To promote digital transaction in the country, Union Government announced various incentives on December 8, 2016, in New Delhi which will be effective from January 1, 2017.

- The incentives which was announced by Union Finance Minister Arun Jaitley were related mostly with the services provided by the Central public sector undertakings and the Railways.

- Aim: to lower cash transactions in the economy and promote digital economy.

Following 11 incentive measures were announced by the Finance Minister

Consumers who will make digital payment at the petrol pumps would be given a discount of 0.75 % on petrol and diesel by the petroleum companies.

- A discount of 0.5 percent will be given to them who will buy monthly seasonal tickets in the Suburban railway networks through digital payment mode. This will be effective from January 1, 2016 and will start with the Mumbai suburban railways.

- Booking Railway Ticket through online mode will enable the passenger to get free accident insurance cover of Rs. 10 lakh.

- Digital payment for railways catering, accommodation and retiring room will also attract 5 percent discount.

- Online purchase of new insurance policy of PSUs will deliver 10 percent discount on General Insurance and 8 percent discount on life Insurance policies.

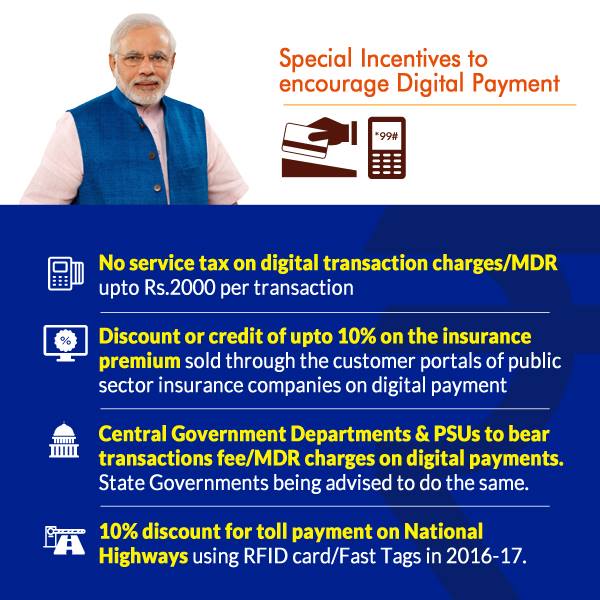

- A discount of 10 per cent will be given to users who pay toll at Toll Plazas on National Highways using RFID card and Fast Tags.

- Government will expand digital payment infrastructure in rural areas through NABARD that will extend financial support to eligible banks to install two Point of Sale (PoS) machine in each of the 1 Lakh villages with population of less than 10,000.

- The Government through NABARD will also support Rural Regional Banks and Cooperative Banks to issue Rupay Kisan Cards to over 4 crore 32 lakh Kisan Credit Card holders to enable them to make digital transactions at POS machines and ATMs.

- Public sector banks are advised that merchant should not be required to pay more than 100 rupees per month as monthly rental for PoS terminals, Micro ATMs and mobile POS.

- Public dealings with (central) government departments and PSUs through digital mode will be free of transaction fees and Merchant Discount Rate (MDR) charges.

- Credit and Debit card transactions worth up to Rs 2,000 will be exempt from any service tax.

AffairsCloud Recommends Oliveboard Mock Test

AffairsCloud Ebook - Support Us to Grow

Govt Jobs by Category

Bank Jobs Notification