We are here for you to provide the important Recent and Latest Current Affairs 7 December 2023, which have unique updates of Latest Current Affairs 2023 events from all newspapers such as The Hindu, The Economic Times, PIB, Times of India, PTI, Indian Express, Business Standard and all Government official websites.

We are here for you to provide the important Recent and Latest Current Affairs 7 December 2023, which have unique updates of Latest Current Affairs 2023 events from all newspapers such as The Hindu, The Economic Times, PIB, Times of India, PTI, Indian Express, Business Standard and all Government official websites.

Our Current Affairs December 2023 events will help you to get more marks in Banking, Insurance, SSC, Railways, UPSC, CLAT and all State Government Exams. Also, try our Latest Current Affairs Quiz and Monthly Current Affairs 2023 PDF which will be a pedestrian to crack your exams.

Read Current Affairs in CareersCloud APP, Course Name – Learn Current Affairs – Free Course – Click Here to Download the APP

We are Hiring – Subject Matter Expert | CA Video Creator | Content Developers(Pondicherry)

Click here for Current Affairs 6 December 2023

NATIONAL AFFAIRS

18 New Products of Uttarakhand gets GI Tag 18 products of Uttarakhand including 12 agricultural goods, 4 Handi-craft goods, 1 food-stuff and 1 manufactured good received Geographical Indication (GI) tag.

18 products of Uttarakhand including 12 agricultural goods, 4 Handi-craft goods, 1 food-stuff and 1 manufactured good received Geographical Indication (GI) tag.

- Uttarakhand has become the 1st state in the country to get the highest number of 18 GI tags in a single day.

- Chief Minister (CM) of Uttarakhand, Pushkar Singh Dhami officially distributed GI certificates to 18 products.

- With these 18 new products, the total number of GI products in Uttarakhand has become 27.

About Uttarakhand:

Chief Minister– Pushkar Singh Dhami

Governor– General(Retired) Gurmeet Singh

Capital– Dehradun

Festival– Kangdali Festival; Uttarayani Mela or Uttarayani Fair

>> Read Full News

Ministry of Panchayati Raj launched GIS application ‘Gram Manchitra’

The Union Minister of State (MoS), MoPR, Kapil Moreshwar Patil launched the Geographic Information System (GIS) application “Gram Manchitra” to encourage technology driven spatial planning by the Gram Panchayat.

- It utilizes geo-spatial technology to offer a dynamic, unified platform for Gram Panchayats to visualize and plan diverse developmental projects spanning natural resource management, water harvesting, sanitation, agriculture, and more.

- Gram Manchitra will serve as a support system for the formulation of Gram Panchayat Development Plan (GPDP).

Key Points:

i.This newly launched app will be aided by MoPR’s previously launched mActionSoft application, which will enhance the platform by integrating geo-tagged data from assets, providing a detailed view of Gram Panchayat projects.

ii.mActionSoft, mobile-based solution captures photos with Global Positioning System (GPS) coordinates/Geo-Tags, creating a transparent record of works and assets, particularly those funded by the Finance Commission.

iii.The Gram Panchayat is responsible for the overall development of the village. They also play a key role in providing basic services like drinking water and sanitation.

INTERNATIONAL AFFAIRS

India Joins Battery Energy Storage Systems Consortium On December 4, 2023, during the 2023 United Nations Climate Change Conference (COP28), India became a member of the Battery Energy Storage Systems (BESS) Consortium, led by the Global Leadership Council (GLC) of the Global Energy Alliance for People and Planet (GEAPP).

On December 4, 2023, during the 2023 United Nations Climate Change Conference (COP28), India became a member of the Battery Energy Storage Systems (BESS) Consortium, led by the Global Leadership Council (GLC) of the Global Energy Alliance for People and Planet (GEAPP).

- A total of 11 countries(first-mover countries), including India, have joined the BESS consortium during the COP28.

- The BESS consortium is committed to achieving a combined commitment of 5 Gigawatts (GW) of BESS by the end of 2024.

