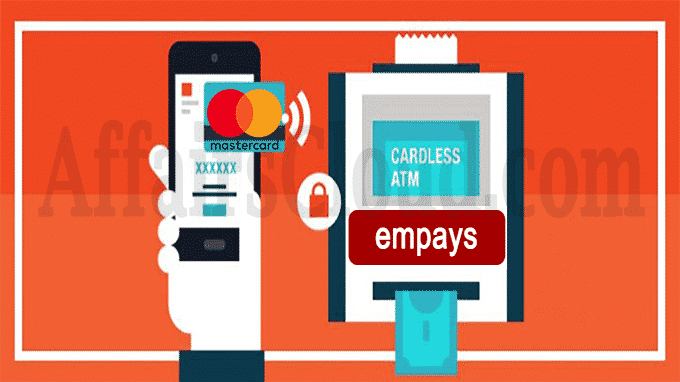

In order to eliminate the use of physical card or touch an ATM PIN pad, amid the spread of coronavirus from contaminated surfaces, Empays Payment Systems has joined hands with Mastercard to launch “Cardless ATM powered by Mastercard” in India based on the standards of EMV (Europay, Mastercard, and Visa). With this, India will be the first country outside the United States (US) where this product will be launched.

In order to eliminate the use of physical card or touch an ATM PIN pad, amid the spread of coronavirus from contaminated surfaces, Empays Payment Systems has joined hands with Mastercard to launch “Cardless ATM powered by Mastercard” in India based on the standards of EMV (Europay, Mastercard, and Visa). With this, India will be the first country outside the United States (US) where this product will be launched.

- This cardless ATM (automated teller machine) will enable the users to withdraw their money just by scanning a (Quick Response) code on the mobile phone, using their banking app.

- It should be noted that Empays is authorised by the Reserve Bank of India (RBI) as a national payment system.

Key Points:

-Empays, which runs the Instant Money Transfer (IMT) Payment System, will upgrade the basic technology behind the IMT Payment System to meet the requirements of Mastercard Cardless ATM.

-Notably, IMT Payment System powers the largest ATM network for cardless cash withdrawals in the world and is available across 40,000 ATMs in India. It uses SMS (short message service) technology to enable cash withdrawals.

-Both companies are working to launch pilots with consenting banks in coming months.

How will it work?

It follows a 4 step procedure:

- Open banking app

- Scan QR on ATM

- Authenticate withdrawal amount on banking app

- Pick up cash from ATM

Point to be noted:

Earlier, AGS Transact Technologies Limited (AGSTTL) has developed ‘touchless’ (based on QR code) solution for cash withdrawals at ATMs.

About Empays Payment Systems :

Founder and Chief Executive Officer (CEO)– Ravi Rajagopalan

Headquarter– Mumbai, Maharashtra

About AGS Transact Technologies

Chairman & Managing Director (CMD)– Ravi B. Goyal

Headquarter– Mumbai, Maharashtra

About Mastercard:

Headquarter– New York, U.S.

CEO– Ajaypal Singh Banga (Michael Miebach will take over Ajay Banga in Jan 2021)