On September 20, 2019, Union Minister for Finance & Corporate Affairs Smt Nirmala Sitaraman in a Press Conference in Goa notified that Taxation Laws (Amendment) Ordinance 2019 was introduced to make certain amendments in the Income-tax Act 1961 and the Finance (No. 2) Act 2019. The new tax rate will be applicable from the current fiscal which began on April 1.The features of the ordinance are as follows:

Total revenue foregone

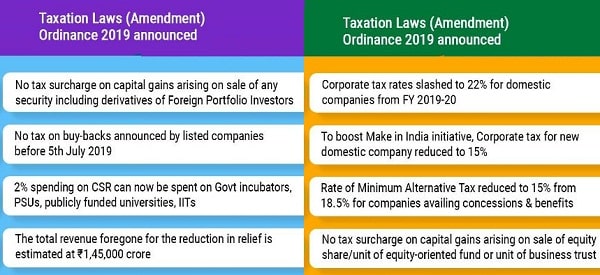

The total revenue foregone for the reduction in corporate tax rate and other relief was estimated at Rs. 1,45,000 crore.

Corporate tax rates slashed to 22% for domestic companies

- A new provision was inserted in the Income-tax Act with effect from FY 2019-20 in order to encourage growth and investments.

- The new provision gives any domestic company an option to pay income-tax at the rate of 22% from earlier 30% subject to the condition that they will not avail any exemption/incentive.

- The effective tax rate will be 25.17% inclusive of surcharge & cess.

- They are not required to pay Minimum Alternate Tax (MAT).

15% income tax rate for new domestic manufacturing companies

- A new provision was inserted in the Income-tax Act with effect from FY 2019-20 to attract fresh investments in manufacturing companies and boost ‘Make-in-India’ initiative.

- Any new domestic company incorporated on or after October 1, 2019 making fresh investment in manufacturing was given an option to pay income-tax at the rate of 15% from earlier 25%.

- It is available to the companies which do not avail any exemption/incentive and commence their production on or before March 31, 2023.

- The effective tax rate for these companies will be 17.01% inclusive of surcharge & cess.

- They are not required to pay Minimum Alternate Tax.

Tax at the pre-amended rate

- A company which does not opt for the concessional tax regime and avails the tax exemption/incentive shall continue to pay tax at the pre-amended rate.

- They can opt for the concessional tax regime after expiry of their tax holiday/exemption period.

- After the exercise of the option they shall be liable to pay tax at the rate of 22% and option once exercised cannot be subsequently withdrawn.

- In order to provide relief to companies which continue to avail exemptions/incentives, the rate of Minimum Alternate Tax was reduced from existing 18.5% to 15%.

Non-applicability of enhanced surcharge on capital gains

- The enhanced surcharge introduced by the Finance (No.2) Act, 2019 will not apply on capital gains arising on sale of equity share in a company or a unit of an equity oriented fund or a unit of a business trust liable for Securities Transaction Tax (STT), in the hands of an individual, Hindu Undivided Family (HUF), Association of Persons (AOP), Body of Individuals (BOI) and Artificial Juridical Person (AJP).

- It shall also not apply to capital gains arising on sale of any security including derivatives, in the hands of Foreign Portfolio Investors (FPIs).

Tax on buy-back of shares

In order to provide relief to listed companies which have already made a public announcement of buy-back before July 5, 2019, tax on buy-back of shares for such companies will not be charged.

Expansion of the scope of CSR 2% spending

- Scope of Corporate social responsibility (CSR) 2% fund has been expanded.

- It can be spent on incubators funded by Central or State Government or any agency or Public Sector Undertaking (PSU) of Central or State Government, and make contributions to public funded Universities, Indian Institutes of Technology (IITs), National Laboratories and Autonomous Bodies (established under the auspices of Indian Council of Agricultural Research (ICAR), Indian Council of Medical Research (ICMR), Council of Scientific & Industrial Research (CSIR), Department of Atomic Energy (DAE), Defence Research and Development Organisation (DRDO), Department of Science & Technology ( DST) , Ministry of Electronics and Information Technology) engaged in conducting research in science, technology, engineering and medicine aimed at promoting Sustainable Development Goals(SDGs).

About Ministry of Finance:

♦ Headquarters: New Delhi

♦ Founded: 29 October 1946