On May 13, 2020, Union Minister of Finance & Corporate Affairs Nirmala Sitharaman provided the details of the first part of the Special economic and comprehensive package of Rs 20 lakh crores, equivalent to 10% of India’s Gross Domestic Product (GDP) announced by Prime Minister Narendra Modi on May 12, 2020. Click Here to Read. This package aims to restore economic growth impacted by COVID-19 and Lockdown.

On May 13, 2020, Union Minister of Finance & Corporate Affairs Nirmala Sitharaman provided the details of the first part of the Special economic and comprehensive package of Rs 20 lakh crores, equivalent to 10% of India’s Gross Domestic Product (GDP) announced by Prime Minister Narendra Modi on May 12, 2020. Click Here to Read. This package aims to restore economic growth impacted by COVID-19 and Lockdown.

- The 15 points plan details were dubbed as “Atmanirbhar Bharat Abhiyaan” (self-reliant India Movement) which is premised on 5 pillars viz. Economy, Infrastructure, System, Vibrant Demography and Demand.

- Also, the measures taken in the package are focused on “Getting back to work” which enables employees, employers, and businesses to get back to production and workers back to gainful employment.

- The second part of the package will be unveiled by the Union Finance Minister on May, 14, 2020.

Here are the details of the package:

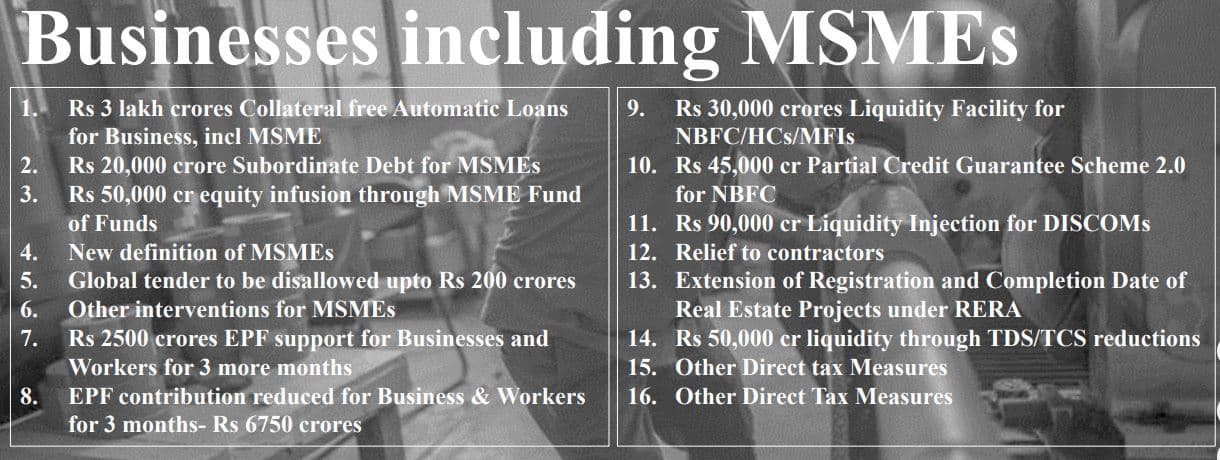

–Rs 3 lakh crore Emergency Working Capital Facility for Businesses, including MSMEs for 4 years

The Government of India is providing Additional working capital finance of 20% of the outstanding credit as on 29 February 2020, in the form of a Term Loan at a concessional rate of interest will be provided. In this regard, 100% guaranteed collateral-free emergency credit line of Rs 3 lakh crore to the micro, small and medium enterprises (MSMEs) with upto Rs 25 crore outstanding and Rs 100 crore turnover, benefitting 45 lakh MSME units. The scheme can be availed till 31st October 2020.

- Credit line tenor: 4 years

- Moratorium: 12 months on principal repayment

–Rs 20,000 crore Subordinate Debt for Stressed MSMEs; Max upto Rs 75 lakhs

Apart from above, a provision of Rs. 20,000 cr has been made for 2 Lakh MSMEs which are Non-performing assets (NPA) or are stressed. In this regard, a financial support of Rs 4000 crore will be provided to Credit Guarantee Trust for Micro and Small enterprises (CGTMSE). CGTMSE will provide partial Credit Guarantee support to banks. Further banks are expected to provide the subordinate-debt to promoters of such MSMEs equal to 15% of his existing stake in the unit.

- The maximum support for the same by banks is Rs 75 lakhs.

- Subordinated debt is a debt which ranks after other debts if a company falls into liquidation or bankruptcy.

About CGTMSE:

It was established by the Ministry of Micro, Small and Medium Enterprises, and Small Industries Development Bank of India (SIDBI) to implement the Credit Guarantee Fund Scheme for Micro and Small Enterprises.

Chairman– Mohammad Mustafa

–Rs 50,000 crores equity infusion for MSMEs through Rs 10,000 cr Fund of Funds

Government will set up a Fund of Funds (FoF) with a corpus of Rs 10,000 crore that will provide equity funding support for MSMEs. FoF will be operated through a Mother and a few Daughter funds. The fund structure will help leverage Rs 50,000 crore at daughter-fund levels.

