Union Finance Minister Piyush Goyal presented an Interim Budget for 2019 in Parliament on February 1 2019. An Interim Budget usually doesn’t list out new schemes or doesn’t unveil any policy measures. The government will present the vote on account for the next four-to-five months. A full-fledged Budget will be presented after the House reassembles after the general election.

India to become a USD 5-trillion economy in the next five years and aspires to become a USD 10-trillion economy in the next 8 years

India to become a USD 5-trillion economy in the next five years and aspires to become a USD 10-trillion economy in the next 8 years

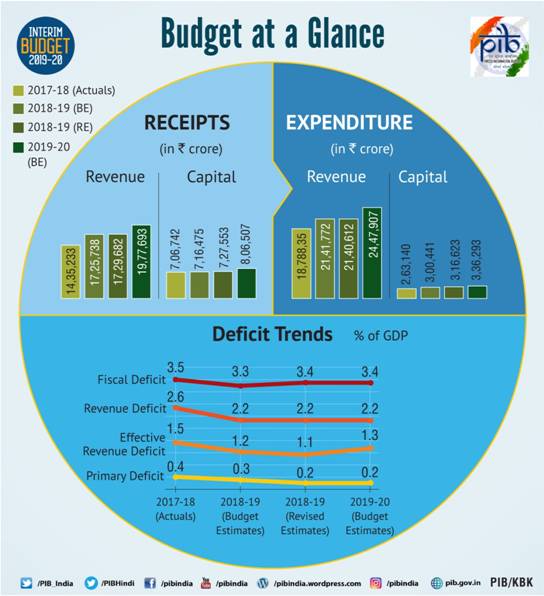

- Fiscal deficit for 2018/19 seen at 3.4% of GDP

- FY20 total expenditure seen at ₹27.84 trillion rupees

- FY20 capital expenditure seen at ₹3,36,292 crore

- Central schemes to get ₹3,27,679 crore FY20

- Recovered ₹3 lakh crore via bankruptcy code

- Current account deficit for 2018/19 seen at 2.5% of GDP

- Bank of India, Bank of Maharashtra and Oriental Bank no more under RBI’s prompt corrective action

Direct Tax proposals

- No income tax for earnings up to ₹5 lakh

- Individuals with gross income of up to ₹6.5 lakh need not pay any tax if they make investments in provident funds and prescribed equities.

- More than Rs. 23,000 crore tax relief to 3 crore middle class taxpayers

- Standard tax deduction for salaried persons raised from ₹40,000 to ₹50,000

- Tax Deducted at Source(TDS) threshold to be raised from Rs. 10,000 to Rs. 40,000 on interest earned on bank/post office deposits

- I-T processing of returns to be done in 24 hours

- Within the next 2 years, all verification of tax returns to be done electronically without any interface with the taxpayer

- Existing rates of income tax to continue

- Tax exempted on notional rent on a second self-occupied house

- Housing and real estate sector to get boost-

- TDS threshold on rental income increased from ₹1.8 lakh to ₹2.4 lakh.

- Benefit of rollover of capital gains increased from investment in one residential house to two residential houses for capital gains up to Rs. 2 crores.

- Tax benefits for affordable housing extended till 31st March, 2020 under Section 80-IBA of Income Tax Act

- Tax exemption period on notional rent, on unsold inventories, extended from one year to two years

Direct tax collections from 6.38 lakh crore rupees in 2013-14 to almost 12 lakh crore rupees; tax base up from Rs 3.79 crore to Rs 6.85 crore. 99.54% returns have been accepted without any scrutiny. In January 2019, GST collections has crossed 1 lakh crore rupees.

Farmers

- Under Pradhan Mantri Kisan Samman Nidhi(PM-KISAN), 6000 rupees per year for each farmer, in three installments, to be transferred directly to farmers’ bank accounts, for farmers with less than 2 hectares land holding.

- This initiative is likely to benefit 12 crore small and marginal farmers, at an estimated cost of Rs 75,000 crore for FY 2019-20 with additional Rs. 20,000 crores in RE 2018-19.

- Outlay for Rashtriya Gokul mission increased to Rs 750 crore.

- Rashtriya Kamdhenu Ayog to be setup for sustainable genetic up-gradation of the Cow resources.

- New separate Department of Fisheries for welfare of 1.5 crore fishermen.

- 2% interest subvention to Farmers for Animal husbandry and Fisheries activities; additional 3% in case of timely repayment.

- Interest subvention of 2% during disaster will now be provided for the entire period of reschedulement of loan.

