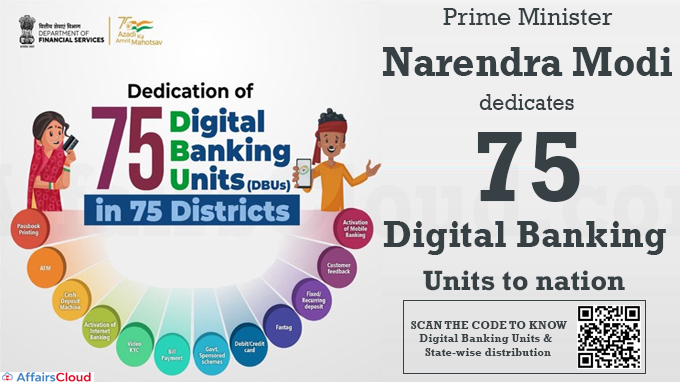

On October 16, 2022, the Prime Minister (PM) of India Narendra Modi dedicated 75 Digital Banking Units (DBUs) across 75 districts to the nation via video conferencing to ensure the benefits of digital banking reach every corner of India.

On October 16, 2022, the Prime Minister (PM) of India Narendra Modi dedicated 75 Digital Banking Units (DBUs) across 75 districts to the nation via video conferencing to ensure the benefits of digital banking reach every corner of India.

- These DBUs were announced during the FY23 budget by Finance Minister Nirmala Sitharaman to commemorate 75 years of India’s Independence.

- Setting up of DBUs is a joint initiative of the Central Government, the Reserve Bank of India (RBI), the Indian Banks Association (IBA) and the participating Commercial banks (other than regional rural banks, payment banks and local area banks) with past digital banking experience are permitted to open DBUs in tier 1 to tier 6 centres.

DBU- Definition:

It is a specialized fixed point business unit or hub with certain minimum digital infrastructure for delivering digital banking products and services as well as servicing existing financial products and services digitally in self-service mode at any time.

- The services include saving bank accounts under various schemes, current accounts, fixed deposit (FD) and recurring deposit (RD) accounts, digital kits for customers, mobile banking, Internet banking, debit cards, credit cards, and mass transit system cards, digital kits for merchants, UPI (Unified Payments Interface) QR (Quick Response) codes, BHIM Aadhaar and point of sale (PoS).

Key Points:

i.11 Public Sector Banks (PSBs), 12 private banks, and one small finance bank are participating in the DBU initiative.

ii.The virtual launch was also attended by the Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das from Washington, United States (US). They were in US for G20 (Group of Twenty) finance ministers and central bank governors meeting

iii.During the conference, banks were urged to set targets so as to bring as many people as possible into the digital banking fold.

iv.Every bank branch should try to bring at least 100 businessmen in their region under 100% digital banking.

v.Establishment of these DBUs will boost the digital infrastructure as this will act as an enabler and facilitate customer experience through seamless banking transactions,

vi.DBUs will also promote financial inclusion by providing 24x7financial services in a paperless efficient safe and secure environment.

Recent Related News:

i.Alappuzha has become the 5th fully Digital Banking District in Kerala. This declaration was made by Thomas Mathew, Regional Director (Kerala and Lakshadweep), Reserve Bank of India (RBI).

ii.In July 2022, NITI Aayog released its report on digital banks, titled ‘Digital Banks: A proposal for Licensing and Regulatory Regime for India’ offering a template and roadmap for licensing and regulatory regime for India. It focuses on avoiding any regulatory or policy arbitrage and offers a level playing field to incumbents as well as competitors.

About Indian Banks Association (IBA):

Chief Executive Officer (CEO)– Sunil Mehta

Headquarters– Mumbai, Maharashtra