- FoF was first announced in the Union Budget on February 1, 2020 based on the recommendations of Upendra Kumar Sinha Committee. An investment of Rs. 10,000 crore was proposed in the Budget for the scheme.

- The fund is meant to address the problem of shortage in growth capital for MSMEs

- The FoF scheme proposes to buy up to 15% equity in MSMEs, with a high credit rating.

- The scheme was approved by the finance ministry in April, pending Cabinet approval.

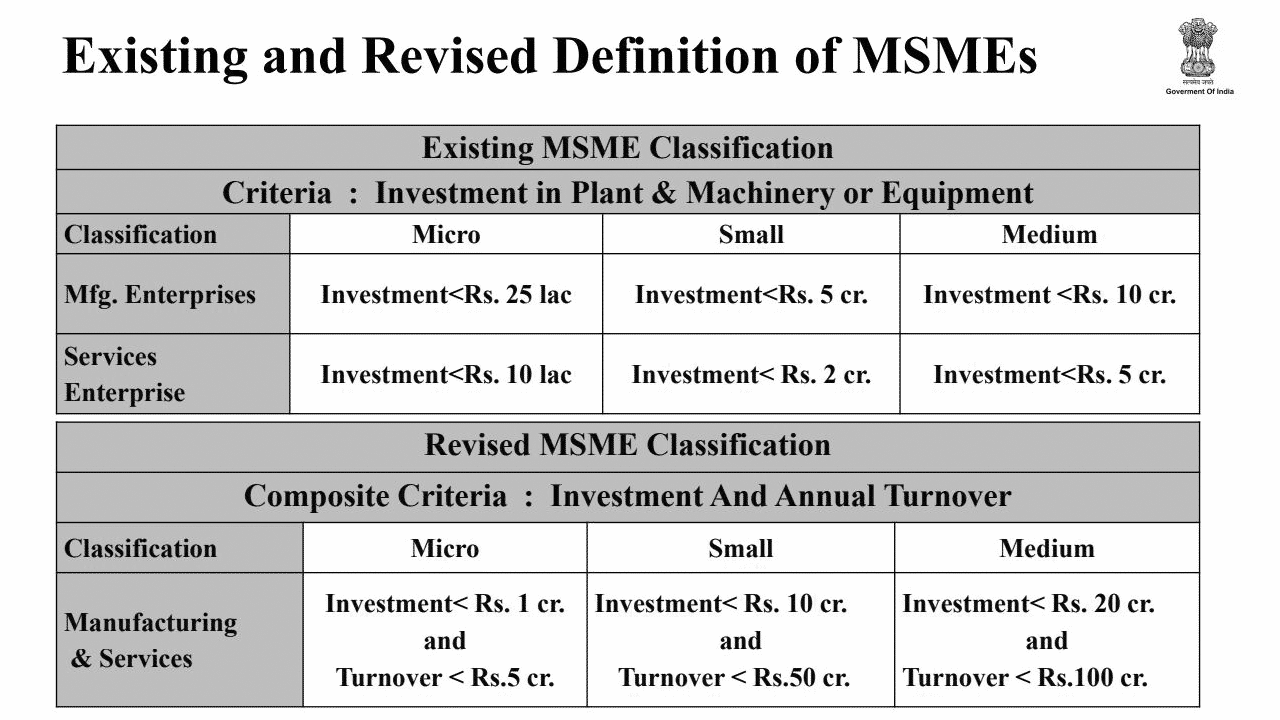

–New definition set for MSME to boost growth

Definition of MSME will be revised by raising the Investment limit and by introducing an additional criterion of turnover. The distinction between the manufacturing and service sector of MSMEs will also be eliminated. Now both will now enjoy the same benefits. Earlier the investment limit for manufacturing and service enterprises was different. Following are the new limits:

- Micro Units: Companies with Investments up to Rs 1 crore & Turnover of below Rs 5 crore.

- Small Units: Companies with investment below Rs 10 crore and turnover under Rs 50 crore.

- Medium Units: Companies having investment under Rs 20 crore and turnover below Rs 100 crore.

As per the proposal, amendments will need to be made in the MSME Development Act of 2006.

–Global tenders to be disallowed upto Rs 200 crores in government procurement

To overcome the unfair competition faced by MSMEs from foreign companies, the global tenders will be disallowed in government procurement tenders up to Rs 200 crore. This step will not only support the “Make in India” initiative but also help MSMEs to increase their business.

- The government has reserved 25% for the MSME sector in all its purchases, including through the Government e-Marketplace portal.

–Rs. 2500 crore Employees Provident Fund (EPF) Support for Business & Workers for 3 more months

Under Pradhan Mantri Garib Kalyan Package (PMGKP), payment of 12% of employer and 12% employee contributions was made into EPF accounts of eligible establishments. This was provided earlier for salary months of March, April and May 2020. Now, this support will be extended by another 3 months to salary months of June, July and August 2020.

