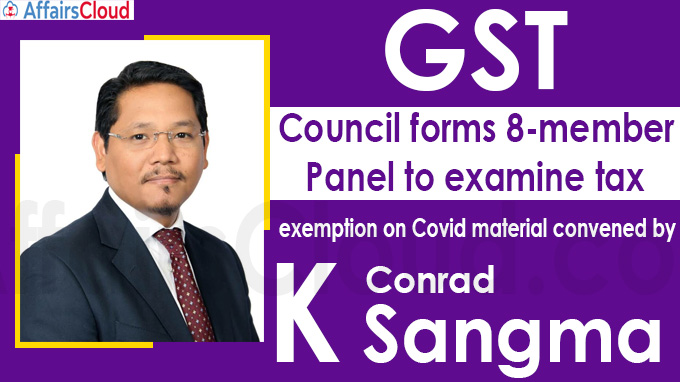

The Goods and Services Tax (GST) Council constituted an 8-member group of ministers (GoM) to examine the need for GST concession/exemption on a range of Covid-19 essentials such as vaccines, drugs, testing kits, and ventilators and make recommendations on the GST rates of COVID-19 relief material.Conrad Kongkal Sangma, Chief Minister of Meghalaya will be the Convenor of the panel.

The Goods and Services Tax (GST) Council constituted an 8-member group of ministers (GoM) to examine the need for GST concession/exemption on a range of Covid-19 essentials such as vaccines, drugs, testing kits, and ventilators and make recommendations on the GST rates of COVID-19 relief material.Conrad Kongkal Sangma, Chief Minister of Meghalaya will be the Convenor of the panel.

- Currently, 5 percent GST is levied on domestically manufactured vaccines, 12 percent GST is levied for COVID-19 drugs and oxygen concentrators.

- The GST Council in its 43rd meeting exempted the import of COVID-19 related goods such as medical oxygen and vaccines from GST till August 31,2021 even if they are imported on a payment basis or free of cost for donating to the government or a state-approved agency. Click here to know more

Convenor and members:

i.Other 7 members of the panel:

- Nitinbhai Patel, Deputy Chief Minister, Gujarat

- Ajit Pawar, Deputy Chief Minister, Maharashtra

- Mauvin Godinho, Minister for Transport & Panchayati Raj, Housing, Protocol and Legislative Affairs, Goa

- K.N. Balagopal, Minister for Finance, Kerala

- Niranjan Puiari, Minister for Finance and Excise, Odisha

- Harish Rao, Minister for Finance, Telangana

- Suresh Khanna, Minister for Finance, Uttar Pradesh

Terms of Reference:

i.The GoM will make recommendations on items required for COVID-19 relief viz, COVID-19 vaccines, drugs and medicines, testing kits, Medical grade oxygen, Pulse oximeters, Hand sanitizers, Oxygen therapy equipment such as Concentrators, Generators and Ventilators, PPE kits, N 95 masks, surgical masks, temperature checking equipment etc.

ii.The GoM will be assisted by a Committee of officers from the Centre and the States, and the panel will submit its report by June 8, 2021.

Note – The GoM was constituted after West Bengal and Punjab asked for exempting GST on all COVID-19 essential materials.

Recent Related News:

The Finance Ministry has set up a 7-member Group of States’ Ministers (GoM) to better understand, examine, and resolve the uncertainty over the valuation of services by casinos, race courses, and online gaming companies for levying Goods and Services Tax (GST).

About GST Council and GST:

i.GST Council is a federal body formed on 15th September 2016 under Article 279A of the Constitution.

ii.The Council is headed by the union finance minister (Current- Nirmala Sitharaman) assisted by the finance minister of all the states of India. It will make recommendations to the Union and the States on important issues related to GST.

iii.GST, an indirect tax was implemented in India on 1 July 2017, India’s GST is based on the Canadian model. France was the 1st country to implement the GST in 1954.

iv.Assam was the 1st state to implement the GST.