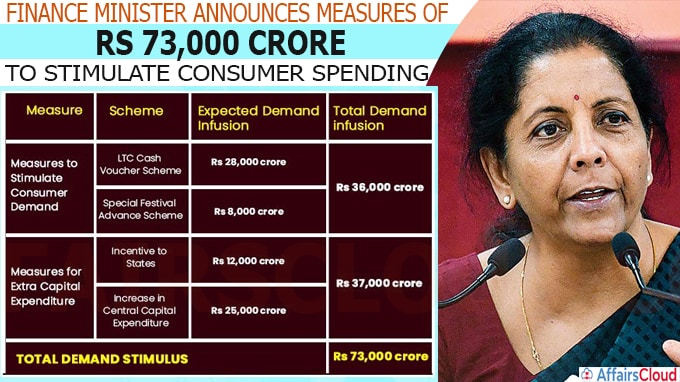

On October 12, 2020, Union Minister for Finance & Corporate Affairs Nirmala Sitharaman announced measures of Rs 73,000 crore to stimulate consumer spending before the end of this Financial Year (FY21) to fight the COVID-19 lockdown induced slowdown, during a press conference in New Delhi. The allocation was made under the two heads- Consumer Spending and Capital Expenditure which is detailed as below:

On October 12, 2020, Union Minister for Finance & Corporate Affairs Nirmala Sitharaman announced measures of Rs 73,000 crore to stimulate consumer spending before the end of this Financial Year (FY21) to fight the COVID-19 lockdown induced slowdown, during a press conference in New Delhi. The allocation was made under the two heads- Consumer Spending and Capital Expenditure which is detailed as below:

Consumer Spending

Leave Travel Concession (LTC) Cash Voucher Scheme

Under this government employees can avail cash voucher for Leave Travel Concession (LTC) if they can’t travel due to pandemic in a four-year block ending in 2021 i.e. 2018-2021.

- If employees opt for it, cost will be around Rs. 5,675 crore.

- Employees of Public Sector Banks (PSBs) and Public Sector Undertakings (PSUs) will also be allowed this facility and the estimated cost for them will be Rs. 1,900 crore.

- With this, an estimated Rs. 19,000 crore demand infusion will be created.

What is LTC?

Central Government employees get LTC in a block of 4 years in which air or rail fare, as per pay scale/entitlement, is reimbursed and in addition, Leave encashment of 10 days is paid. But due to COVID-19, employees are not in a position to avail of LTC in the current block of 2018-21.

Therefore, the Government has decided to give cash payment in lieu of one LTC during 2018-21, in which:

- Full payment on Leave encashment and

- Payment of fare in 3 flat-rate slabs depending on class of entitlement

- Fare payment will be tax free

Conditions on Opting this scheme

An employee, opting for this scheme, will be required to buy goods / services worth 3 times the fare and 1 time the leave encashment before 31st March 2021.

The scheme also requires that money must be spent on goods attracting GST of 12% or more from a GST registered vendor through digital mode.

Special Festival Advance Scheme (SFAS)

This scheme enables all Central Government employees (gazette & non- gazette) to get an interest-free advance of Rs. 10,000 to be spent by 31st March, 2021 on the choice of festival of the employee. The interest-free advance is recoverable from the employee in maximum 10 instalments.

- In this regard, employees will get a pre-loaded RuPay Card of the advance value. The Government will bear Bank charges of the card

The one-time disbursement of SFAS is expected to amount to Rs. 4,000 crore

Capital Expenditure

Special Assistance to the states

Under this, the Central Government is issuing a special interest-free 50-year loan to States of Rs. 12,000 crore Capital Expenditure (CAPEX) which can be used for new or ongoing capital projects needing funds and / or settling contractors’/ suppliers’ bills on such projects. It is to be spent by March 31 2021. The Scheme consists of 3 Parts.

Part – 1 of the scheme provides for:

Rs. 200 crore each for 8 North East states (Rs. 1,600 crore)

Rs. 450 crore each Uttarakhand, Himachal Pradesh (Rs. 900 crore)

Part – 2 of the scheme provides for:

Rs. 7,500 crore for remaining states, as per 15th Finance Commission devolution.

Both Part 1 and Part 2 of interest-free loans given to States are to be spent by 31st March, 2021.

Part – 3 of the scheme i.e. Rs. 2,000 crore will be given to those states which fulfill at least 3 out of 4 reforms spelled out in Aatma Nirbhar Bharat Package (ANBP). This is over and above other borrowing ceilings.

Enhanced Budget Provisions:

An additional budget of Rs. 25,000 crore, in addition to Rs. 4.13 lakh crore given in Union Budget 2020, is being provided for CAPEX on roads, defence, water supply, urban development and domestically produced capital equipment.

Other Participants: Union Minister of State (MoS) for Finance & Corporate Affairs Anurag Singh Thakur, Finance Secretary Dr Ajay Bhushan Pandey, Department of Financial Services Secretary Shri Debashish Panda and Department of Economic Affairs Secretary Shri Tarun Bajaj.

Recent Related News:

i.On September 9, 2020, Nirmala Sitharaman virtually inaugurated Doorstep Banking Services by Public Sector Banks (PSBs) and participated in the online awards ceremony to felicitate best performing banks on EASE Banking Reforms Index for FY19-20.

ii.On September 5, 2020, Nirmala Sitharaman virtually announced the 4th edition of State Business Reform Action Plan (BRAP) Ranking for 2018-19 which was released by Department of Industrial Promotion and Internal Trade (DPIIT). In accordance with that, Andhra Pradesh (AP) topped the Ease of Doing Business (EODB) ranking 2019, followed by Uttar Pradesh (UP) and Telangana at 2nd & 3rd place respectively.