The other first-mover countries are: Barbados, Belize, Egypt, Ghana, Kenya, Malawi, Mauritania, Mozambique, Nigeria, and Togo

Note: COP28 is being held in Dubai, United Arab Emirates (UAE) from 30 November to 12 December 2023.

Key Points:

i.90 GW of storage capacity must be developed, To achieve the estimated 400 GW of renewable energy required to alleviate energy poverty by 2030 and save a gigaton of Carbon dioxide (CO2),

- The 5GW goal will support the creation of a roadmap for achieving the rest by 2030.

ii.During the Energy Transition Dialogues (TETD) organised by GEAPP in New Delhi in November 2023, GEAPP also announced the expansion of its BESS project in India.

- This aims to achieve the target of 1GW for DISCOMS (Distribution Companies) under BESS by 2026.

India’s efforts towards BESS:

India has taken significant steps for the integration of BESS which include the following:

i.In September 2023, the Indian Government approved a scheme to develop 4,000 MWh of BESS projects by 2030-31, offering up to 40% capital cost support through Viability Gap Funding (VGF) to encourage public-private partnerships and reduce BESS infrastructure project costs.

ii.IndiGrid, India’s first power sector infrastructure investment trust, was awarded its first BESS project to design, supply, test, install, commission, operate, and maintain a 20 MW/40 MWh in Delhi.

- GEAPP will provide concessional debt financing for 70% of the total capital investment and technical assistance for the project.

About BESS Consortium:

BESS Consortium is a multi-stakeholder partnership set up to ensure these BESS benefits transform energy systems across low- and middle-income countries (LMICs).

BESS Consortium’s first-mover countries will be supported by resources like the African Development Bank (AfDB), the World Bank(WB), the Asian Development Bank (ADB), Sustainable Energy for All (SEforALL), COP28 Presidency with additional partners and countries expected to join.

About Global Leadership Council (GLC) of GEAPP:

GLC is a high-level coalition of global leaders brought together by GEAPP.

GLC is co-chaired by Jonas Gahr Store, Prime Minister of Norway and Dr Rajiv J. Shah, President of The Rockefeller Foundation.

Established in 2022

BANKING & FINANCE

World Bank Launched Various initiatives to Address Methane Emissions Globally at the COP28 summit The World Bank (WB) launched partnership platforms namely the Global Methane Reduction Platform for Development (CH4D), a hub for methane reduction in agriculture and waste, and the Global Flaring and Methane Reduction Partnership (GFMR) which focuses on reducing methane leaks in the oil and gas sector.

The World Bank (WB) launched partnership platforms namely the Global Methane Reduction Platform for Development (CH4D), a hub for methane reduction in agriculture and waste, and the Global Flaring and Methane Reduction Partnership (GFMR) which focuses on reducing methane leaks in the oil and gas sector.

- WB also launched an 18-month “blueprint for methane reduction” to set up 15 national programs to reduce methane emission.

- The proposals were launched at the 28th Conference of the Parties (COP28) of the United Nations Framework Convention on Climate Change (UNFCCC), being held in Dubai, United Arab Emirates (UAE) from 30 November to 12 December 2023.

About World Bank (WB):

World Bank Group President– Ajay Banga

Headquarters– Washington, DC, USA

Established in– 1944

>> Read Full News

Bank of Baroda Introduced BOB Parivar Account for Savings & Current Accounts Bank of Baroda (BOB), a leading public sector bank(PSB), has launched the BOB Parivar Account for Savings and Current Accounts which groups all the bank accounts belonging to members of a single family under One Family.

Bank of Baroda (BOB), a leading public sector bank(PSB), has launched the BOB Parivar Account for Savings and Current Accounts which groups all the bank accounts belonging to members of a single family under One Family.

- The ‘My Family, My Bank’ segment was launched under the “BOB Ke Sang Tyohaar Ki Umang” festive campaign of BoB.

About BOB Parivar Account:

i.The accounts under the BOB Parivar Account will be operated independently by the primary account holder.

ii.This eliminates the need to maintain a quarterly average balance (QAB) in every single account. The QAB is recorded at the Group/Family level.

