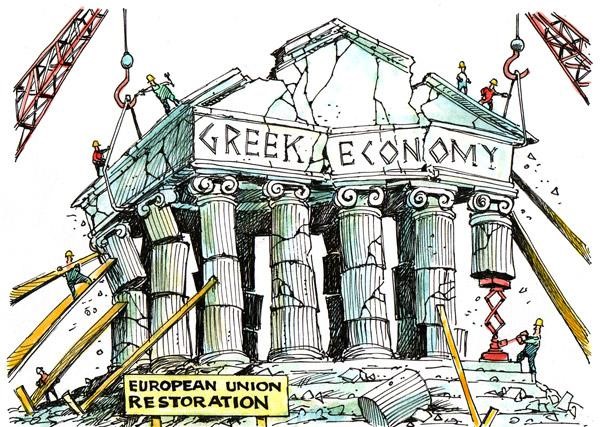

Greece signed a historic agreement on bailout deal with the Eurozone. This deal was much needed for Greece to be a part of euro.

Prime Minister Alexis Tsipras agreed to harsh reforms after long negotiations in return for a 3 year bailout worth up to 86 billion euros (USD 96 billion).

This is Greece’s third bailout programme in 5 years.

Greek banks have been closed for nearly two weeks and there were fears they were about to run dry due to a lack of extra funding by the European Central Bank.

In the absence of bailout Greece would have had to print its own currency and effectively leave the single currency.

Previous Bailouts

- 2010 – 110 billion euros

- 2012 – 130 billion euros

What happens now?

- According to the agreement, Athens will now have to rush through new tough reform laws by Wednesday.

- Greece has to introduce harsh conditions on labour reform and pensions, VAT and taxes, and measures on privatisation.

- Greece will also park assets for privatisation worth up to 50 billion euros (USD 56 billion) in a special fund which will be used to recapitalise Greece’s cash-starved banks.

AffairsCloud Recommends Oliveboard Mock Test

AffairsCloud Ebook - Support Us to Grow

Govt Jobs by Category

Bank Jobs Notification