis, Hexacentrus ashoka, & Hexacentrus tiddae |

| 16 | Renowned Author & 2-time Kerala Sahitya Akademi Award Winner Sarah Thomas Passed Away |

| 17 | Earth Hour 2023 – March 25 |

| 18 | Chennai’s WABAG bags Rs 4,400 crore Seawater Desalination Project in Tamil Nadu |