Eligibility:

i.Savings account segment is open to a family of a minimum 2 members and a maximum of 6 members.

ii.Current account segment is open to proprietorship, partnership, LLP, and Pvt. Ltd. companies, which are group companies or sister concerns.

Categories:

i.Both the BOB Parivar Saving Accounts and the BOB Parivar Current Account segments are classified into 3 different categories: Diamond, Gold and Silver.

ii.These accounts vary on Pooled Quarterly Average Balance (PQAB) requirements.

- For Savings Account:

- Diamond – Rs 5 lakh and above

- Gold- Rs 2 lakh and above

- Silver – Rs 50000 and above

- For Current Account:

- Diamond- Rs 10 lakh and above

- Gold – Rs 5 lakh and above

- Silver – Rs 2 lakh

Benefits:

The benefits of this account includes,

- Concessional interest rates on retail loans for savings account holders.

- Concession in manual NEFT(National Electronic Funds Transfer)/RTGS (Real Time Gross Settlement) charges.

- Complete waiver of processing charges on Retail loans.

About Bank of Baroda (BOB):

MD & CEO– Debadatta Chand

Established in 1908

Headquarters– Vadodara, Gujarat

Tagline– “India’s International Bank”

HDFC Bank Partnered with Tata Neu to Launch Tata Neu HDFC Bank Credit Cards HDFC Bank Limited in partnership with Tata Neu launched the co-branded credit card “Tata Neu HDFC Bank credit card” powered by RuPay/Visa.

HDFC Bank Limited in partnership with Tata Neu launched the co-branded credit card “Tata Neu HDFC Bank credit card” powered by RuPay/Visa.

The credit card is available in 2 variants:

- Tata Neu Infinity HDFC Bank Credit Card

- Tata Neu plus HDFC Bank Credit Card

Note: This collaboration will help Tata Neu to expand into financial services which aims to provide online payment services to its customers.

About Tata Neu HDFC Plus Credit Card:

Eligibility:

i.For salaried individuals:

- Age: Minimum 21 years & Maximum 60 Years

- Net Monthly Income should be more than Rs 25,000

ii.For Self-Employed Person:

- Age: Minimum 21 years & Maximum 65 Years

- Income Tax Return should be more than Rs 6 Lakhs per annum

Joining fees: Rs 499 + GST & Renewal fees: Rs 499 + GST

About Tata Neu Infinity HDFC Bank Credit Card:

Eligibility:

i.For salaried individuals:

- Age: Minimum 21 years & Maximum 60 Years

- Net Monthly Income should be more than Rs 1 lakh.

ii.For Self-Employed Person:

- Age: Minimum 21 years & Maximum 65 Years

- Income Tax Return should be more than Rs 12 lakh per annum.

Joining fees: Rs 1499 + GST & Renewal fees: Rs 1499 + GST

click here to know more

About Tata Neu App:

i.Tata Neu app is popularly known as the Super app developed by Tata Group. This app was launched on April 7, 2022. Tata Neu is a single online platform which provides various services like shopping, and booking flights and hotels.

ii.Tata Neu app gives Neu coins to its customers as an incentive which can used for availing other services on the app.

Additional info:

NeuCoins are the rewards a customer earns when transacting on the Tata Neu app, website, or at any brand stores or hotels.

- 1 NeuCoin is worth Rs 1.

About HDFC Bank Limited:

Chairman– Atanu Chakraborty

Headquarters– Mumbai, Maharashtra

Established– 1994

Tagline– “We Understand Your World”

ADB Offered Loans for Various Projects in India and Co-Hosts ‘Kutumb‘ with IIFL Home Finance Ltd Asian Development Bank (ADB) helps its members and partners by providing loans, technical assistance, grants, and equity investments to promote social and economic development. Recently it has collaborated with GOI, Uttarakhand, and IIFL Home Finance Limited for various projects.

