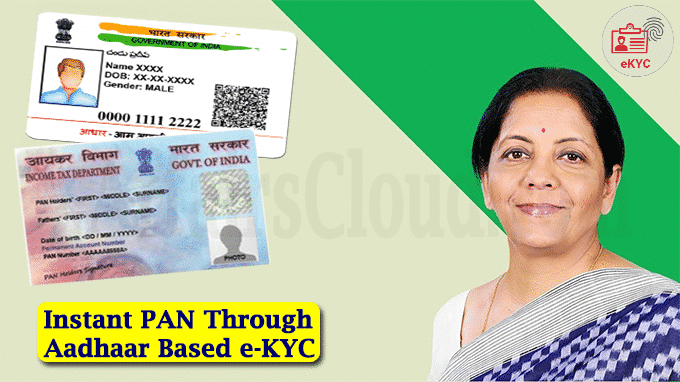

On May 28, 2020, Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman launched the Instant Permanent Account Number (PAN) facility of Income Tax (IT) Department through Aadhaar based e-KYC (Electronic Know your Customer) to further ease the process for the taxpayers in New Delhi. This launch has been made on the lines of the para 129 of the FY20-21 Budget stating a simplified allotment process of PAN.

On May 28, 2020, Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman launched the Instant Permanent Account Number (PAN) facility of Income Tax (IT) Department through Aadhaar based e-KYC (Electronic Know your Customer) to further ease the process for the taxpayers in New Delhi. This launch has been made on the lines of the para 129 of the FY20-21 Budget stating a simplified allotment process of PAN.

- However, its Beta version on trial basis was started on 12th Feb 2020 on the e-filing website of Income Tax Department. Since then 6,77,680 instant PANs have been allotted with a turnaround time of about 10 minutes, till 25th May 2020.

- The launch was made in presence of Minister of State (MoS) for Finance and Corporate Affairs Anurag Singh Thakur, Finance Secretary Dr. Ajay Bhushan Pandey and Central Board of Direct Taxes (CBDT) Chairman Pramod Chandra Mody.

What is an instant PAN facility?

It is a system under which PAN will be instantly allotted online for those who possess a valid Aadhaar number. The allotment process is paperless and an electronic PAN (e-PAN) is issued to the applicants free of cost.

How to apply for e-PAN.

- One needs to access the e-filing website of the Income Tax Department to provide her/his valid Aadhaar number and then submit the OTP received on her/his Aadhaar registered mobile number.

- On successful completion of this process, a 15-digit acknowledgement number is generated and after allotment, one can download the e-PAN.

- The e-PAN is also sent to the applicant on her/his email id if it is registered with Aadhaar.

About PAN:

PAN is a 10-digit alphanumeric number. It is an identification number assigned to all taxpayers in India. All tax related information for a person/company is recorded against a single PAN number. Hence no two tax paying entities can have the same PAN. It is issued by the Income tax department.