A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/ securities issued by Government or local authority or other marketable securities.

A NBFC does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property.

NBFCs lend and make investments and hence their activities are similar to that of banks; however there are a few differences as given below:

- NBFC cannot accept demand deposits;

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself;

- deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

- It is also known as Non Banking Financial Institution(NBFI).

- They do not have a banking license.

Every NBFC should be registered with RBI under the RBI Act, 1934. The requirements for a company to be registered as NBFC with RBI are:

- It should be a company registered under Section 3 of the companies Act, 1956 and

- The minimum net owned funds of the Company should be Rs. 2 Crore

Some facts related to NBFC:

- The list of registered NBFCs with RBI can be find on RBI site.

- The interest rates charged to the borrowers by NBFCs are not regulated by RBI. NBFC has the right to choose its own interest rates. However, NBFC should provide complete transparency to its customer about the rate of interest charged in the application form.

- All NBFCs are not entitled to accept public deposits. Only those NBFCs to which the Bank had given a specific authorization can accept public deposits.

- The RBI does not guarantee repayment of deposits by NBFCs even though they may be authorized to collect deposits.

- If an NBFC defaults in repayment of deposit, the depositor can approach Company Law Board or Consumer Forum or file a civil suit in a court of law to recover the deposits.

- There is no Ombudsman for hearing complaints against NBFCs.

- However, in respect of credit card operations of an NBFC, which is a subsidiary of a bank, if a complainant does not get satisfactory response from the NBFC within a maximum period of 30 days from the date of lodging the complaint, the customer will have the option to approach the Office of the concerned Banking Ombudsman for redressal of his grievance/s.NBFC categories:

NBFCS are categorised into Asset Finance Company (AFC), Investment Company (IC), Loan Company (LC), Infrastructure Finance Company (IFC), Systemically Important Core Investment Company , Infrastructure Debt Fund: Non- Banking Financial Company (IDF-NBFC), Non-Banking Financial Company – Micro Finance Institution (NBFC-MFI), Mortgage Guarantee Companies (MGC), NBFC- Non-Operative Financial Holding Company (NOFHC).

Residuary Non-Banking Company (RNBC)

A RNBC is a non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner. It is also a non-banking financial company. The functioning of these companies is different from those of NBFCs in terms of method of deposits.

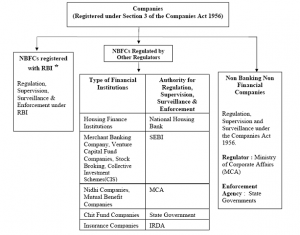

The following chart gives the overview of regulators of different types of Non-Banking Companies: