Goods and Services Tax (GST) regime officially came into force from July 1, 2017. Government launched the Goods and Services Tax (GST) at a special midnight meeting in Central Hall of Parliament.

Highlights of GST Launch Ceremony:

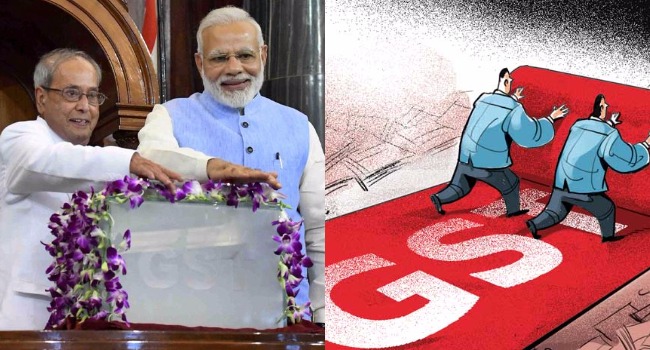

President Pranab Mukherjee and PM Modi pressed a button in a specially crafted box at the stroke of midnight and formally launched GST.

- Besides, President Pranab Mukherjee and Prime Minister Narendra Modi, Vice – President Hamid Ansari, Lok Sabha Speaker Sumitra Mahajan, Former Prime Minister H D Deve Gowda and Union Cabinet Ministers including Finance Minister Arun Jaitley were present at the launch ceremony.

- It is to be noted that members of Congress, RJD, DMK and Left parties boycotted the launch ceremony, whereas members of NCP, the JD-U and the JD-S broke ranks with opposition parties to attend the launch ceremony.

- President Pranab Mukherjee, who had as finance minister in the UPA government in 2011 piloted a constitutional amendment bill to bring in the GST, said the new indirect tax regime is a “disruptive change”.

- PM Modi said the indirect tax reform is a result of combined efforts of various political parties at different points of time. PM Modi referred to GST as “good and simple tax” that marks economic integration of India.

July 1 to be observed as GST Day

As per an order issued by Central Board of Excise and Customs (CBEC), July 1 will be known as ‘GST Day’ and will be celebrated in all offices of CBEC just as Central Excise Day and International Customs Day.

- On July 1, 2017, all the offices of the Central Board of Excise and Customs (CBEC) have been instructed to remain open as a trade facilitation measure.

- In order to facilitate smooth switchover to GST, Government has asked tax offices to convert into GST Seva-Kendras for providing all assistance to tax payers.

- Apart from giving guidance to GST assessees, GST Seva Kendras should render assistance to taxpayers in migration, registration as well as filing of returns.

- A guidance manual for such GST Seva Kendras too has been circulated to all offices in a bid to standardise quality taxpayer services.

- CBEC will be putting up of banners welcoming members of the trade and industry for any facilitation at all field offices.

- In addition to this, name board of the field offices will be re-named as Central GST Zone/ Commissionrate/ Division/ Range and the logo ‘One Nation, One Tax, One Market’ will be displayed prominently on the name boards/banners/office letterheads.

AffairsCloud Recommends Oliveboard Mock Test

AffairsCloud Ebook - Support Us to Grow

Govt Jobs by Category

Bank Jobs Notification