The Government of India (GoI) has hiked the insurance premium rates for the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) to make them economically viable.

- The revision in premium rates is the first in seven years since the schemes’ commencement in 2015. The revised premium rates will be effective from June 1, 2022.

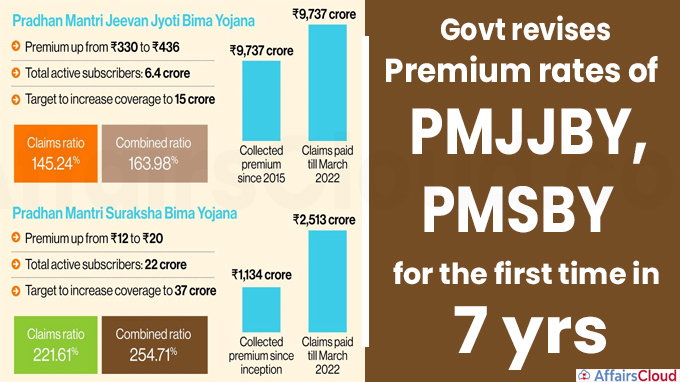

The premium rates for both schemes have been revised by making it Rs 1.25 per day, that includes revising PMJJBY from Rs. 330 per annum to Rs. 436 per annum and PMSBY from Rs. 12 per annum to Rs. 20 per annum.

- In percentage terms, PMJJBY’s premium has increased by 32%, while PMSBY’s premium has increased by 67%.

Reason For the Hike in Premium Rates:

i.The premium amount (Rs. 12 per annum for PMSBY and Rs. 330 per annum for PMJJBY) was subject to an annual review based on claims experience when the schemes were first launched in 2015.

- Despite recurring losses to the insurers, no premium rate revisions have been made in the last seven years since the schemes were launched.

ii.The Insurance Regulatory and Development Authority (IRDAI) reported that, while the claims ratio (percentage of amount of claims paid to premium received) for PMJJBY and PMSBY is 145.24% and 221.61%, respectively, the combined ratio (sum of claims ratio and expense ratios) for PMJJBY and PMSBY is 163.98% and 254.71%, respectively, for the period up to March 31, 2022.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

i.The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a renewable one-year life insurance scheme that provides death coverage.

- It offers Rs 2 lakh in life insurance coverage to anyone aged 18 years to 50 years who have a bank or post office account and agree to enrol or enable auto-debit of premiums. The scheme is being offered by Life Insurance Corporation (LIC).

ii.PMJJBY’s premium rate has been revised to Rs 1.25 each day, bringing the annual premium amount from Rs 330 to Rs 436.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

i.The Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a one-year renewable personal accident insurance policy that covers death or disability caused by an accident. The insurance coverage period runs from June 1 to May 31.

- It offers Rs 2 lakh in insurance coverage for accidental death or total permanent disability and Rs 1 lakh in insurance coverage for partial permanent disability to anyone aged 18 years to 70 years who have a bank or post office account and agree to join or enable auto-debit of premiums

ii.PMSBY’s annual premium has been increased from Rs 12 to Rs 20.

NOTE:

- The transmission of benefits through these schemes was extensively monitored throughout the COVID-19 epidemic, and a range of initiatives were implemented to simplify procedures and expedite claims.

- It featured bank outreach programmes and messages to beneficiaries of those who died during the COVID-19 pandemic, as well as the simplification of claim forms and proofs of death.

Key Statistics on PMJJBY and PMSBY:

i.As of March 31, 2022, there were 6.4 crore and 22 crore active members enrolled in PMJJBY and PMSBY, respectively.

ii.As of 31.3.2022, the implementing insurers had collected Rs 1,134 crore in premiums and had paid Rs 2,513 crore in claims under the PMSBY.

- Also, the implementing insurers had collected Rs. 9,737 crores in premiums and had paid Rs. 14,144 crores in claims under PMJJBY as of 31.3.2022.

iii. Both schemes employed the Direct Benefit Transfer (DBT) channel to deposit claims into recipients’ bank accounts.

Envisioned Outcome:

i.Revised rate would attract other private insurers to join in the scheme’s implementation.

- It will increase the scheme’s saturation among eligible target populations, particularly those who are underserved or unserved.

ii.The hike in premium rates will help India become a fully insured society.

- In the next five years, a target has been established to increase coverage from 6.4 crore to 15 crore under PMJJBY and from 22 crore to 37 crore under PMSBY.

About Ministry of Finance (MoF):

Union Minister: Nirmala Sitharaman (Rajya Sabha – Karnataka)

Minister of State (MoS): Pankaj Chaudhary (Maharajganj Constituency, Uttar Pradesh); Dr. Bhagwat Kishanrao Karad (Rajya sabha Maharashtra).