Asian Development Bank (ADB) helps its members and partners by providing loans, technical assistance, grants, and equity investments to promote social and economic development. Recently it has collaborated with GOI, Uttarakhand, and IIFL Home Finance Limited for various projects.

- ADB has approved a USD($) 98 million(Rs.816 Cr) loan to improve the horticulture crop farmers’ access in India to certified disease-free planting materials.

- ADB approves USD 200 million boost to enhance water supply and sanitation in Uttarakhand

- IIFL Home Finance Ltd. presents the 15th chapter of ‘Kutumb’ in collaboration with the Asian Development Bank (ADB).

About Asian Development Bank

Founded in-1966

Headquarters– Manilla, Philippines

President- Masatsugu Asakawa

>> Read Full News

SBI Card joins Bharat BillPay in the Credit Card Category SBI Card has joined the credit card category of Bharat BillPay. The integration of the SBI Card into Bharat BillPay was made by NPCI Bharat BillPay (NBBL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI),

SBI Card has joined the credit card category of Bharat BillPay. The integration of the SBI Card into Bharat BillPay was made by NPCI Bharat BillPay (NBBL), a wholly-owned subsidiary of the National Payments Corporation of India (NPCI),

- The goal of this partnership is to make credit card bill payments more convenient and accessible.

Key Points:

i.This will enable SBI Card’s approx 1.68 crore customers to pay and manage their credit card bills through Bharat BillPay’s supported payment channels.

- These channels include: Online via banks, Payment apps, Bharat BillPay physical outlets.

ii.On the other hand, Bharat BillPay’s settlement technology enhances security, ensuring a reliable and seamless payment experience for all consumers.

iii.Credit card issuers already present in this category include Kotak Mahindra Bank, BoB Financial, Federal Bank, AU Small Finance Bank, IndusInd Bank, and Canara Bank.

Note –

NPCI incorporated Bharat BillPay in December 2020, which is accountable for driving the Reserve Bank Of India (RBI)-conceptualised Bharat Bill Payment System (BBPS).

Aditya Birla Sun Life launches ABSLI Salaried Term Plan for Salaried Individuals Aditya Birla Sun Life Insurance (ABSLI) has launched the ABSLI Salaried Term Plan, a budget-friendly term insurance plan for salaried individuals.

Aditya Birla Sun Life Insurance (ABSLI) has launched the ABSLI Salaried Term Plan, a budget-friendly term insurance plan for salaried individuals.

- The plan is categorised as a non-linked, non-participating, Life Individual, pure risk, and premium plan.

Key Points:

i.This plan allows the policyholders to customize their plan based on their protection needs.

ii.Along with the Standard Life Cover option, the policyholders can opt for a Life Cover with a Return of Premium (ROP) feature.

- With this option, policyholders can receive a refund of the total premiums paid upon survival.

Features of Plan:

i.ABSLI Salaried Term Plan provides long-term comprehensive protection with a policy term of up to 49 years.

- The minimum & maximum entry age is 21 to 55 years, respectively, with a maximum maturity age of 70 years.

ii.The policyholders can also choose between multiple PPT (Premium Payment Term) options i.e., Limited Pay (5, 7, 10, 12, 15 and 20 Years) & Regular Pay.

iii.Fixed Income Cover: In case of the policyholder’s death, the nominee receives a monthly income equal to 1.25% of the chosen sum assured for the selected Income Benefit Period, which can span 10, 15, or 20 years.

About Aditya Birla Sun Life Insurance (ABSLI):

ABSLI is a life insurance subsidiary of Aditya Birla Capital Ltd (ABCL).

MD & CEO– Kamlesh Rao

Headquarters– Mumbai, Maharashtra

Incorporated in 2000

Commenced operations in 2001

Union Bank Collaborates with Accenture to Boost Operational Efficiency

The Union Bank of India (UBI) has partnered with Accenture, a leading global professional services company, to design and develop a scalable and secure enterprise data lake platform with advanced analytics and reporting capabilities.

