In October 2025, the Reserve Bank of India (RBI) published the second edition of the half-yearly Payment Systems Report for June 2025, confirming significant and sustained growth in India’s digital ecosystem.

- This report presents a comprehensive analysis of various payment systems operated by the RBI, the National Payments Corporation of India (NPCI), banks and other Payment System Operators (PSOs).

Exam Hints:

- What? RBI Payment System Report 2025

- Growth: Digital payments – 99.7% in volume, 95.7% in value in 2024;

- Payment Modes: UPI – 85% volume terms, 9% value terms; RTGS – 69% value terms, 0.1% – volume terms; Cards – 111.64 cr; PPIs – 698.9 cr in CY 2024; BBPS – 217.5 cr in CY2024; IMPS – 593.8 cr in CY 2024; NEFT – 926.8 cr

- G-sec: Rs. 1,812 lakh cr in CY 2024

- Remittances: Inward: USD 137.7 bn, Outward: USD 98.4 bn

- Cost of Remittance: 6.62% in Q3

Digital Payment Boom

Growth: In the past 10 years, the digital transactions have increased 38 times in volume terms and more than three times in value terms.

- The digital payments made up 99.7% transactions in volume and 95.7% in terms of value in 2024.

- During the first half (H1) of 2025, the total transaction volume touched 12,549 crore (cr), amounting to Rs. 1,572 lakh cr and digital payments comprising 99.8% of volume and 97.7% of value.

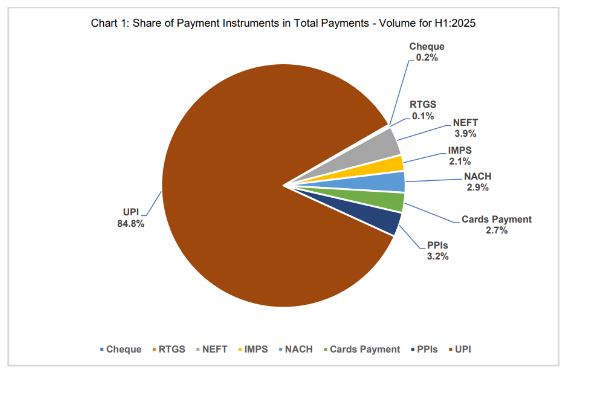

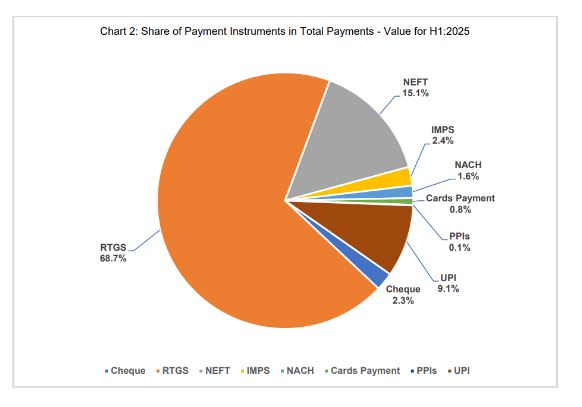

Payment Modes: Unified Payment Interface (UPI) remained the most preferred payment mode, contributing 85% of total transaction volume, though only 9% in value.

- In H1 of 2025, the volume of UPI transactions stood at 10,637 crore amounting to Rs. 143.3 lakh cr in value.

- While, the Real Time Gross Settlement (RTGS) system recorded the largest share of 69% in terms of value but accounted for the lowest share of 0.1% in terms of volume.

Other Payment Modes: As of June 2025, there were 111.64 crore outstanding cards in India, including 11.12 crore credit cards and 100.52 crore debit cards.

- The Prepaid Payment Instruments (PPIs) transaction volume rose from 516.2 crore in Calendar Year (CY) 2019 to 698.9 crore in CY 2024, transaction value remained almost at the same level of Rs. 2.23 lakh cr.0

- The growth of Bharat Bill Payment System (BBPS) has been remarkable, with transaction volume rising from 12.6 cr in CY 2019 to 217.5 cr in CY 2024.

- Immediate Payment Services (IMPS) transactions have shown significant growth, with volume doubling from 238.3 cr in CY 2019 to 593.8 cr in CY 2024.

- During the period CY 2019 to CY 2024, National Electronic Funds Transfer (NEFT) transactions more than tripled in terms of volume, from 262.2 cr to 926.8 cr, while in terms of value it is has almost doubled.

Government Securities (G-Sec)

Twofold growth: The G-Sec market has experienced notable expansion from a value of Rs. 769 lakh cr in CY 2019 to Rs. 1,812 lakh cr by CY 2024.

- Transaction volume also increased from 13.76 lakh in 2019 to 17.6 lakh in 2024.

Remittances

Inward and Outward Remittance: India remains the top recipient of global foreign remittances, with a record USD 137.7 bn inflow in 2024, more than double that of Mexico, the second-highest recipient with USD 67.6 bn.

- The United States of America (USA) consistently leads global remittance outflows, sending USD 98.4 bn in 2024.

Cost of Remittance: Global average cost of remittance marginally decreased from 6.65 % in Q2 (Quarter 2: July-September) 2024 to 6.62% in Q3 (Quarter 3: October-December) 2024.

- The United Nation (UN) Sustainable Development Goals (SDG) and the G20 have indicated a target of 3% for the global average remittance cost to be reached by 2030.