- Decision taken to increase MSP (minimum support price) by 1.5 times the production cost for all 22 crops.

Labour

- Pradhan Mantri Shram Yogi Mandhan scheme to provide assured monthly pension of 3000 rupees per month, with contribution of only Rs 100/55 per month, for workers in unorganised sector after 60 years of age.

- This will benefit 10 crore workers in unorganized sector & become the world’s biggest pension scheme for unorganized sector in five years.

- New Pension Scheme (NPS) had been increased 10% to 14% with effect from April 1, 2019.

- Gratuity limit payment increased from Rs. 10 lakhs to Rs. 20 lakhs

- ESI Cover limit increased to ₹ 21,000. Minimum pension also increased to ₹ 1000.

Health

- 22nd AIIMS to be setup in Haryana

- National Health Mission budget estimates were hiked from Rs 30,634 crore to Rs 32,251 crore from the previous fiscal.

North East

- Allocation to be increased by 21% to Rs. 58,166 crores in 2019-20 BE(Budget Estimates) over 2018-19 BE

- Arunachal Pradesh came on the air map recently

- Meghalaya, Tripura and Mizoram came on India’s rail map for the first time

- Container cargo movement through improved navigation capacity of the Brahmaputra

Defence

- Defence budget hiked to over Rs 3 lakh crore for first time ever

Railways

- Capital support of Rs.64,587 crore proposed in 2019-20 (BE) from the budget

- Overall capital expenditure programme to be of Rs. 1,58,658 crores

- Operating Ratio expected to improve from 98.4% in 2017-18

- to 96.2% in 2018-19 (RE) and to 95% in 2019- 20 (BE)

- Safest year’ for railways in its history

- All Unmanned Level Crossings on broad gauge network eliminated.

- Semi high-speed “Vande Bharat Express” introduced – first indigenously developed and manufactured.

Major Fund Allocations

- Rural Development: increased by 4.6 per cent to Rs 1.18-lakh crore for the next financial year as compared to Rs 1.12-lakh crore in the current fiscal.

- 60, 000 crore allocation for MGNREGA in 2019-20 BE(Budget Estimates).

- For fiscal year 2018-19, NREGS was allocated Rs 55,000 crore.

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) promises unskilled manual work to every adult for at least 100 days in rural parts of the country. It was introduced in 2005.

- PMAY-G, the allocation is less at Rs 19,000 crorefrom Rs 21,000 crore in 2018-19.

- PMGSY stands at Rs 19,000 crore for 2019-20, same as in 2018-19.

- Rs 93,847.64 crore allocated for education sector for 2019-20, an increase of over 10 per cent from Rs 85,010 crore 2018-19

- Rs 37,461.01 crore has been allocated for higher education, Rs 56,386.63 crore has been earmarked for school education.

- Job and Skill Development from Rs 5,071 crore to Rs 7,511 crore 2019-20.

- Urban Rejuvenation Mission AMRUT and Smart Cities Mission: BE were increased from Rs 12,169 to Rs 13,900 crore for the 2019-20 fiscal year.

- Food subsidy to Food Corporation of India under National Food Security Act: increased from Rs 1,38,123 crore to Rs 1,51,000 crore.

- Space Technology: increased from Rs 6,576 crore to Rs 7,483 crore.

- National Highways Authority of India: increased from Rs 29,663 crore to Rs 36,691 crore.

- Direct Benefit Transfer: increased from Rs 16,478 crore to Rs 29,500 crore.

- Urea subsidiary: raised from Rs 45,000 crore to Rs 50, 164 crores.

- Sports Budget: increased from Rs 2002.72 (2018-2019) crore to Rs 2216.92 crore.

- Allocation for Integrated Child Development Scheme (ICDS) increased by over 18% to Rs. 27,584 crores in BE 2019-20

- Substantial increase in allocation for the Scheduled Castes and Scheduled Tribes –

- Allocation for SCs increased by 35.6% – from Rs. 56,619 crores in BE 2018-19 to Rs. 76,801 crores in BE for 2019-20

- Allocation for the STs increased by 28% – from 39,135 crore in BE 2018-19 to Rs. 50,086 crores in 2019-20 BE

Digital Villages

- The Government to make 1 lakh villages into Digital Villages over next five years

Women

- Rs.1330 Crore allocate for the Mission for Protection and Empowerment for Women.

- Maternity leave of 26 weeks under Pradhan Mantri Matru Vandana Yojana for pregnant women in work.

- More than 70% of the beneficiaries of Pradhan Mantri MUDRA Yojana are women.

- 6 crore free LPG connections under the Ujjawala Yojana.