- The partnership aims to improve operational efficiency, enhance customer-centric banking services, and manage the risk of Union Bank of India.

i.The platform generates business-relevant insights by using leverage structured and unstructured data from within the bank as well as from external sources.

ii.The platform will use the predictive analytics, machine learning (ML) and artificial intelligence(AI) and leverage structured and unstructured data from within the bank and from external sources to generate business-relevant insights.

iii.This will enable the bank to develop data visualisation and reporting capabilities including interactive dashboards and reports for business, operational and regulatory purposes.

ECONOMY & BUSINESS

S&P’s Global Credit Outlook 2024: India set to become 3rd largest economy by 2030 According to ‘Global Credit Outlook 2024: New Risks, New Playbook’ released by S&P Global Market Intelligence, India is set to become the third-largest economy in the world by 2030 and it is projected to be the fastest-growing major economy in the next 3 years.

According to ‘Global Credit Outlook 2024: New Risks, New Playbook’ released by S&P Global Market Intelligence, India is set to become the third-largest economy in the world by 2030 and it is projected to be the fastest-growing major economy in the next 3 years.

Largest Economy:

i.At present, India is the fifth largest economy in the world.

ii.The top five economy along with their Gross Domestic Product (GDP) are as follows (according to the ranking):

- United States Of America (USA) – USD 26,954 Billion

- China – USD 17,786 Billion

- Germany – USD 4,430 Billion

- Japan – USD 4,231 Billion

- India – USD 3,730 Billion

GDP prediction:

i.According to the report, India’s GDP is set to grow at 6.4% in the current fiscal (FY24), which is 40 basis points(bps) higher than the previous forecast.

ii.It is expected to grow at 6.4% for FY25, this is 50 bps lower than the earlier projection.

iii.For FY26 and FY27, India’s GDP is expected to grow at 6.9% and 7%, respectively.

Note:

i.India‘s nominal GDP is expected to rise from USD 3.5 trillion in 2022 to USD 7.3 trillion by 2030.

ii.With this, Indian GDP will exceed the Japanese GDP by 2030, making India the 2nd largest economy in the Asia-Pacific region.

Key Points:

i.India has a scope of becoming next major global manufacturing hub.

ii.The report also pointed out that India is in need of a strong logistics framework to transform into a manufacturing-dominant economy from the current services-dominated economy.

iii.It also suggested that by enhancing the skills of workers and boosting female participation in the workforce, India will India to realise its demographic dividend.

iv.India growing digital market will boost the startup ecosystem, especially in financial and consumer technology.

Additional Info:

In the second quarter of the financial year 2023-24(July to September 2023) India experienced the GDP growth rate of 7.6%.

ONDC launches ‘Build for Bharat’ Initiative to Tackle Challenges in Digital Commerce Space

The Open Network for Digital Commerce (ONDC) has launched a nationwide initiative called ‘Build for Bharat‘ in collaboration with Google Cloud India Private Limited, Antler Innovation India Private Limited, Paytm(One97 Communications Limited), Protean eGov Technologies Limited and Startup India.

- Objective: To tackle diverse challenges in digital commerce and to promote industry innovation to develop practical solutions.

- The initiative, organized at a national-scale in more than 50 cities across India, plans to utilise India’s technological and entrepreneurial potential.

ONDC is an initiative of the Department for Promotion of Industry and Internal Trade (DPIIT) under the Ministry of Commerce and Industry (MoC&I).

AWARDS & RECOGNITIONS

Suganthy Sundararaj Honored With PRSI National Award 2023

Public Relations Society of India (PRSI) honoured Suganthy Sundararaj, Regional Head of Public Relations at Apollo Hospitals, with the PRSI National Award 2023 for her outstanding contributions to PRSI and the industry.

- The award was presented during the International Public Relations (IPR) Festival 2023 held in New Delhi, Delhi from 25th to 27th November 2023.

- The award recognised her dedication to the PR industry and her role in shaping the strategic management of the PR function in the healthcare domain.

Suganthy Sundararaj has executed the PR mandate for Apollo Hospitals for more than 40 years. She has driven key initiatives and built lasting relationships with the media.

