Indradhanush(rainbow) mission, a seven-pronged plan to revamp functioning of public sector banks (PSBs) was launched by Government of India Finance minister Arun Jaitley.Through this plan it helps the lenders register higher growth rate than earlier estimated and effectively deal with the issue of Non-Performing Assets (NPAs).

According to rating agency Crisil, the plan to provide a clear roadmap on capital infusion by the government and maintaining a capital buffer beyond the regulatory minimum reinforces the rating agency stance that the credit ratings of public sector banks would remain in the ‘high safety’ category in the near term.

According to rating agency Crisil, the plan to provide a clear roadmap on capital infusion by the government and maintaining a capital buffer beyond the regulatory minimum reinforces the rating agency stance that the credit ratings of public sector banks would remain in the ‘high safety’ category in the near term.- Indradhanush proposals can help PSBs effectively deal with the malaise of NPAs. These banks can potentially grow faster than its earlier estimate of 12 per cent annually till fiscal 2019.

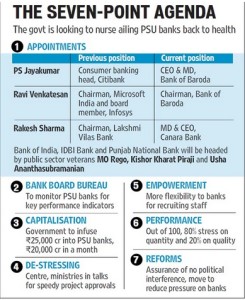

- The seven elements of Indradhanush includes Appointments, Board of Bureau, Capitalization, De-Stressing, Empowerment, Framework of Accountability and Governance Reforms.

- The government said that it would infuse Rs 20,088 crore into 13 PSU banks within a month’s time with country’s largest lender SBI cornering a hefty Rs 5,531 crore.

- The 13 PSU Banks includes State Bank of India, Bank of India, IDBI, Bank of Baroda, Punjab National Bank, Canara Bank, Indian Overseas Bank, Union Bank of India, Corporation Bank, Andhra Bank, Bank of Maharashtra, Allahabad Bank, Dena Bank.

- Indradhanush mainly focuses on systemic changes in state-run lenders, including a fresh look at hiring, a comprehensive plan to de-stress bloated lenders, capital infusion, accountability incentives with higher rewards including stock options and cleaning up governance.

Indradhanush, 7 Point Agenda:

1. Appointments :

Executives from the private sector have been hired to run state-owned banks. Separate post of CMDs and MD and CEO in PSU.

2. Bank Board Bureau :

The Bank Board Bureau will start functioning from the next financial year and is the first step toward a full-fledged bank holding company, an entity that will house the government’s stake in state run banks struggling with mounting non-performing loans that have touched 6 per cent of gross advances. Envisaged as a panel of eminent professionals, the bureau will advise banks and act as a link with the government.

3. Capitalization :

The government will inject a total of Rs 25,000 crore of capital into debt-laden state banks in this fiscal; Rs 20,000 crore would be injected in a month. Over the next four years, the government plans to inject Rs 70,000 crore.

4. De-stressing:

The government will concentrate on distressing the banks’ bad loans, a cell in debt of focus to monitor stressed assets.

5. Empowerment :

More flexibility will be given to state run banks for hiring manpower. Greater autonomy to PSB and Govt is also looking to set up bank holding company.

6. Framework of Accountability:

A new framework of key performance indicators for state-run lenders to boost efficiency in functioning while assuring them of independence in decision making.

7. Governance Reforms:

Performance link incentives will be announced.