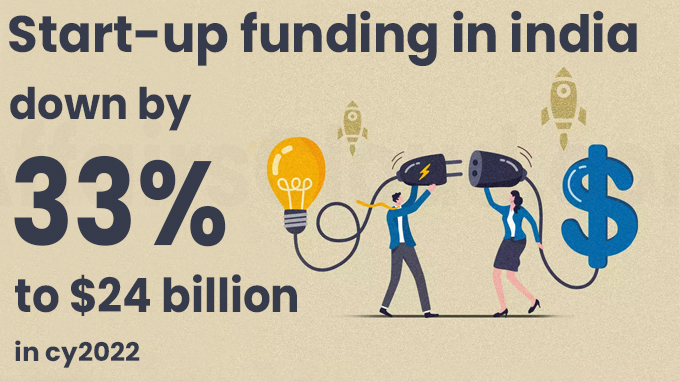

In accordance with the “Startup Tracker-CY22” report published by PricewaterhouseCoopers (PwC India), funding for Indian startups fell by 33% to USD 24 billion in calendar year 2022 (CY22) as compared to CY21 but was still more than twice as much as the amount raised in CY20 and CY19 combined together.

In accordance with the “Startup Tracker-CY22” report published by PricewaterhouseCoopers (PwC India), funding for Indian startups fell by 33% to USD 24 billion in calendar year 2022 (CY22) as compared to CY21 but was still more than twice as much as the amount raised in CY20 and CY19 combined together.

- Startups received a total of USD 13.2 billion in funding in 2019, USD 10.9 billion in CY20, and USD 35.2 billion in CY21.

Key Report Findings:

i.In value terms, early-stage deals made up roughly 12% of the total capital in CY22, compared to just under 7% in CY21.

- It demonstrated that investors were positive about the Indian start-up ecosystem despite the global slowdown.

ii.In volume terms, early-stage deals made up 60–62% of the total funding in CY21 and CY22, with an average ticket size of USD 4 million per deal.

- Nearly 25% of all funding activity in CY22 was in the SaaS (Software as a Service) segment, which saw funding values rise by 20% from CY21 to CY22.

iii.Growth and late-stage funding deals accounted for 88% of funding activity in CY22 in terms of value, accounting for 38% of overall deal count.

- In CY22, funding for late-stage deals decreased by 52%.

- During CY22, growth-stage deals had an average ticket size of USD 43 million and late-stage deals had an average ticket size of USD 94 million.

iv.The global venture capital dry powder pile has increased to nearly USD 590 billion, with the majority of these funds committed in CY21 and CY22.

v.The number of mergers and acquisitions (M&A) transactions fell by 17% in CY22 compared to CY21, with 60% of the transactions occurring in the SaaS, e-commerce + D2C, and EdTech sectors.

- The three industries with the highest number of M&A deals were e-commerce (61), D2C (61), and SaaS (60).

vi.As of December 2022, Bengaluru (Karnataka), the National Capital Region (NCR), and Mumbai (Maharashtra), accounted for close to 82% of all startups in India in terms of city-wise startup funding.

- In the top 3 cities, as much as 28% of startups have raised more than USD 20 million.

- Bengaluru had the most unicorns, followed by the NCR and Mumbai.

Recent Related News:

In December 2022, HDFC Bank in partnership with the Government of India (GoI)’s flagship initiative ‘Startup India’, launched the 6th ‘Parivartan SmartUp Grants’, the annual grants program for social startups.

About PricewaterhouseCoopers (PwC India):

Chairperson – Sanjeev Krishan

Headquarters – Kolkata, West Bengal