Three Indian Banks namely, the State Bank of India (SBI), HDFC Bank and ICICI Bank are featured in the list of top 50 largest banks in Asia-Pacific Region by Assets – 2024 released by The S&P Global Market Intelligence.

Three Indian Banks namely, the State Bank of India (SBI), HDFC Bank and ICICI Bank are featured in the list of top 50 largest banks in Asia-Pacific Region by Assets – 2024 released by The S&P Global Market Intelligence.

- The cumulative asset of these 3 Indian Banks surged exponentially by 50.5% year-on-year(y-o-y) basis to USD1.51 trillion in 2023.

- China’s Industrial and Commercial Bank of China limited retained its position as the largest bank in Asia pacific as well as in world in 2023.

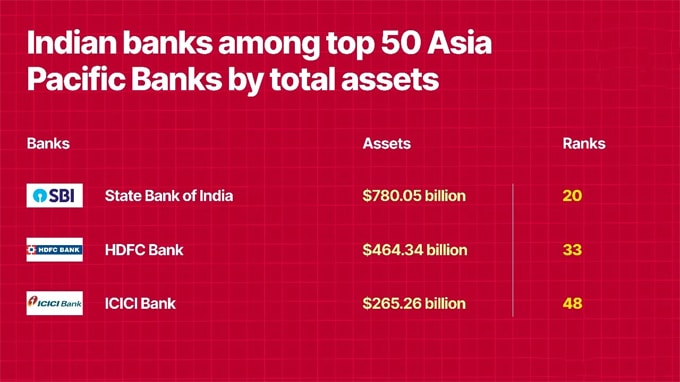

Ranking of Indian Banks on the list:

| Rank | Name of the Bank | Headquarter |

|---|---|---|

| 20 | SBI | Mumbai, Maharashtra |

| 33 | HDFC Bank | Mumbai, Maharashtra |

| 48 | ICICI Bank | Mumbai, Maharashtra |

Top 4 banks by Assets in Asia-Pacific region in 2023:

| Rank | Name of the Bank | Headquarter |

|---|---|---|

| 1 | Industrial and Commercial Bank of China | Beijing, China |

| 2 | Agricultural Bank of China | Beijing, China |

| 3 | China Construction Bank Corporation | Beijing, China |

| 4 | Bank of China Limited | Beijing, China |

Points to note:

i.SBI, India’s largest Public Sector Bank(PSB), has improved its ranking to 20th in 2023 from 21 in 2022. SBI’s assets valuation stands at USD 780.05 billion in 2023.

ii.HDFC Bank’s valuation increased to USD 464.34 billion in 2023, over 51% higher than its value in 2022. HDFC bank has jumped from 46th rank in 2022 to 33rd rank in 2023.

- The value of HDFC bank increased due to its merger with its parent organisation Housing Development Finance Corporation(HDFC) Limited in July 2022.

iii.ICICI Bank, 2nd largest private sector bank in India, has made its debut in the top 50 Asia-Pacific lender list in 2023. It is currently ranked 48th position. iv.The report outlined various factors which contributed towards the growth of Indian bank’s assets in recent year are: improvement in financial metrics, coupled with high credit growth in a robust economic environment.

iv.The report outlined various factors which contributed towards the growth of Indian bank’s assets in recent year are: improvement in financial metrics, coupled with high credit growth in a robust economic environment.

v.The size of Indian lenders remained far below Chinese and Japanese Banks i.e. total assets of Industrial and Commercial Bank of China is USD6.30 trillion(2023), which is more than 8 times of Indian PSB, SBI.

vi.The report quoted Reserve Bank of India(RBI) data which mentioned that India, world’s fastest-growing economy growth rate stood at 15.6%(as of 29th December, 2023).

Key Points:

i.Mainland China-based Banks retained its position among the top banks in Asia-Pacific region. 6 banks of out of the top 10 banks in the list are based in China.

- The combined total assets of top 4 performing banks of China grew 10.2% year-on-year(y-o-y) to USD21.91 trillion in 2023, with agricultural bank showed maximum growth at 14.3%.

ii.Lenders based in Japan and South Korea witnessed the biggest declines in their annual ranking.

- The combined assets of Japanese banks decreased 2.5%(y-o-y) in 2023 to USD10.53 trillion whereas South Korean banks had a 0.9% (y-o-y) decline to USD2.66 trillion.

iii.The combined assets of 3 Singaporean banks increased to 3.7% (y-o-y) to USD1.40 trillion.

- The ranking of DBS Group Holdings Limited and United Overseas Bank Limited improved, while Oversea-Chinese Banking Corporation Limited ranking fell from three places to 37.

About S&P Global Inc.:

President and Chief Executive Officer(CEO): Douglas L. Peterson

Headquarters: New York, U.S.A

Established: 1917