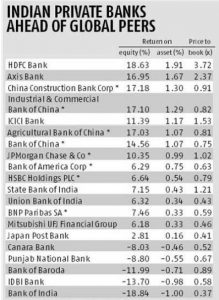

Leading Indian private banks namely HDFC Bank, Axis Bank and ICICI Bank along with their Chinese peers China Construction Bank Corp (CCB), Industrial and Commercial Bank of China (ICBC) and Agricultural Bank of China (ABC) occupy the top six slots among global banks on key return ratios, namely return on equity (RoE) and return on assets (RoA).

About HDFC Bank :

HDFC Bank is an Indian banking and financial services company headquartered in Mumbai, Maharashtra. It has about 76,286 employees including 12,680 women and has a presence in Bahrain, Hong Kong and Dubai.

- HDFC Bank is the second largest private bank in India as measured by assets.It is the

largest bank in India by market capitalization as of February 2016.

largest bank in India by market capitalization as of February 2016. - It was ranked 58th among India’s most trusted brands according to Brand Trust Report, 2015.

About ICICI Bank :

- ICICI Bank – Industrial Credit and Investment Corporation of India is anIndian multinational banking and financial services company headquartered in Mumbai, Maharashtra with its registered office in Vadodara.

- In 2014, it was the second largest bank in India in terms of assets and third in term ofmarket capitalisation. It offers a wide range of banking products and financial services for corporate and retail customers through a variety of delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

- The bank has a network of 4,450 branchesand 13,995 ATMs in India, and has a presence in 19 countries including India.

- ICICI Bank is one of theBig Four banks of India, along with State Bank of India, Bank of Baroda and Punjab National Bank. The bank has subsidiaries in the United Kingdom and Canada; branches in United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar, Oman, Dubai International Finance Centre, China and South Africa and representative offices in United Arab Emirates, Bangladesh, Malaysia and Indonesia.

About AXIS Bank :

Axis Bank Limited is the fourth largest private sector bank in India. Axis Bank’s stake holders include prominent national and international entities.

- As of 2013, approximately 43% of the shares are owned by Foreign Institutional Investors. Promoters (UTI,LIC and GIC), who collectively held approx. 34% of the shares, are all entities owned and controlled by the Government of India.

- The remaining 23% shares are owned by corporate bodies, financial institutions and individual investors among others. The bank offers financial services to customer agent covering Large and Mid-Sized Corporates, MSME, Agriculture and Retail Businesses.

- Axis Bank has its registered office at Ahmedabad.

Indian Banking Statistics :-

With respect to Indian private banks, their out-performance on return ratios front is largely fuelled by healthy pre-provisioning profits generated not just in FY16, but over the past many years.

- On the other hand, most public sector banks have struggled on this front in recent years with the exception of SBI and Union Bank that have started seeing some increase in this metric in both FY15 and FY16.

- Analysts at Credit Suisse, too remain positive on Indian private banks despite acknowledging the fact that they are the most expensive banks in the Asia-Pacific region.

- For FY16,HDFC Bank and Axis Bank earned the highest return on assets of 1.91 per cent and 1.67 per cent, respectively, followed by CCB, which clocked return on assets of 1.3 per cent.

- ICBC and ICICI Bank completed the top five lists with RoAs of 1.29 per cent and 1.17 per cent, respectively.

- The Chinese banks follow December year-end and, hence, the data for them is at the end of calendar year 2015. HDFC Bank tops its global peers on RoE as well, which stood at 18.63 per cent in FY16.

- Axis Bank stood fifth in this table with a RoE of 16.95 per cent, after CCB, ICBC and ABC that reported RoEs of 17.18 per cent, 17.1 per cent and 17.03 per cent.

largest bank in India by market capitalization as of February 2016.

largest bank in India by market capitalization as of February 2016.