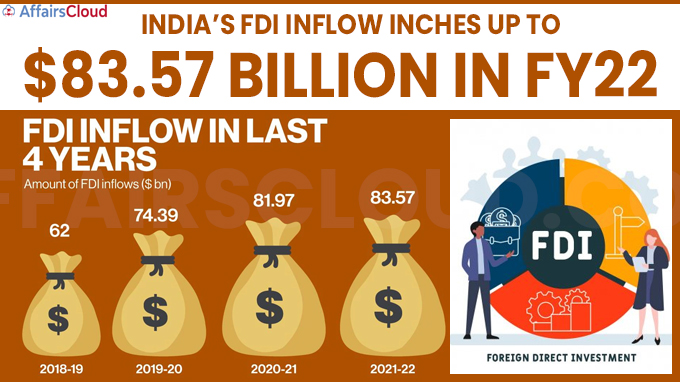

In accordance with the data released by the Department for Promotion of Industry and Internal Trade (DPIIT), India’s foreign direct investments (FDI) inflow was increased by 1.95% on-year to the highest ever annual figure of USD83.57 billion in the FY22 (2021-2022) as compared to $81.97 billion in FY21. This constituted an ‘endorsement‘ of India’s status among global investors.

- In India, Singapore is the top investing country with 27% of the equity inflows. It is followed by the United States (US) with inflows at 18% and Mauritius at 16% in FY22.

- Among states, Karnataka is the top recipient state for another year i.e. FY22 with 38% share of the total FDI equity inflows which were maximum in the computer software and hardware sector (35%), automobile industry (20%), and education (12%). It is followed by Maharashtra at 26% and Delhi at 14%.

- FDI inflow has increased by 23% post-Covid (March, 2020 to March 2022: USD 171.84 billion) in comparison to FDI inflow reported pre-Covid (February, 2018 to February, 2020: USD 141.10 billion) in India.

Key Points:

i.Total FDI includes equity capital of unincorporated bodies, reinvest earnings and other capital.

ii.India’s FY22 FDI overtook FY21’s FDI by USD 1.60 billion despite military operation in Ukraine and COVID-19 pandemic

iii.Computer Software & Hardware has emerged as the top recipient sector of FDI Equity inflow during FY22 with around 25% share followed by Services Sector (12%), and Automobile Industry (12%).

- Under the sector Computer Software & Hardware, the major recipient states of FDI Equity inflow are Karnataka (53%), Delhi (17%) and Maharashtra (17%) during FY22.

iv.In Manufacturing sector, India is rapidly emerging as a preferred country for foreign investments which has increased by 76% in FY22 ($21.34 billion) compared to previous FY21 ($12.09 billion).

Why is India regarded as the Preferred FDI destination?

In order to keep India an attractive and investor friendly destination, the Central Government reviews the FDI Policy from time to time which results in liberal and transparent guidelines. Most of the sectors are open to FDI under the automatic route. Already the Government has undertaken reforms in sectors such as coal mining, contract manufacturing, digital media, single brand retail trading, civil aviation, defence, insurance and telecom.

Recent Related News:

i.The Central Government has extended the timeline for startups to 10 years from 5 years to convert debt investment in a company into equity shares, from the day when initial convertible note was issued. This amendment was made during the review of the extent of FDI policy in India by DPIIT where the entity announced various amendments.

ii.DPIIT has virtually organised the 1st-ever ‘Startup India Innovation Week’ from 10th -16th of January 2022, to commemorate the 75th year of India’s independence ‘Azadi Ka Amrit Mahotsav’ and showcase the spread and depth of entrepreneurship across India.

About Department for Promotion of Industry and Internal Trade (DPIIT):

It works under the aegis of the Ministry of Commerce and Industry (MoCI).

Secretary– Anurag Jain

Headquarters– New Delhi, Delhi