MSME and Traders

- 2% interest subvention on an incremental loan of Rs 1 crore for GST registered SMEs

- Atleast 3% of the 25% sourcing for the Government undertakings will be from women owned SMEs

- Renewed Focus on Internal trade; DIPP renamed to Department for Promotion of Industries and Internal trade

Fiscal Programme

- Fiscal deficit pegged at 3.4% of GDP for 2019-20

- Target of 3% of fiscal deficit to be achieved by 2020-21.

- Fiscal deficit brought down to 3.4% in 2018-19 RE from almost 6% seven years ago

- Total expenditure increased by over 13% to Rs.27,84,200 crore in 2019-20 BE

- Capital Expenditure for 2019-20 BE estimated at Rs. 3,36,292 crores

- Centrally Sponsored Schemes (CSS) allocation increased to Rs. 3,27,679 crores in BE 2019-20

- Government confident of achieving the disinvestment target of 80,000 crore

- Focus now on debt consolidation along with fiscal deficit consolidation programme.

Entertainment Industry

- Indian filmmakers to get access to Single window clearance as well for ease of shooting films

- Regulatory provisions to rely more on self-declaration

- To introduce anti-camcording provisions in the Cinematograph Act to control piracy

Others

- New National Artificial Intelligence portal to support National Program on Artificial Intelligence

- A new committee under NITI Ayog to identify all the remaining De-notified nomadic and semi-Nomadic tribes.

- New Welfare development Board under Ministry of social justice and empowerment for development and welfare of De-notified nomadic and semi nomadic tribes

Vision 2030 in Budget

Ten dimensions of Vision for India of 2030:

- Next Generation Infrastructure – to provide an “ease of living”.

- Digital India – reached every corner of the economy and every citizen.

- Clean and Green India – Making India pollution free by leading transport revolution with Electric Vehicles and focus on Renewables.

- Rural Industrialization – using modern digital technologies to generate massive employment

- Clean Rivers – safe drinking water to all Indians using micro-irrigation techniques.

- Oceans and Coastlines – scaling up of Sagarmala

- Space Programme – India becoming a launchpad of the world by placing an Indian astronaut in space by 2022

- Self-Sufficient – in food and improving agricultural productivity with emphasis on organic food

- Healthy India – with a distress-free and comprehensive wellness system for all

- Minimum Government, Maximum Governance – with proactive, responsible, friendly bureaucracy and electronic governance.

“Union government present a Vote-on-Account along with the interim budget 2019″

What is a vote on account?

A vote on account essentially means that the government seeks the approval of Parliament for meeting expenditure — paying salaries, ongoing programmes in various sectors etc — with no changes in the taxation structure, until a new government takes over and presents a full Budget that is revised for the full fiscal.

Why present a vote on account?

The reasoning is that there is little time to get approvals from Parliament for various grants to ministries and departments, and to debate these as well as any provisions for changes in taxation.

More importantly, the reasoning is that it would be the prerogative of the new government to signal its policy direction, which is often reflected in the Budget.

Difference between Full Budget and Vote on Account:

- Full Budget deals with both expenditure and revenue side but Vote-on-account deals only with the expenditure side of the government’s budget.

- The vote-on-account is normally valid for two months but full budget is valid for 12 months (a financial year).

- As a convention, a vote-on-account is treated as a formal matter and passed by Lok Sabha without discussion. But passing for budget happens only after discussions and voting on demand for grants.

What’s an Interim Budget?

An Interim Budget is not the same as a ‘Vote on Account’. While a ‘Vote on Account’ deals only with the expenditure side of the government’s budget, an Interim Budget is a complete set of accounts, including both expenditure and receipts. An Interim Budget gives the complete financial statement, very similar to a full Budget.

History of the Budget

- The first Union Budget of Independent India was presented by Finance Minister of India RK Sanmukham Chetty on November 26, 1947. The first budget of the Republic of India was presented by John Mathai.

- Former FM Morarji Desai, has presented the budget a record 10 times. This is the most by any finance minister in the history of India. Chidambaram is second in place to present eight budgets.

- Indira Gandhi was the first woman Finance Minister to present the budget on February 28, 1970.

- On April 7, 1860, Finance Minister of India James Wilson was presented the first budget of India under the British rule.

- From 2017 the Railway Budget was added to the Union Budget.

- The longest budget speech was delivered by former PM Dr Manmohan Singh, comprising 18,650 words, during his tenure as Finance Minister in 1991.

- The shortest budget speech comprising 800 words was given by HM Patel in 1977 while delivering the Interim Budget.