Note: The theme of IPR Festival 2023 is “G20: Showcasing Indian Values and The Emerging India to the World: Opportunities for Public Relations’.

Additional Info:

i.NHPC Limited received 2nd prize under the ‘Annual Report’ category of ‘PRSI National Awards 2023

ii.Indian Oil Corporation Ltd. (IndianOil) has won 35 awards in the event whereas Garden Reach Shipbuilders & Engineers Limited(GRSE) received awards in five categories.

ACQUISITIONS & MERGERS

SBI to Acquire Additional 20% Stake in SBI Pension Funds for Rs 229.52 Crore The Executive Committee of the Central Board (ECCB) of State Bank of India (SBI) has approved SBI to acquire an additional 20% stake in SBI Pension Funds Private Limited (SBIPFPL) for a cash consideration of Rs. 229.52 crore.

The Executive Committee of the Central Board (ECCB) of State Bank of India (SBI) has approved SBI to acquire an additional 20% stake in SBI Pension Funds Private Limited (SBIPFPL) for a cash consideration of Rs. 229.52 crore.

- These stakes are currently held by SBI Capital Markets Limited (SBICAPS), a wholly-owned subsidiary of SBI.

About the Acquisition:

i.After the acquisition, SBI will own 80% of the stake in of SBIPFPL whereas the remaining 20% of the stake will be owned by SBI Funds Management Limited.

ii.The acquisition will be completed by 15th December 2023.

iii.The acquisition is based on the valuation report of Deloitte Touche Tohmatsu India Limited Liability Partnership (LLP).

iv.The entire process will be carried out on an arm’s length basis.

v.The proposal also received approval from Reserve Bank of India (RBI) and Pension Fund Regulatory and Development Authority (PFRDA).

Present Composition:

i.At present, SBI is the major stakeholder in SBIPFPL, holding 60% of the shares.

ii.SBICAPS and SBI Funds Management Limited each hold 20% of the remaining shares.

Additional Info:

SBI Funds Management Limited is a joint venture of SBI (62.53%) and Amundi (36.73%), a French asset management company.

About State Bank of India (SBI):

Chairman– Dinesh Kumar Khara

Headquarters– Mumbai, Maharashtra

Established in – 1955

Tagline– The banker to Every Indian

About SBI Pension Funds Private Limited (SBIPFPL):

It is appointed as the Pension Fund Manager (PFM) to manage the pension corpus under the National Pension System (NPS).

Managing Director & Chief Executive Officer (CEO) – Anthony Rodrigues

Headquarters– Mumbai, Maharashtra

Established in – 2007

SCIENCE & TECHNOLOGY

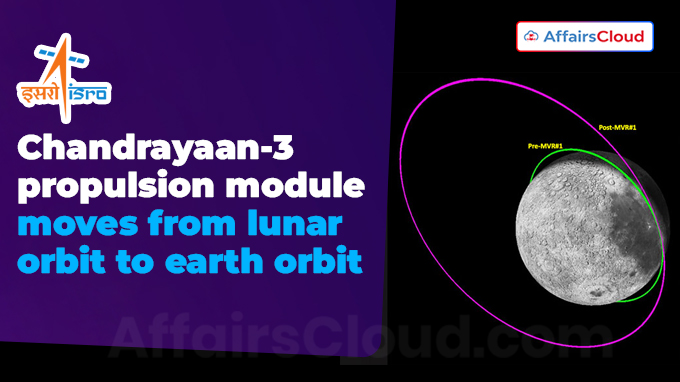

Chandrayaan-3 Propulsion Module Moves from Lunar Orbit to Earth Orbit The Propulsion Module (PM) of Chandrayaan-3 by the Indian Space Research Organisation (ISRO) retreats from an orbit around the moon to an orbit around Earth.

The Propulsion Module (PM) of Chandrayaan-3 by the Indian Space Research Organisation (ISRO) retreats from an orbit around the moon to an orbit around Earth.

