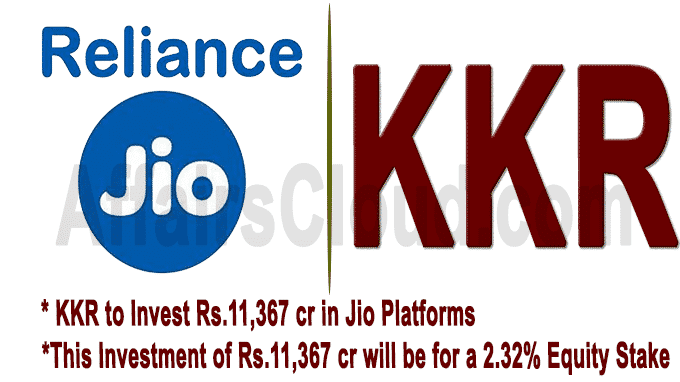

On May 22, 2020, Reliance Industries Limited(RIL) announced the sale of a 2.32 % stake in its digital unit, Jio Platforms to US private equity giant KKR for Rs 11,367 crores, which is the 5th deal of Jio since 22 April that will inject Rs 78,562 crores in RIL to cut debt.

On May 22, 2020, Reliance Industries Limited(RIL) announced the sale of a 2.32 % stake in its digital unit, Jio Platforms to US private equity giant KKR for Rs 11,367 crores, which is the 5th deal of Jio since 22 April that will inject Rs 78,562 crores in RIL to cut debt.

Major Highlights

i.After this transaction, Jio Platforms will have an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore.

ii.This is KKR”s largest investment in Asia & it will translate into a 2.32% equity stake in Jio Platforms on a fully diluted basis.

iii.As part of its plans to be debt-free, RIL is also raising Rs 53,215 crore by a rights issue.

Previous deals by Jio

| Date | Name of the Company | Stake % | Amount in crores |

| April 22 | 9.99% | Rs 43,574 | |

| May 4 | Silver Lake | 1.15% | Rs 5,665.75 |

| May 8 | Vista Equity Partners | 2.32% | Rs 11,367 |

| May 17 | General Atlantic | 1.34% | Rs 6,598.38 |

KKR

i.Since its inception in 1976, the firm invested over USD 30 billion (total enterprise value) in tech companies, and its technology portfolio currently has more than 20 companies across the technology, media and telecom sectors.

ii.It has a history of building leading global enterprises and successfully investing in businesses in the technology sector, including BMC Software, ByteDance and GoJek, through its private equity and technology growth funds. India has been a key strategic market for KKR with a history of investing in the country since 2006.

Managing Director(MD), Private Equity, Mumbai- Rupen Jhaveri

Co-Chairman and Co-CEO– George Roberts

About RIL:

Corporate Office– Mumbai, Maharashtra

Chairman & MD– Mukesh D. Ambani