Prime Minister Narendra Modi introduced Pradhan Mantri Sukanya Samridhi Yojana on 22nd January 2015. It was a part of the BBBP yojana.

BBBP – Beti Padao Beti Bachao

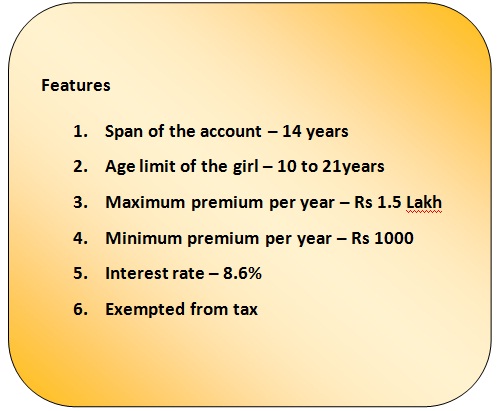

Key Features of the scheme

Features – Related to the opener

- A parent or guardian can open a bank savings account in the name of a girl child.

- The scheme also allows the parents to open only 2 accounts. One in case of twins and the other is the case of 2 girl children.

- Also, he or she should be the legal guardian.

Who is a legal Guardian

A legal guardian is the prime care taker of a child. He or she is appointed by the biological parents of the child or by the court.

Features – Age limits

- Age of the girl at the time of opening the account should not exceed 10 years.

- The girl child can withdraw half of this savings at her age of 18 years. However, at this time she can only withdra 50% of the amount for her higher studies.

- At her 21 years of age, the girl can claim her entire mature amount for her marriage.

Features – Account

- The span of the account is for 14 years

- The maximum credit limit for a year is Rs 1.5 lakh and that of the minimum is Rs 1000 per year.

- The investment made under the scheme is exempt from the income tax act of 80C.

- The interest rates of the Yojana is decided by the Government every year. And every year the interest rates might tend to change. The interest rate of the scheme for this current year is 8.6%

Closure of the account

- When the girl child dies, the account is closed. And the standing amount is given to the parents.

- When the girl child is married before 21 years then the account becomes non – operative.

- If the parents or the guardian fail to pay a year’s premium, the account automatically goes into closure mode.

Residence – The girl child has to be an Indian residence.

Account Transferability – The account can be transferred from the original location to anywhere in India. And also, the scheme provides electronic transferability.

Analysis of Pradhan Mantri Sukanya Samridhi account

How different from general savings account

Some private banks like HDFC that recently launched Kid’s advantage account allow to open minor accounts only if either of the parent has an account ith the bank. This is not the case with the yojana.

Advanageous factors

There is no minimum capital requirement as it is needed for the other minor accounts. For example, the ICICI young star and smart star accounts demand an average monthly balance of Rs 2500.

Low interest rates

The initial interest rates of the scheme was 9.2%. However it as brought don to 8.6% during the budget of 2016 – 17. Though it was brought don, it is still hisgher than the other privatised schemes launched by the others.

Quiz on PMSSY – Test Yourself

- when was the scheme launched?

- What ere the initial interest rates of the schmeme?

- Is it a part of Beti Bachao Beti Padao campaign?

- When can a girl child use this amount?

- Can a NRI open this account?

- What is the maximum and minimum amounts of deposit under the scheme?

References

- http://www.news18.com/news/india/pm-modi-launches-sukanya-samridhi-yojna-under-beti-bachao-campaign-737270.html

- http://www.thehindu.com/news/cities/Vijayawada/sukanya-samriddhi-yojana-evokes-good-response/article6993204.ece