- This will provide liquidity relief of Rs 2500 cr to 3.67 lakh establishments and for 72.22 lakh employees.

- It applied to firms with at least 90 per cent of the workforce earning less than Rs 15,000 a month.

About PMGKP:

On 26th March, 2020 Nirmala Sitharaman announced Pradhan Mantri Garib Kalyan Package to provide direct financial assistance to poor people amid COVID-19 lockdown. In this regard, free food grains and cash payment to women and poor senior citizens and farmers are provided. It also provided insurance cover of Rs 50 Lakh per health worker.

–EPF contribution reduced for Business & Workers for 3 months- Rs 6750 crores Liquidity Support

To provide more take home salary for employees and to give relief to employers, the EPF or Employee Provident Fund contribution is being reduced for businesses and workers for three months to 10% each from the existing 12% for all establishments covered by EPFO. This will provide liquidity of about Rs.2250 Crore per month and Rs 6,750 crores for 3 months. This will provide liquidity relief to 3.67 lakh establishments and for 72.22 lakh employees.

- Central public sector enterprises (CPSEs) and State PSUs will however continue to contribute 12% as employer contribution.

- It should be noted that this scheme will be applicable for workers who are not eligible for 24% EPF support under PM Garib Kalyan Package and its extension (mentioned above).

–Rs 30,000 crores Special Liquidity Scheme for NBFC/HFC/MFIs

Government has announced further liquidity support to non-banking financial companies (NBFCs), housing finance companies (HFCs) and microfinance institutions (MFIs). In this regard, under the government’s special liquidity scheme, banks will be allowed to invest, through both primary and secondary market transactions, in investment-grade debt papers issued by NBFCs, HFCs and MFIs.

- These investments, to the extent of Rs 30,000 crore, will be fully guaranteed by the government.

–Rs 45,000 crores Partial credit guarantee Scheme 2.0 for Liabilities of NBFCs/MFIs

Rs 45,000 crore liquidity will also be given to NBFCs via partial credit guarantee scheme (PCGS) 2.0. The scheme is designed to boost NBFCs, HFCs and MFIs with low credit ratings that require liquidity for fresh lending to MSMEs and individuals.

- The existing PCGS scheme will be extended to cover borrowings such as primary issuance of bonds/CPs of such entities.

- Under the scheme, the first 20% of the loss will be borne by the government which will be the guarantor.

–Rs 90,000 crore Liquidity Injection for DISCOMs by PFC & REC

Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) will infuse liquidity in the DISCOMS to the extent of Rs 90000 crores in two equal instalments. The ₹90,000 crore reform-linked injection will help in clearing outstanding dues of discoms which currently stands at Rs 94,000 cr.

- Central Public Sector Undertakings (CPSUs) will also provide a rebate to state discoms which will have to be passed on to the industrial consumers.

- The government has also decided to waive off the fixed charges and interstate transmission charges by Power Grid against the power not drawn from NTPC, Damodar Valley Corporation (DVC) and other CPSE from the period from 24th March 2020 to 17th May 2020. This results in a savings of around ₹1,400 crore for discoms.

–Reduction in Rates of ‘Tax Deduction at Source’ and ‘Tax Collected at Source” by 25% for the remaining period of FY 20-21

The Central Board of Income Tax on Wednesday ordered a 25% reduction in the rate of income tax deducted at source (TDS) and tax collection at source (TCS) from 14 May, 2020 to 31st March, 2021 to provide more money in the hands of taxpayers. This will provided liquidity to the tune of Rs 50,000 Crore.

- This concession is applicable for 23 specified payments where TDS is levied at rates ranging between 20% and 1% and 11 payments where TCS is applicable.

- Payment for contract, professional fees, interest, rent, dividend, commission, brokerage, etc. shall be eligible for this reduced rate of TDS.

–Other Direct Tax Measures

Extension of dates: The due date of all Income Tax Returns for Assessment Year 2020-21 will be extended to 30 November, 2020. Similarly, tax audit due date will be extended to 31 October 2020.

- The date for making payment without additional amount under the “Vivad Se Vishwas” scheme will be extended to 31 December, 2020.

–Tax Relief to Business

The pending income tax refunds to charitable trusts and non-corporate businesses and professions including proprietorship, partnership and LLPs and cooperatives shall be issued immediately.

–Relief to Contractors; extension provided upto 6 months

All central agencies like Railways, Ministry of Road Transport and Highways and CPWD will give extension of up to 6 months for completion of contractual obligations, including in respect of Engineering, Procurement, and Construction (EPC) and concession agreements.

–Relief to Real Estate Projects

The Central Government has extended the Registration and Completion Date of Real Estate Projects under Real Estate Regulatory Authority (RERA) amid COVID-19 impact. The Central Government directed to advise States/UTs and their Regulatory Authorities to the following effect:

- Treat COVID-19 as an event of ‘Force Majeure’ (natural disaster) under RERA.

- The registration and completion date for all registered projects will be extended up to 6 months and may be further extended by another 3 months based on the State’s situation.