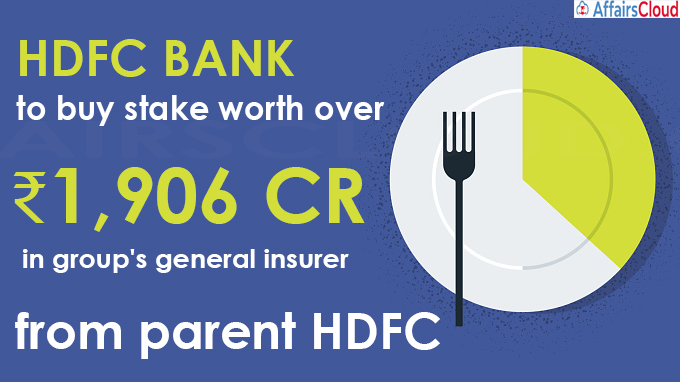

HDFC bank is all set for the purchase of 3,55,67,724 equity shares of Rs 10 each in group firm HDFC ERGO General Insurance Company from the parent company Housing Development Finance Corporation (HDFC). The approval for the same was provided by the board of HDFC Bank during its meeting.

HDFC bank is all set for the purchase of 3,55,67,724 equity shares of Rs 10 each in group firm HDFC ERGO General Insurance Company from the parent company Housing Development Finance Corporation (HDFC). The approval for the same was provided by the board of HDFC Bank during its meeting.

Key Points:

i.These shares are worth Rs 1,906.43 crore means their aggregate consideration is Rs 536 per share.

ii.These also represent 4.99% of the outstanding issued and paid-up capital of HDFC ERGO General Insurance Company Ltd from HDFC Ltd.

iii.HDFC is the promoter and related party of the bank.

HDFC Bank to buy 8,108 shares in Borderless Softtech worth Rs 6.9 crore

Apart from above, HDFC Bank along with its subsidiary HDFC Securities will purchase 8,108 compulsory convertible cumulative preference shares (CCCPS) worth Rs 6.9 crore of face value of Rs 10 each of Borderless Softtech at a premium of Rs 606.60 for consideration of Rs 616.60 per piece.

Key Points:

i.The acquisition will be initiated at a cash consideration of Rs 49,99,392 by HDFC Bank and Rs 6,41,19,617 by HDFC Securities.

ii.Post investment, the bank will hold in aggregate 7.76% of the shareholding of the company. On the other hand, HDFC Securities will acquire 1,03,989 optionally redeemable compulsory convertible cumulative preference shares (ORCCCPS).

ii.Borderless Softtech is a backend software infrastructure development company. It facilitates global fractional investing in US listed stocks, funds and ETFs (exchange traded funds).

Recent Related News:

In April 2021, HDFC Limited acquired a 9.9% stake in the Kerala based Asset Management company, Kerala Infrastructure Fund Management Ltd (KIFML).

About HDFC Bank:

Establishment-1994

Managing Director & Chief Executive Officer– Sashidhar Jagdishan

Headquarters– Mumbai,Maharashtra

Tagline– We understand your world

Chatbot– Eva