Money laundering is an act of converting illegal money to legal money. By illegal money we mean the money which has come from illegal sources of earning money like smuggling, any terrorist activity, drug trade, etc.

A person who is found having money from illegal sources can be made to go to prison, or any other liable punishment. So the persons or rather criminals try to convert their illegal money to legal money so that their money appears clean which is known as money laundering.

The banks have also been directed to look into this matter like if they find any suspicious activity in an account or there is huge transaction of money from an account, etc.

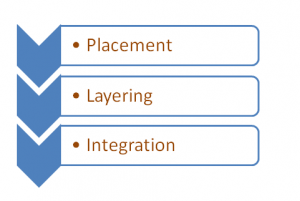

There are three stages in which money laundering is done which we will discuss later.

Before that some of the methods of converting illegal money to legal money as the criminals follow include

- doing investments in property or any business,

- multiple transfers of money in various bank accounts or from one place to another,

- used for purchasing foreign currency and then back to own currency,

- repayment of loans and credit cards,

- through political parties, corporate companies and the shares market, etc.

The three stages of money laundering are:

- Placement Stage: As the name suggests, the first stage is pacing the money into the system by the methods provided above. Placing money in bank accounts, smuggling money to abroad, etc.

- Layering Stage: The main aim of this stage is to separate the illegal company from its source. In this stage the money placed in transferred to other accounts. The money is then distributed among various investments, like some in a business, some in charity, investments in share markets, etc.

- Integration Stage: Integration means joining. So in last stage of money laundering, the whole illegal money which was divided at various places in layering stage starts getting integrated into a single account so that the money now appears to have come from legal sources i.e. from businesses in the country, from share markets, any profits, etc.

If the money reaches the last stage, it appears to have come from legal sources and does not draw any attention of being illegal money.

To study the issue, in 2002, an act was passed by the Parliament of India called the Prevention of Money laundering Act 2002.

According to Section 3 of the act: “Whosoever directly or indirectly attempts to indulge or knowingly assists or is involved in any process or activity connected with the proceeds of crime and is projecting it as the untainted property shall be guilty of the offence of money laundering”.

A step to prevent money laundering is Know Your Customer (KYC) policy. The KYC helps to ensure that banks’ services are not misused.

Some of the methods of Money Laundering:

- Smurfing- Cash broken into smaller deposits of money, to defeat suspicion of money laundering and to avoid anti-money laundering reporting requirements.

- Trade-based laundering: it is a complex form of money laundering. It involves under- or over-valuing invoices to disguise the movement of money.

- Shell companies and trusts: Trusts and shell companies disguise the true owners of money.

- Black salaries: Company having unregistered employees without written contracts. They pay them cash salaries with illegal money.

- Other ways: Other methods of money laundering include Smuggling, Casinos, gambling etc.