On 26th Feb. 2020 ,Union Minister for Finance & Corporate Affairs Nirmala Sitharaman had revealed the following reforms and index on a launching event which organized by Indian Banks’ Association (IBA) at New Delhi.

1.‘EASE 3.0(Enhanced Access and Service Excellence 3.0)’ – Public Sector Bank (PSB) Reforms Agenda 2020-21 for smart, tech-enabled banking

2.PSB EASE Reforms Annual Report 2019-20

EASE 3.0 and its action reforms: –

PSB Reforms EASE Agenda is a common reform agenda for PSBs aimed at institutionalizing clean and smart banking. It was launched in January 2018.

Objective of EASE 3.0 :- EASE 3.0 sets the agenda and roadmap for FY21 for their transformation into digital and data-driven NextGen Banking of the Future India. Finance Minister also insisted Public Sector Banks (PSBs) to have one to one interface with their customers through leveraging technology.

- She advised the Public Sector Banks (PSBs) to make their customers friendly by using the local language at the bank branch.

Reforms of EASE 3.0: –

- Dial-a-loan: Digitally-enabled doorstep facilitation for initiation for all customer loans.

- Customer-need driven credit offers by larger PSBs to existing customers through analytics.

- Partnerships with FinTechs and E-commerce companies for customer-need driven credit offers .

- Credit@click: End-to-end digitalised, time-bound retail and MSME lending by larger PSBs, leveraging Account Aggregators, FinTechs and PSBloansin59minutes.com.

- Cash-flow-based MSME credit by larger PSBs, using FinTech, Account Aggregator and other third-party data and transactions-based underwriting models.

- Tech-enabled agriculture lendin.

- Palm banking: End-to-end digitalized delivery of financial services in regional languages and with industry-best service quality.

- EASE Banking Outlets: On-the-spot banking at frequently visited places such as train stations, bus stands, malls, hospitals, etc. through paperless and digitally-enabled banking outlets and stalls.

Some of the PSBs upcoming plans:-

The following upcoming plans were unveiled by some of an important PSBs during launching function.

i.State Bank of India :-

- Shishu e-Mudraapp-based lending – instant sanction of working capital up to Rs. 50,000 for existing small business customers and also announced its plan to scale up sanctioning through the app to Rs.1 lakh in branch-assist mode.

- YONO Krishi – app-based, which enables credit including agricultural gold loan, estimation and purchase of agricultural inputs, and information needed for agricultural operations.

- SAFAL for pre-approved agricultural loan along with multipurpose insurance cover.

ii.UCO Bank(United Commercial Bank ):-

- It unveiled its plans for customers to obtain via app, portal or call centre, Doorstep Banking Servicesoffered collectively by PSBs as “PSB Alliance”, for services such as pick-up of cheques and income-tax exemption certificates and delivery of income-tax challan, drafts and account statements in major cities across India.

iii.Union Bank of India:-

- It presented a preview of its app for end-to-end digitalized lending to MSMEs of up to Rs. 50 crore.

iv.Bank of Baroda:-

- It showcased its tablet-based Tab Banking services for doorstep account-opening, including in villages and for migrant laborers in industrial units, and has created capacity for opening about 10,000 accounts per day.

- Also showed a preview of its tab-based doorstep loan application, disbursement and collection for informal enterprises in partnership with NBFCs, including in rural areas.

v.Syndicate Bank:-

- It presented micro ATM and tablet based doorstep micro-financing of women entrepreneurs.

Performance of EASE Reforms 1.0 and 2.0:-

Public Sector Banks have shown important enhancement in the Action Points of the EASE Reforms Agenda since its introduction. The improved financial condition of PSBs reflects in many parameters such as

- Gross NPAs(Non-performing asset )reduced from Rs 96 lakh crore(14.6%) in March-2018 to Rs 7.17 lakh crore (11.3%) in December-2019;

- A sharp decline in fraud occurrence from 65%of advances during FY10-FY14 to 0.20% in FY18-FY20; due to fraud prevention reforms and proactive checking of legacy NPA

- Record recovery of Rs 2.04 lakh crorein FY19-9MFY20 driven by newly setup dedicated stressed account management verticals in PSBs that have recovered Rs 1.21 lakh crore in the same period;

- Number of PSBs under Prompt corrective action (PCA) down to four;

- 12 PSBs reporting profits in 9MFY20;

- Capital to Risk (Weighted) Assets Ratio (CRAR) 340 bpsabove the regulatory minimum; and

- The highest provision coverage ratio of 5%in nearly eight years.

PSB EASE Reforms Annual Report 2019-20 or EASE 2.0 index :-

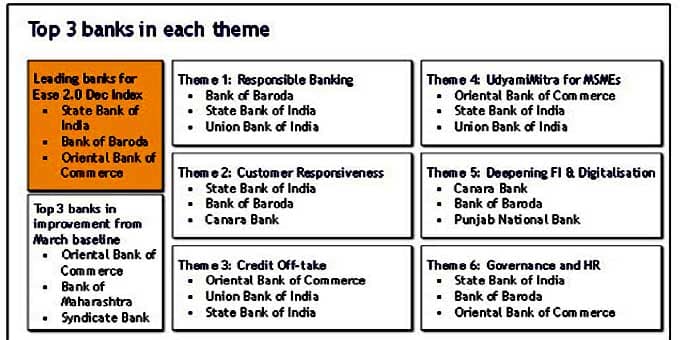

Index measures the performance of each PSB on 100+ objective metrics across six themes such as

- Responsible Banking

- Customer Responsiveness

- Credit off-take

- UdyamiMitra for MSMEs

- Deepening FI & Digitalisation

- Governance and HR

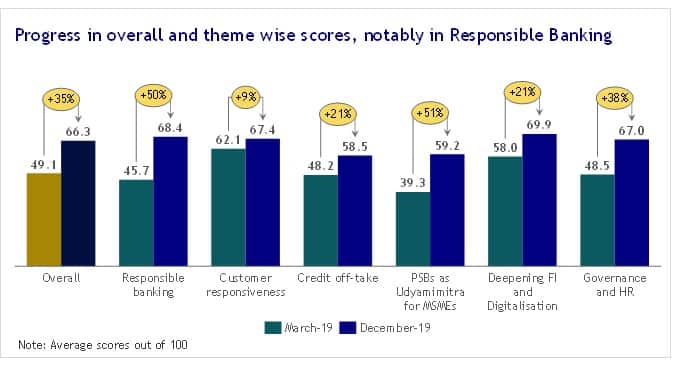

Significant progress is seen across six themes of the Reforms Agenda, with the highest improvement seen in the themes of ‘Responsible Banking’ and ‘PSBs as Udyamimitra for MSMEs’.

Top 3 performing banks in EASE 2.0 index – State Bank of India, Bank of Baroda and Oriental Bank of Commerce.

Top 3 banks in improvement from March Baseline – Oriental Bank of Commerce, Bank of Maharashtra and Syndicate Bank.

Progress in overall and theme wise scores:-

PSBs have shown a good improvement in their performance over three quarters since the launch of EASE 2.0 Reforms Agenda.

The overall score of PSBs increased by 35% between March-2019 and December-2019, with the average EASE index score improving from 49.1 to 66.3 out of 100.

| Themes | Score in March 2019 | Score in December 2019 | Improved score in % |

| Responsible Banking | 45.7 | 68.4 | 50 |

| Customer Responsiveness | 62.1 | 67.4 | 9 |

| Credit off-take | 48.2 | 58.5 | 21 |

| UdyamiMitra for MSMEs | 39.3 | 59.2 | 51 |

| Deepening FI & Digitalisation | 58.0 | 69.9 | 21 |

| Governance and HR | 48.5 | 67.0 | 38 |

The final EASE 2.0 index will be published after declaration of bank results for the financial year.

Participants

Minister of State (MoS) for Finance and Corporate Affairs Anurag Thakur was the guest of honour for the event. Finance Secretary Rajiv Kumar, Secretary Designate cum Special Secretary (Financial Services) Debashish Panda and Chairman IBA, Rajnish Kumar also attended the event.

About Indian Banks’ Association (IBA) – Representative body of Bank Administration in India, operating in India.

- Chairman of IBA – State Bank of India’s Chairman Mr. Rajnish Kumar .

- CEO – G. Kannan

Click here to read full coverage.