On April 21,2025, the Reserve Bank of India (RBI) has announced amendments to the existing Liquidity Coverage Ratio (LCR) framework.

On April 21,2025, the Reserve Bank of India (RBI) has announced amendments to the existing Liquidity Coverage Ratio (LCR) framework.

- These amendments shall be applicable to all Commercial Banks (excluding Payments Banks, Regional Rural Banks and Local Area Banks).

- To give the banks adequate time to transition their systems to the new standards for LCR computation, the revised instructions shall become applicable w.e.f. (with effective from) April 01, 2026.

About LCR:

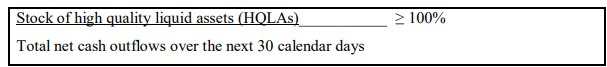

i.The LCR promotes short-term resilience of banks to potential liquidity disruptions by ensuring that they have sufficient high quality liquid assets (HQLAs) to survive an acute stress scenario lasting for 30 days. ii.The banks should maintain a LCR of at least 100% at any point of time.

ii.The banks should maintain a LCR of at least 100% at any point of time.

RBI mandates 2.5% additional run-off factor:

i.The following amendment has been made by the RBI:

- A bank shall assign an additional 2.5 per cent run-off factor for retail deposits which are enabled with internet and mobile banking facilities (IMB).

- Therefore, the stable retail deposits enabled with IMB shall have 7.5 per cent run-off factor and less stable deposits enabled with IMB shall have 12.5 per cent run-off factor (as against 5 and 10 per cent respectively, prescribed currently).

Other Amendments made by the RBI:

i.Level 1 HQLA in the form of Government securities shall be valued at an amount not greater than their current market value.

ii.Funds received from non-financial groups—such as trusts, partnerships, proprietorships, and similar entities—will now be categorized as funding from ‘non-financial corporates’ and will attract a lower run-off rate of 40% instead of the current 100%, unless these groups are considered Small Business Customers (SBC) under the LCR rules.

Important Terms:

i.High Quality Liquid Assets: Liquid assets comprise of high quality assets that can be readily sold or used as collateral to obtain funds in a range of stress scenarios.

ii.Run-off Factor: The run-off factor estimates how much of a bank’s liabilities (like deposits or borrowed funds) are expected to be withdrawn or “run off” during a period of financial stress, usually over 30 days.

- If a deposit has a run-off rate of 40%, it means that 40% of that deposit is expected to be withdrawn in a stress scenario, and the bank must hold enough high-quality liquid assets (HQLA) to cover that.