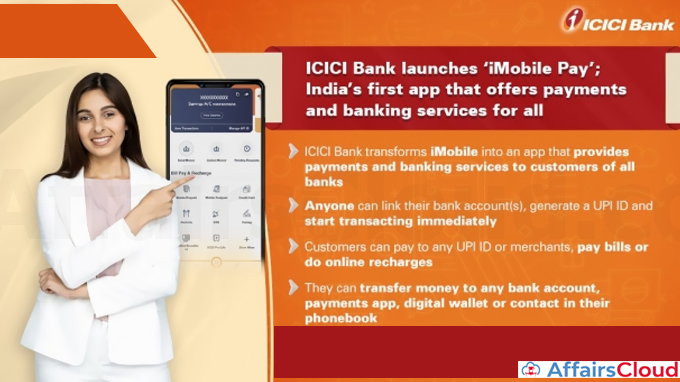

On December 7, 2020, ICICI (Industrial Credit and Investment Corporation of India) Bank launched “iMobile Pay” app offering payments and banking services for all i.e. customers of any bank can use this app.Bank claims that, iMobile Pay is 1st of its kind app.

On December 7, 2020, ICICI (Industrial Credit and Investment Corporation of India) Bank launched “iMobile Pay” app offering payments and banking services for all i.e. customers of any bank can use this app.Bank claims that, iMobile Pay is 1st of its kind app.

Key Features:

–It has all features of payment apps like scanning of QR (Quick Response) code for making payments, sending money to any UPI ID, bank account, self, instant transfer of money free-of-cost to any bank account, payment app or digital wallet.

–It can be used at a number of establishments including petrol pumps, grocery stores, restaurants, pharmacies, hospitals, multiplexes and much more.

—Upcoming features: Paying utility bills, recharge mobile phones, check CIBIL score, book travel tickets, buy travel and gift cards, invest in an FD (Fixed Deposit), RD (Recurring Deposit), mutual funds and insurances.

- There will be spends tracker also that will provide an overview of spends.

Recent Related News:

i.On October 6, 2020 ICICI Bank in partnership with Visa introduced a debit card facility for customers who avail Loan Against Securities (LAS) from the bank. The card is available on the Visa platform. With this introduction, ICICI bank becomes the 1st bank in India to launch this facility after the Reserve Bank of India (RBI) allowed banks to issue electronic(e) cards to customers availing an Overdraft (OD) facility, that are only in the nature of personal loan with no specific end-use restriction.

ii.On 10th September 2020, ICICI Bank launched its comprehensive banking programme for the Startups named “iStartup 2.0” which will support the requirements of the startups like regulatory assistance, analytics, staffing, acquisition and digital outreach of customers.

About ICICI Bank:

Managing Director (MD) and Chief Executive Officer (CEO) – Sandeep Bakhshi

Headquarters– Mumbai, Maharashtra

Tagline– Hum Hai Na, Khayal Apka

Virtual Assistant– iPal