- ISRO performed three maneuvers, including the first orbit-rising maneuver (from 150 km to 5112 km), the second maneuver moved PM to Earth orbit of 1.8 lakhs x 3.8 lakhs km, and the final Trans-Earth Injection (TEI) maneuver.

i.ISRO is set to launch India’s first X-ray polarimeter satellite (XPoSat) to investigate the polarisation of intense astronomical X-ray sources.

- XPoSat has two payloads, including the POLIX (Polarimeter Instrument in X-rays) and the XSPECT (X-ray Spectroscopy and Timing).

About the Indian Space Research Organisation (ISRO):

Chairman– S. Somanath

Headquarters– Bengaluru, Karnataka

Establishment– 1969

>> Read Full News

IMPORTANT DAYS

UNCTAD eWeek – December 4 to 8 2023 The United Nations Conference on Trade and Development (UNCTAD) eWeek, previously known as UNCTAD eCommerce Week, is a global forum on development and the digital economy.

The United Nations Conference on Trade and Development (UNCTAD) eWeek, previously known as UNCTAD eCommerce Week, is a global forum on development and the digital economy.

UNCTAD eWeek 2023 is being observed from 4th to 8th December 2023 at the International Conference Center of Geneva(CICG) in Geneva, Switzerland.

- eCommerce Week 2022 was observed from 25th to 29th April 2022.

Theme: The theme of UNCTAD eWeek 2023 is “Shaping the future of the digital economy.”

Organiser: UNCTAD eWeek 2023 is organised by UNCTAD in collaboration with ‘eTrade for all’ partners with the support of the Swiss government

About United Nations Conference on Trade and Development (UNCTAD):

UNCTAD is the UN’s leading institution dealing with trade and development.

Secretary-General– Rebeca Grynspan

Headquarters– Geneva, Switzerland

Established in 1964.

>> Read Full News

*******

List of Less Important News – Click Here

Current Affairs Today (AffairsCloud Today)

| Current Affairs 7 December 2023 |

|---|

| 18 New Products of Uttarakhand gets GI Tag |

| Ministry of Panchayati Raj launched GIS application ‘Gram Manchitra’ |

| India Joins Battery Energy Storage Systems Consortium |

| World Bank Launched Various initiatives to Address Methane Emissions Globally at the COP28 summit |

| Bank of Baroda Introduced BOB Parivar Account for Savings & Current Accounts |

| HDFC Bank Partnered with Tata Neu to Launch Tata Neu HDFC Bank Credit Cards |

| ADB Offered Loans for Various Projects in India and Co-Hosts ‘Kutumb’ with IIFL Home Finance Ltd |

| SBI Card joins Bharat BillPay in the Credit Card Category |

| Aditya Birla Sun Life launches ABSLI Salaried Term Plan for Salaried Individuals |

| Union Bank Collaborates with Accenture to Boost Operational Efficiency |

| S&P’s Global Credit Outlook 2024: India set to become 3rd largest economy by 2030 |

| ONDC launches ‘Build for Bharat’ Initiative to Tackle Challenges in Digital Commerce Space |

| Suganthy Sundararaj Honored With PRSI National Award 2023 |

| SBI to Acquire Additional 20% Stake in SBI Pension Funds for Rs 229.52 Crore |

| Chandrayaan-3 Propulsion Module Moves from Lunar Orbit to Earth Orbit |

| UNCTAD eWeek – December 4 to 8 2023 |

Aspirant: Does Affairscloud covers all the Current affairs topics related to examinations?

Affairscloud: We Guaranteed All the Important topics related to examination are covered in Our Daily CA content and Daily CA Quizzes.

Aspirant: Why is there a delayal in news?

Affairscloud: As some of the major news sites doesn’t provide the required data on the exact day, we take extra time for important data to be presented to the aspirants on the examination basis to ensure nothing is missed.

Example: In ‘Important Days’ topics the International Organisations publish their reports and Rankings in the evenings, to make sure every data is covered, we delay the topics to the next day.

| Candidates appearing for Competitive Exams. Kindly Share the General Awareness questions,which asked in their respective exams to “[email protected]” |

|---|