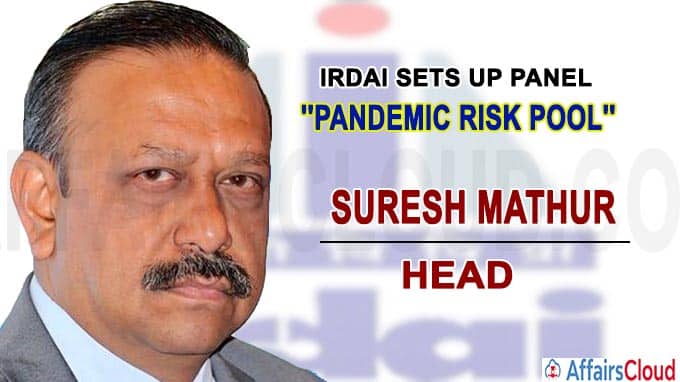

On July 08, 2020, With the Coronavirus (COVID-19) pandemic causing massive disruption across various sectors, the Insurance Regulatory and Development Authority of India (IRDAI) has formed a 9- member working group under the chairmanship of Suresh Mathur, Executive Director of Irdai to look into the possibility of setting up ‘Pandemic Risk Pool’ to deal with the various risks arising out of a pandemic -like health emergencies & recommend the structure and operating model for the Pool within 8 weeks.

On July 08, 2020, With the Coronavirus (COVID-19) pandemic causing massive disruption across various sectors, the Insurance Regulatory and Development Authority of India (IRDAI) has formed a 9- member working group under the chairmanship of Suresh Mathur, Executive Director of Irdai to look into the possibility of setting up ‘Pandemic Risk Pool’ to deal with the various risks arising out of a pandemic -like health emergencies & recommend the structure and operating model for the Pool within 8 weeks.

- It is to be noted that Risk pools are set up usually only for events that are deemed beyond the capacity of insurers and governments to handle. India has formed risk pools for nuclear disaster (Rs 1,500 crore) and terrorism (Rs 1,200 crore) so far.

Key Points:

i.As per IRDAI, the risk pool will provide protection for some of the risks like Business Interruption (BI) losses without concurrent material damage, loss of employment .

ii.At present, insurers and reinsurers globally don’t provide any covers to compensate any losses out of a Pandemic event as it does not involve damage to property. However, Covid-19 has generated various kinds of massive business losses that led businesses, insurers to discussions on the feasibility of such a product.

Composition of the panel:

Some of the other members of the abovesaid panel are-. Suchita Gupta, general manager, GIC RE; Hitesh Kotak, Chief Executive Officer,Munich Re India Branch; Ankur Nijhawan,Chief Executive Officer,AXA India Reinsurance Branch; Susilendra Rao, Chief Manager United India Insurance; Anita Yadav, VP Bajaj Allianz General Insurance; Shri M.N.Munshi, Assistant General Manager, Health Department, IRDAI; Shri. Ajay KumarAssistant General Manager (OSD)Non-Life Department, IRDAI; Smt. Saba TalukdarManager (OSD)Re-insurance Department, IRDAI.

About Insurance Regulatory and Development Authority of India (IRDAI):

Location– Hyderabad, Telangana

Chairman– Subhash Chandra Khuntia