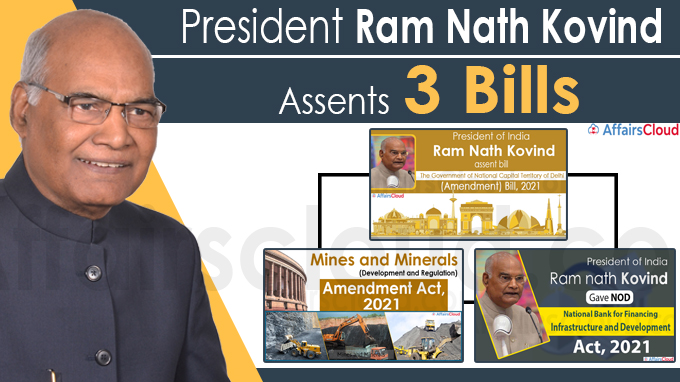

President Ram Nath Kovind gave his Assent to 3 Major Bills passed by the Indian Parliament. They are

President Ram Nath Kovind gave his Assent to 3 Major Bills passed by the Indian Parliament. They are

- National Bank for Financing Infrastructure and Development (NaBFID) Bill, 2021

- The Government of National Capital Territory of Delhi (Amendment) Bill, 2021

- The Mines and Minerals (Development and Regulation) Amendment Bill, 2021

National Bank for Financing Infrastructure and Development (NaBFID) Bill, 2021 Ministries involved – Ministry of Finance;Corporate Affairs;Information and Broadcasting.

Ministries involved – Ministry of Finance;Corporate Affairs;Information and Broadcasting.

i.It aims to establish the National Bank for Financing Infrastructure and Development (NBFID) as the principal Development Financial Institution (DFI) for Infrastructure financing in India.

- It will be set up as a corporate body with authorised share capital of One Lakh Crore Rupees & INR 20, 000 crores as equity & INR 5,000 crore as grant.

- DFI will provide long-term finance for segments of the economy in which risks involved are beyond the acceptable limits of commercial banks & other financial institutions.

- A 5 years’ tax break to NaBFID or DFI was announced by Finance Minister Nirmala Sitharaman to ensure that more funds flow to it.

- The ambit of developmental projects to be undertaken by the NaBFID includes social sector infrastructure projects including Health & Education.

In the Reserve Bank of India Act, 1934 (hereinafter referred to as the principal Act),in section 2, after clause (ccc), the following clauses shall be inserted, namely:

- ‘(ccci) “National Bank for Financing Infrastructure and Development” means

the Institution established under section 3 of the National Bank for Financing

Infrastructure and Development Act, 2021. - (cccii)” other development financial institution” means a development financial institution licensed under section 29 of the National Bank for Financing Infrastructure and Development Act, 2021.

Objectives

It basically has 2 objectives – Financial & Developmental

- Financial – To directly or indirectly lend, invest, or attract investments for infrastructure projects located entirely or partly in India.

- Developmental – Facilitating development of the market for bonds, loans, and derivatives for infrastructure financing.

Functions

- Extending Loans and advances for Infrastructure projects & taking over or refinancing such existing loans

- Attracting Investment from private sector investors & institutional investors for infrastructure projects

- Organising and facilitating foreign participation in infrastructure projects

- Facilitating negotiations with various government authorities for dispute resolution in the field of infrastructure financing

- Providing consultancy services in infrastructure financing.

Sources of Fund

- The shares of NBFID will be held by the Central Government, Multilateral Institutions, Sovereign Wealth Funds, Pension Funds, Insurers, Financial Institutions, Banks & other institutions prescribed by the Central Government.

- The Central Government will own 100% shares of Institution which will subsequently be reduced up to 26%.

- It may also borrow money from the Central Government, RBI, Scheduled Commercial Banks, Mutual Funds, Multilateral institutions such as the World Bank and Asian Development Bank.

Support from Central Government

- It will provide grants worth INR 5, 000 Crore to NBFID by the end of the first financial year.

- Government will also provide guarantee at a concessional rate of up to 0.1% for borrowing from multilateral institutions, sovereign wealth funds, and other foreign funds.

Management

It will be governed by a Board of Directors. The Chairperson will be appointed by the Central Government in consultation with RBI.

The Government of National Capital Territory of Delhi (Amendment) Bill, 2021 Ministry Involved – Home Affairs

Ministry Involved – Home Affairs

It amends the Government of National Capital Territory of Delhi Act, 1991.

Key Points

- It provides for the functioning of the Legislative Assembly and the Government of the National Capital Territory (NCT) of Delhi.

- It amends certain powers and responsibilities of the Legislative Assembly of Delhi and the Lieutenant Governor.

- Article 239 which deals with the administration of Union Territories like Delhi. In section 21 of the Government of National Capital Territory of Delhi Act, 1991 (hereinafter referred to as the principal Act), after sub-section (2), the following sub-section shall be inserted, namely, The Bill provides that the term ‘Government’ referred to in any law made by the Legislative Assembly will imply Lieutenant Governor (LG).

Other Changes

- It prohibits the Legislative Assembly from making any rule to enable itself or its Committees to consider the matters of day-to-day administration of the NCT of Delhi & conduct any inquiry in relation to administrative decisions.

- It gives power to the LG to make rules in matters which fall outside the purview of the elected government in Delhi.

- Further it states that, the opinion of the LG of Delhi should be obtained before the state government takes any form of executive action based on decision taken by an individual minister or cabinet.

The Mines and Minerals (Development and Regulation) Amendment Bill, 2021 (Ministry of Mines)

(Ministry of Mines)

It amends the Mines and Minerals (Development and Regulation) Act, 1957 (which regulates the mining sector in India).

i.The main objective of the Bill is to Reform the Mining sector in India.

- The act provides for removal of distinction between captive and merchant mines. Captive mines can now sell up to 50% of their annual mineral production in the open market after meeting their own needs.

- It empowers the Central Government to issue directions regarding composition & utilization of funds maintained by the District Mineral Foundation.

- At present, India utilizes only 45% of its Mineral resources, which have resulted in dependence on imports.

Benefits

- It is expected to increase the production level of minerals, generate employment, increase revenues and ensure private participation in the exploration and mining activities.

- The reforms are expected to create more than 55 Lakh employment in India.

- It will aid Foreign Direct Investment (FDI) & technologies in the mining sector.

- Government has also proposed to make the National Mineral Exploration Trust (NMET) an autonomous and professional body which would provide funds for exploration.

- The bill empowers the Central Government to specify a time for completion of the auction process in consultation with the State Government.

Reasons for Reforms:

- India’s mineral sector contributes only 1.75% to India’s GDP, with India importing minerals worth INR 2.5 Trillion annually.

- National Mineral Policy has set a goal to increase mineral production by 200% in 7 years. Out of India’s geological potential area of 0.571 million square Kms, only 10% has been explored.

About President of India:

Constituting Instrument – Article 52 of the Indian Constitution

About Ministry of Mines:

Union Minister – Pralhad Joshi (Lok Sabha MP, Constituency – Dharwad, Karnataka)