In the evolving financial sector, Government leaped into the next step for collecting the bad debts and bad loans by passing two key bill amendments in the Lok Shaba namely Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, and the debt recovery tribunal (DRT) Act.

What is SARFAESI Act?

- Under this act secured creditors (banks or financial institutions) have much right for enforcement of security interest under section 13 of SARFAESI Act, 2002.

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 aka sarfaesi act is an Indian law, which allows banks and other financial institution to auction residential or commercial properties to recover loans. The first asset reconstruction company (ARC) of India, ARCIL, was set up under this act.

- If borrower of financial assistance makes any default in repayment of loan or any installment and his account is classified as Non performing Asset by secured creditor, then secured creditor may require before expiry of period of limitation by written notice to the borrower for repayment of due in full within 60 days by clearly stating amount due and intention for enforcement.

- Where he does not discharge dues in full within 60 days, then without intervention of any court or tribunal Secured creditor may take possession of secured asset, or take over management of business of borrower or appoint manager for secured asset or without taking any of this action may also proceed against guarantor or sell the pledged asset.

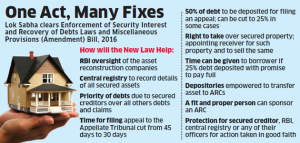

- It is noted that the act was amended by “Enforcement of Security Interest and Recovery of Debts Laws and Miscellaneous Provisions (Amendment) Bill, 2016“, passed by Lok Sabha on 2 August 2016.

What is Debt Recovery Tribunal?

The Recovery of Debts Due to Banks and Financial Institutions Bill having been passed by both the Houses of Parliament received the assent of the President on 27th August 1993.

- It came on the Statute Book as THE RECOVERY OF DEBTS DUE TO BANKS AND FINANCIAL INSTITUTIONS ACT, 1993 (51 of 1993).

- Banks had very hard time recovering bad loans. Because often, borrowers (loan takers) would file frivolous cases in civil courts. So 1993, Government established Debt Recovery Tribunals to deal with NPA matters.

- Now borrower cannot approach civil court, they’ve to go to special Debt Recovery Tribunal (DRT). This led to some relief, but then DRTs clogged down by truckload of cases.

- This two new bills imparts two new rectifications namely gives 180 days for disposal of recovery applications and also provides a 30-day timeline for the district magistrate to complete this process and he will also assist the lender in taking over the management if the lender has secured more than 51% stake in the company through conversion of debt into equity.

- The Act provides for setting up of a central registry that will maintain records of transactions related to secured assets, which will help prevent fraud by providing clear rights over the assets.

- The amendments are aimed at faster recovery and resolution of bad debts by banks and financial institutions and making it easier for asset reconstruction companies (ARCs) to function.

- Along with the new bankruptcy law which came into effect earlier this year, the amendments will put in place an enabling infrastructure to effectively deal with non-performing assets in the Indian banking system.

AffairsCloud Recommends Oliveboard Mock Test

AffairsCloud Ebook - Support Us to Grow

Govt Jobs by Category

Bank Jobs Notification