Some Basic info to understand this news better:

- Capital infusion refers to the process whereby funds are injected into startup companies or ailing companies by an investor with a financial interest in the company. Capital infusion also refers to the process of transferring money from a successful unit, division or subsidiary of a company to another unit that is not doing well with the aim of injecting new life into that unit.

- In context of banks, capital infusion means capital provided to banks to to help them get over the problems arising out of slow economic growth. One such problem of banks is to meet BASEL III norms.

Now, the news:

- The government has decided to infuse capital in public sector banks (PSBs) based on the requirement of individual lenders — which is a departure from the precedent set last year..

- The government has asked PSBs to make detailed presentations on their capital requirement for the current financial year. If the government is convinced that a bank needs funds, then it will infuse capital.

- The government has earmarked Rs 7,940 crore for capital infusion in PSBs in 2015-16.

- Last year, the finance ministry decided to infuse capital in nine PSBs depending on their performance.Two parameters were applied for identifying the banks. First the weighted average of return on assets for all PSBs, for the last three years put together, was arrived at and all those who were above the average were considered.The second parameter used was return on equity (ROE) for these banks for the last financial year.Those who had performed better than the average had been rewarded.

- The Reserve Bank of India (RBI) has been telling the government to allocate more capital for the banks as they need to clean up their balance sheet and should we well capitalised to fund growth when it picks up.

Know More about this news topic:

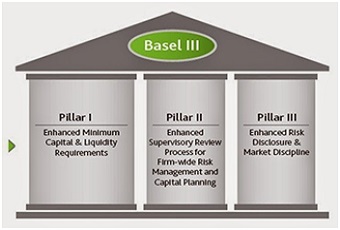

- Basel III is part of the continuous effort made by the Basel Committee on Banking Supervision to enhance the banking regulatory framework. It builds on the Basel I and Basel II documents, and seeks to improve the banking sector’s ability to deal with financial and economic stress, improve risk management and strengthen the banks’ transparency. In short, Basel III is a set of standards and practices created to ensure that international banks maintain adequate capital to sustain themselves during periods of economic strain.

- Basel III establishes more stringent capital requirements, tripling the amount of capital banks must keep on hand to absorb losses during financial crises. The name for the accords is derived from Basel, Switzerland, where the committee that maintains the accords meets.

AffairsCloud Recommends Oliveboard Mock Test

AffairsCloud Ebook - Support Us to Grow

Govt Jobs by Category

Bank Jobs Notification